Wider China-Hong Kong Discrepancy Revives Fake Trade Doubts

This article from Bloomberg news may be of interest to subscribers. Here is a section:

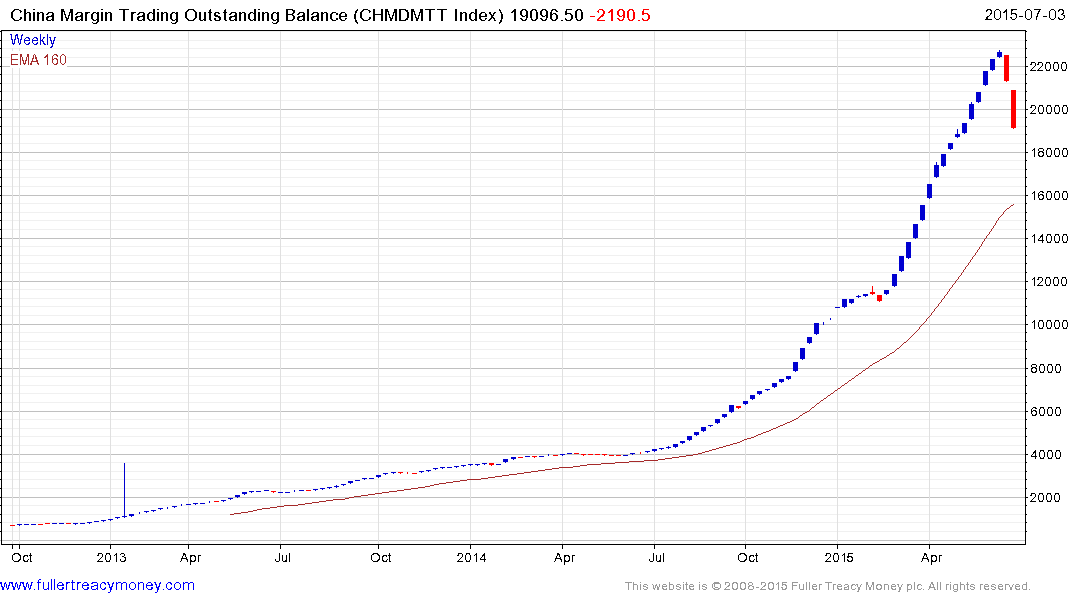

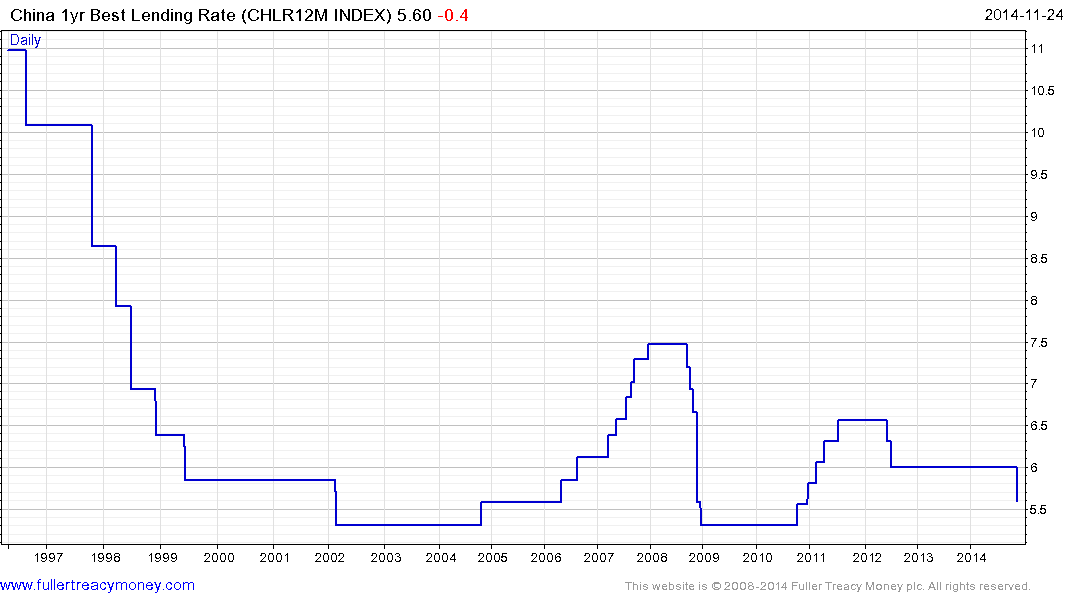

Eoin Treacy's view -The discrepancy suggests China’s trade recovery in December was inflated by fake invoicing to skirt capital controls and profit from the difference between the yuan’s exchange rates in on-shore and off-shore currency markets.

In a twist to fake invoicing in 2013, when the government said export and import figures were overstated due to the phony trade to bring money into the mainland, the refreshed practice has more to do with capital outflows from China. Outflows jumped in December, with the estimated 2015 total reaching $1 trillion, Bloomberg Intelligence estimates show.

Offshore Affiliates

"The divergence of trade data indicates a potential use of the trade channel for financial arbitrages," said Raymond Yeung, a Hong Kong-based senior economist at Australia & New Zealand Banking Group Ltd. Given how the spread between the onshore and offshore yuan widened in December, exporters and importers "may move funds across the border through trading with offshore affiliates. By blowing up trade figures, traders may potentially receive a larger forex quota to move their funds abroad."

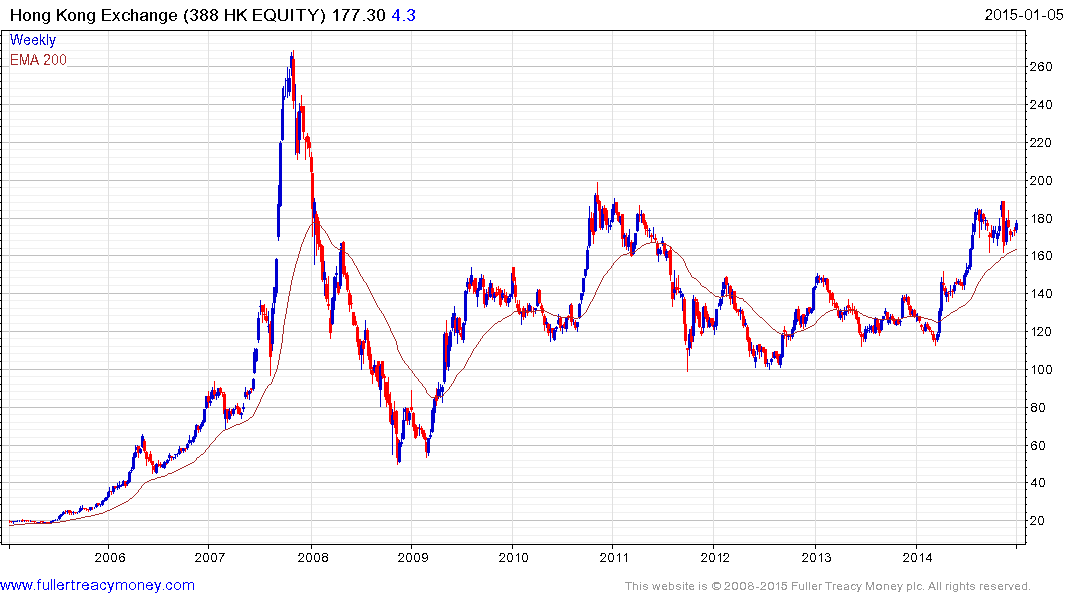

The above news of record capital outflows acted a drag on the stock market today with the A-Share Index dropping below the psychological 3000 level to extend the downtrend.

This section continues in the Subscriber's Area. Back to top