Debt and (Not Much) Deleveraging

Thanks to a subscriber for this heavyweight 136-page report from McKinsey. Here is a section:

Debt continues to grow. Since 2007, global debt has grown by $57 trillion, or 17 percentage points of GDP.* Developing economies account for roughly half of the growth, and in many cases this reflects healthy financial deepening. In advanced economies, government debt has soared and private-sector deleveraging has been limited.

?Reducing government debt will require a wider range of solutions. Government debt has grown by $25 trillion since 2007, and will continue to rise in many countries, given current economic fundamentals. For the most highly indebted countries, implausibly large increases in real GDP growth or extremely deep reductions in fiscal deficits would be required to start deleveraging. A broader range of solutions for reducing government debt will need to be considered, including larger asset sales, one-time taxes, and more efficient debt restructuring programs.

Shadow banking has retreated, but non-bank credit remains important. One piece of good news: the financial sector has deleveraged, and the most damaging elements of shadow banking in the crisis are declining. However, other forms of non-bank credit, such as corporate bonds and lending by non-bank intermediaries, remain important. For corporations, non-bank sources account for nearly all new credit growth since 2008. These intermediaries can help fill the gap as bank lending remains constrained in the new regulatory environment.

Households borrow more. In the four “core” crisis countries that were hit hard—the United States, the United Kingdom, Spain, and Ireland—households have deleveraged. But in many other countries, household debt-to-income ratios have continued to grow, and in some cases far exceed the peak levels in the crisis countries. To safely manage high levels of household debt, more flexible mortgage contracts, clearer personal bankruptcy rules, and stricter lending standards are needed.

China’s debt is rising rapidly. Fueled by real estate and shadow banking, China’s total debt has quadrupled, rising from $7 trillion in 2007 to $28 trillion by mid-2014. At 282 percent of GDP, China’s debt as a share of GDP, while manageable, is larger than that of the United States or Germany.* Several factors are worrisome: half of loans are linked directly or indirectly to China’s real estate market, unregulated shadow banking accounts for nearly half of new lending, and the debt of many local governments is likely unsustainable.

Here is a link to the full report.

The extent of debt deleveraging tends to be a subject that receives little press attention because it is so difficult to quantify. Some people are worried about the quantity of debt that has continued to climb since 2008. However the detail of who is responsible for this debt is more important.

Quantitative easing is in many respects a transfer of debt from private institutions to government. This has allowed corporations to reduce their debt servicing costs and to lock in the lowest rates anyone has ever seen; often at lengthy maturities. Consumers have been spending less, refinancing mortgages and today’s news suggests more are getting back to work. The USA’s private sector has deleveraged and its government has become overleveraged. If the data in the above report is considered from a long-term perspective we can see cyclicality where credit contraction follows credit splurges and vice versa.

The Fed has ended its quantitative easing program and has also lengthened the maturity of its holdings over the last five years. This suggests that as interest rates move higher from today’s low levels, the pace with which the size of the Fed’s balance sheet will contract will be slow and measured and may not begin for some time since they can still roll forward maturing bonds. While most people are caught up considering what the Fed will do, it is worth considering that consumers and corporations are in a position to increase their debt burdens as the economic expansion picks up pace.

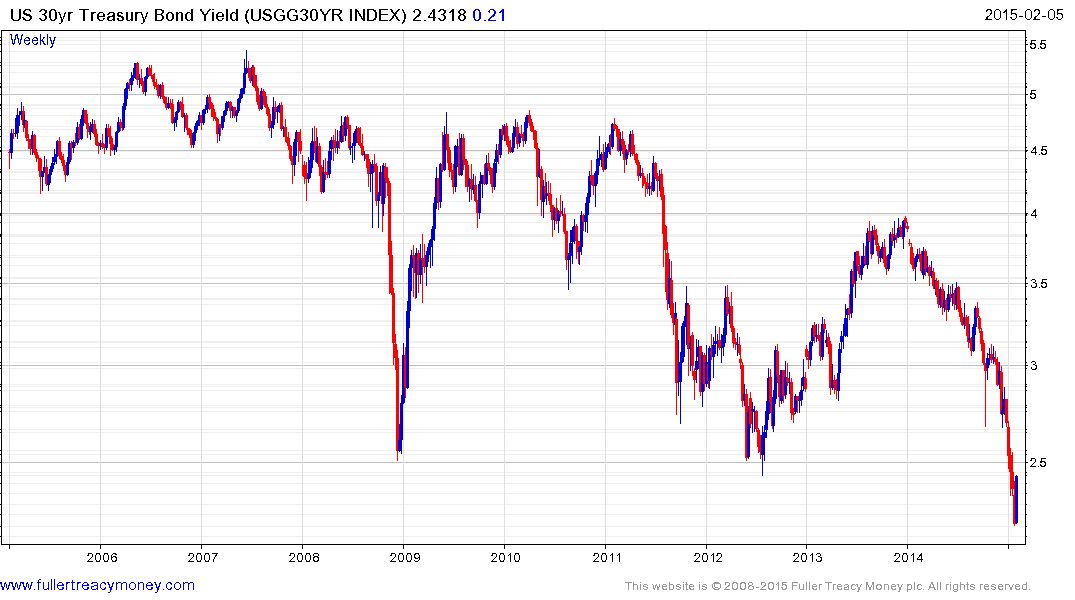

Against this background, the 30-year Treasury yield hit a new all-time low at the end of January. The trend has a rivetingly consistent progression of lower rally highs over more than a decade but is overextended at present. This week’s upward dynamic signals a low of at least near-term significance and potential for a reversion back up towards the mean has increased.

China is at a point where its debt burden has the capacity to become a problem. Central Government and personal debt levels are among the healthiest in the world but the burden put on the municipal sector from relying on land sales has created an unsustainable trend in fixed asset investment. This is why the property registration currently underway and national property tax it will facilitate is so important. Provided the reforms currently underway are in fact implemented, the unruly debt restructuring many fear can be avoided. The sector is important to monitor nonetheless.

One of the primary drivers of the recovery in the Chinese stock market over the last three months has been from investors migrating from property investment to the stock market. The logic being that the government’s actions to contain the knock-on effect of weakness in the property sector should be of benefit to asset prices represented by the stock market. The opening up of the Hong Kong Shanghai Stock Connect, the prospect of a Shenzhen equivalent being opened and the market’s low absolute and relative valuations are additional bullish considerations.

Back to top