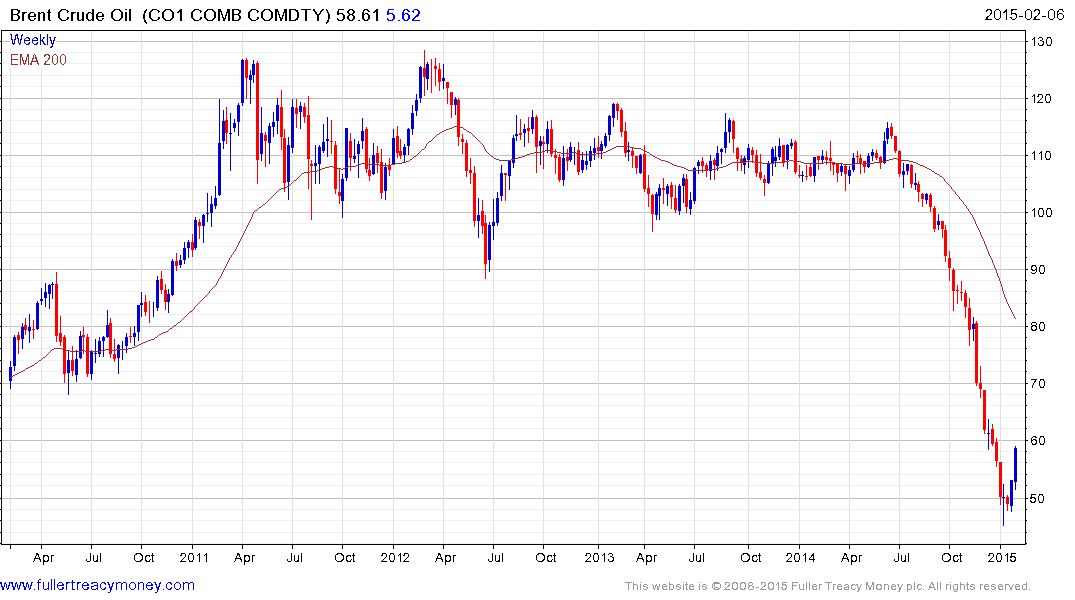

Oil Heads for Biggest Two-Week Gain in 17 Years Amid Volatility

This article by Moming Zhou and Jake Rudnitsky for Bloomberg may be of interest to subscribers. Here is a section:

Saudi Arabia led a decision in November by the Organization of Petroleum Exporting Countries to maintain its collective output target of 30 million barrels a day. The 12-member group, which pumps about 40 percent of the world’s oil, produced 30.9 million barrels a day in January, exceeding its quota for an eighth straight month.

Statoil will deepen spending cuts by 30 percent to $1.7 billion from 2016 and reduce capital expenditure to $18 billion this year from earlier targeting $20 billion, the Stavanger, Norway-based company said Friday. The move followed similar announcements by competitors including Shell, BP and Chevron Corp. that they would cut billions of dollars in investments.

?U.S. companies pulled 83 oil rigs out of fields in the latest week, following 94 in the previous week, according to Baker Hughes data.

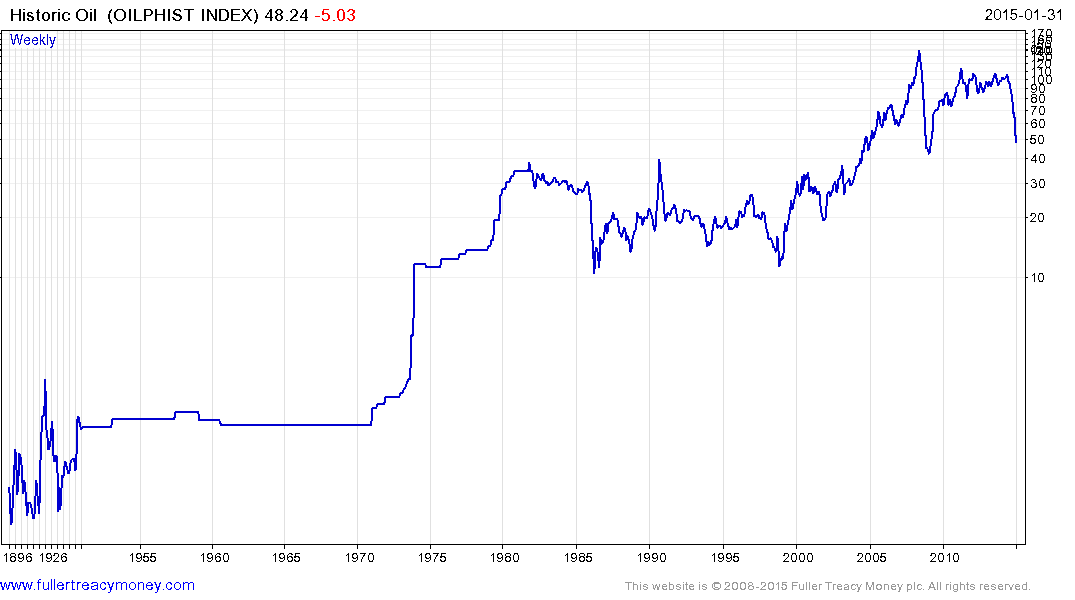

We have long described the peak oil arguments in terms of rising cost of marginal production. If one looks at long-term charts of oil prices we can see that despite volatility and a number of decade-long bull markets, once supply catches up with demand, prices retreat to wherever the cost of marginal production has increased to.

The above chart highlights that 50 to 60¢ was the level at which demand returned to dominance prior to 1933. After World War II prices were held at $1.80. The 1970s saw a great deal of disruption and volatility but prices stabilised above $10 which represented the point at which marginal supply was no longer viable. The upper side of that 25-year range was around $40 which remains an important level. A great deal of offshore and unconventional oil is uneconomic below $40. Likewise a great deal of the same production becomes highly economic around $100. If history is any guide oil prices could range in that band for a prolonged period suggesting the cyclicality of industry is very much intact.

The production profile of unconventional wells may contribute to sharp medium-term price swings. This link to North Dakota Petroleum Council’s website carries some valuable information. On average it takes 30 days to drill a horizontal well. Once the drilling equipment has been removed and the well bore lined and sealed, it takes approximately another 30 days to bring the well on line. The prolific early production rate and quick peak and decline rates of shale oil and gas wells is well known.

In order to sustain production growth trajectories a steady pace of drilling is required. In the absence of drilling it is reasonable to assume that production will peak within a year and trend lower as progressively more unconventional wells enter their declining production profile. Unconventional oil production can be considered the marginal supplier to the market since it represents domestic supply within the largest consuming nation. As a result of the above factors it is very sensitive to oil prices and the drilling schedule ensures that production will only growth when prices are high enough to justify the expenditure.

The Baker Hughes Oil Active Rig Count is therefore interesting and continues to trend sharply lower which will act a lead indictor for supply and a bullish consideration for price.

Back to top