Must... FiX... This...

Thanks to a subscriber for this report from Maybank which may be of interest. Here is a section:

However, the currency risk is the issue and we suspect a lot of companies have borrowed USD given low interest rates and on the expectation that the USD would continue to depreciate (Figure 19).

8) This is particularly true for China where BIS data shows borrowing increased an impressive 4.5x over the past five years (Figure 20). While external debt to GDP is manageable from a level perspective, the acceleration is a cause for concern in a world where exchange rates are driven by capital rather than current account flows.

9) Our analysis of Chinese corporate returns reveals that there is overcapacity through much of the listed sector, including the consumer space. Furthermore, returns on equity would have been even lower had leverage not sharply increased. Falling margins, falling asset turnover, falling ROAs, rising leverage, falling ROEs are not great combinations (Figures 34, 39 and 42).

10) We suspect it was weak growth and a strong USD that encouraged the PBoC to surprise the market and cut rates. Left to itself, Chinese policy making credibility is high enough that the work-out can be achieved. The risk is that external pressures, via a stronger USD, attracts capital away and we see downward pressure on the RMB. This keeps us underweight Chinese properties. We would be Neutral China.

Here is a link to the Subscriber's Area.

At the Chicago venue for The Chart Seminar in September a knowledgeable Peruvian delegate spoke at length on the repercussions for his country of a strong Dollar because there was such a dependency on Dollar funding. It’s easy to think about how this situation could have evolved.

The Dollar has been weak for a long time. The funny thing about trends is that the longer they persist the greater the incentive to believe they will continue for even longer. If I have company seeking funding for expansion and credit in my home country is difficult to come by and/or has high interest rates, the relative attraction of the Dollar, which had been trending lower in nominal and real terms was powerful.

At the current time, as energy and industrial resource prices remain under pressure and with related economies slowing, the greenback’s strength represents a serious issue for anyone with Dollar denominated loans. The below chart of year-to-date currency total returns exemplifies the pressure a number of commodity producers are under.

The Argentine Peso has been flattered by its interest rate as has the Ukrainian Hyrvnia, while the Russian Ruble, Colombian Peso and Norwegian Kroner have been among the weakest on a total return basis this year.

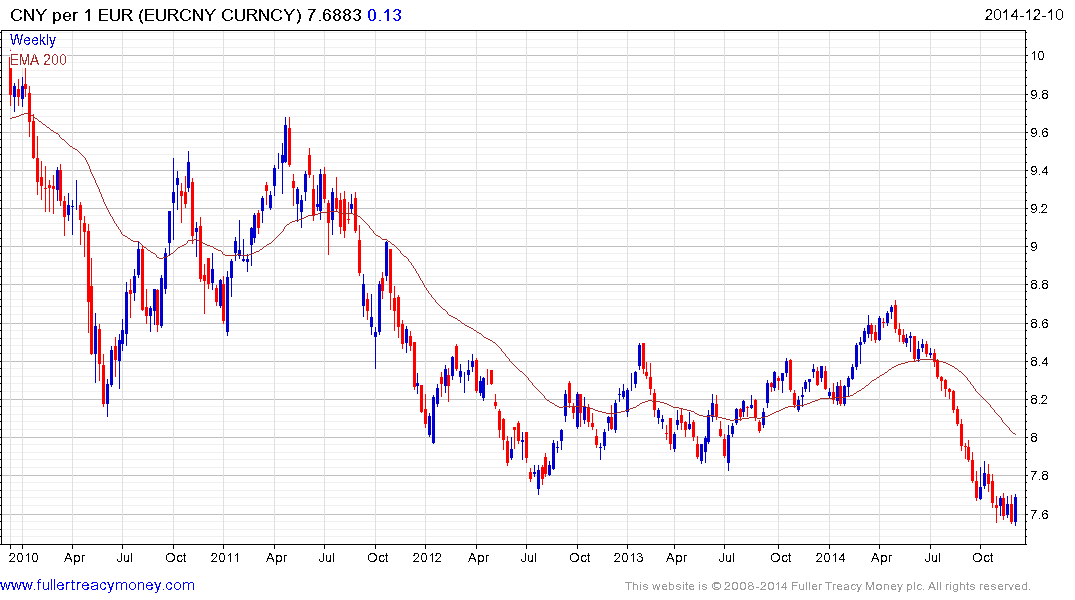

I would be interested in any additional intelligence subscribers might have on Chinese exposure to Dollar funding costs. The Renminbi may have weakened somewhat this week but is still trading in a tight band against the US Dollar. Its performance relative to a comparatively weak currency such as the Euro is probably more instructive. This week’s upside weekly key reversal by the Euro is a testament to the fact that the Chinese are not willing to be the only country in Asia with a strong currency.

Back to top