Rate-cut, reform & re-rating in the Year of the Ram

Thanks to a subscriber for this report from Deutsche Bank focusing on China. Here is a section:

Macro: Broad-based easing to bottom line ; watch CPI & RMB

We forecast lower-than-consensus GDP in 1H15, while 2H15 may see a minor pick-up thanks to rates and RRR cuts in 1-3Q15. We think the policy regime bottom line, but refrain from suggest closely watching the developments in CPI (esp. pork prices) and RMB depreciation to gauge how far the policy easing could go.Earnings: Non-financial earnings to recover at the expense of financials

We see a decent recovery in non-financial earnings growth to 8% in 2015 (vs. 0% in 2014), thanks to profit margin expansion amid softening commodity prices and falling financial costs. However, financials earnings growth may slow to 3% in 2015 (vs. 8.5%), sending overall H-share earnings growth to 5.5% (vs. 4.4%). This trend may extend in 2016 and H-share earnings could grow at a similar 5.4%. We believe cost cutting has its limit for Chinese corporate, top-line is still needed for a more sustainable earnings recovery.Liquidity: When G2 diverges the loosening PBoC vs. the tightening Fed

H-share liquidity conditions may weaken due to 1) further global capital outflows alongside the tightening Fed and strengthening US dollar, and 2) the mounting northbound while lukewarm southbound flows in the Shanghai Connect. A-shares may continue to benefit from the loosening PBoC and outperform H-shares, but in the near term, we would watch out for prudential measures given recent rapid leverage build-up, esp. via alternative channels.Valuations: 8-11x the fair range; market to enter

Modeling MSCI China with a three-stage DDM, we estimate 8-11x 12-month forward P/E as the fair valuation range. We expect the index to re-rate from the current 9.4x 12-month forward P/E to 10x by end-2015, based on 3.5% RFR and 6.5% risk premium. Also, considering around 5% rollover in 12-month the rising P/E and EPS boosting the index by 12% to 74 by end-2015.

Here is a link to the full report.

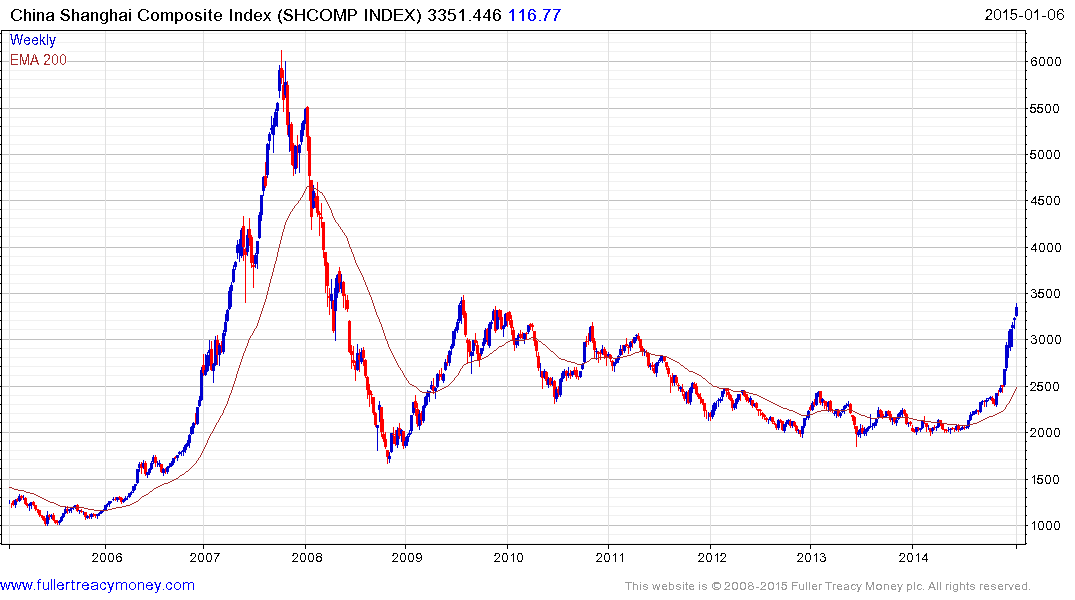

The Chinese mainland’s stock market remains in robust form despite the short-term overbought condition currently evident. This explosive breakout will roll over into a consolidation of gains at some point but a clear downward dynamic, held for more than a day or two, would be required to check momentum.

The Hong Kong Hang Seng China Enterprise Index has paused in the region of the upper side of its 3-year range and some consolidation of recent gains is looking likely. Nevertheless, a sustained move below the 200-day MA, currently near 11,000 would be required to question medium-term upside potential.

Back to top