Mainland Chinese stocks fail to make the MSCI's emerging market index, but that won't be the case for long

This article by David Scott for Business Insider may be of interest to subscribers. Here is a section:

The answer is no, not yet, but it could happen before the next MSCI annual market classification review scheduled for June 2016.

?On a posting on its website the MSCI noted that it “expects to include China A-shares in its global benchmarks after a few important remaining issues related to market accessibility have been resolved”.

Here’s Remy Briand, MSCI managing director and global head of research, on the decision announced this morning.

“Substantial progress has been made toward the opening of the Chinese equity market to institutional investors. In our 2015 consultation, we learned that major investors around the world are eager for further liberalization of the China A-shares market, especially with regard to the quota allocation process, capital mobility restrictions and beneficial ownership of investments. Because MSCI’s client base is so large and diverse, we have a strong interest in ensuring that remaining issues are addressed in an orderly and transparent way.”

The Chinese now have a blueprint for what they need to do to gain access to a massive pool of international liquidity. Considering the fact they have a vested interest in diversifying their domestic risk in sectors that drove the breakneck pace of development, we can expect measures to fulfil MSCI’s requirements over the next year.

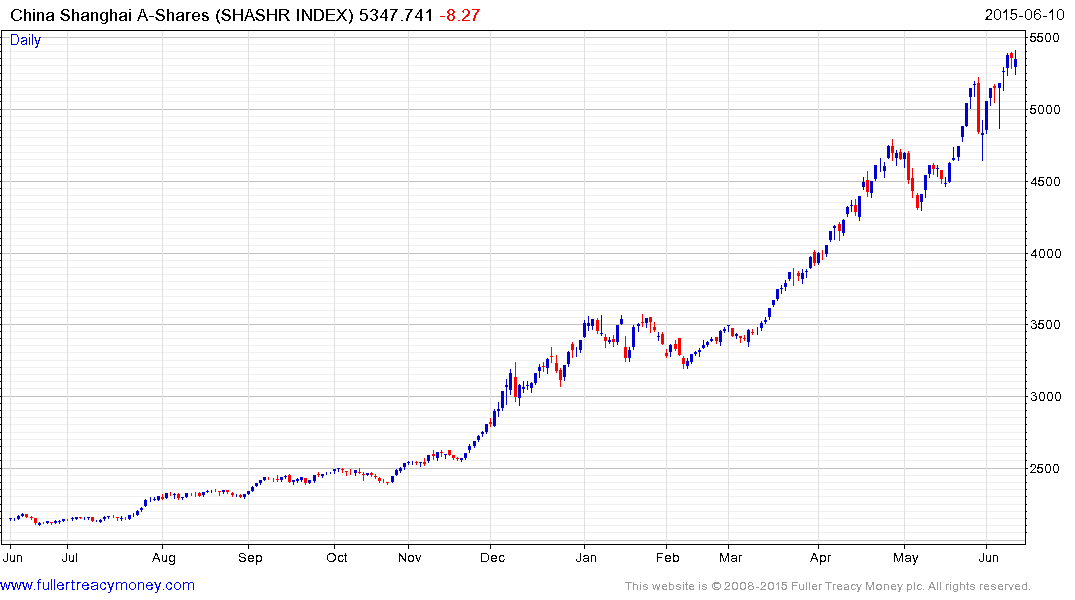

Since the answer was a ‘not yet’ instead of a ‘no’ the mainland stock market has been reasonably steady not least because it has been primarily driven by domestic demand. Nevertheless, the progression of higher reaction lows will need to hold if a deeper and potentially lengthy process of mean reversion is to be avoided.

.png)

The Shenzhen A-shares Index firmed today to retest its highs and a downward dynamic larger than that posted in May would be required to check momentum.

Hong Kong was where the greatest sense of disappointment was seen not least because it is so

much more sensitive to international flows. The Hang Seng broke downwards from its short-term range suggesting a retest of the upper side of the underlying three-year range is now more likely.

Back to top