US listed China

The opening of the Shanghai-Hong Kong Stock Connect has acted as a catalyst for the revival of interest in the Chinese stock market since November. Since then the mainland administration has followed with market support measures including lower bank reserve requirements, cutting interest rates, removing obstacles to property speculation, opening the market for equity options as well as a politicians talking the market higher.

The Shanghai A-Share Index began to rally from July and surged higher in October led by brokers, insurance companies, banks and railroads. Following consolidation between January and March it has rallied for the last eight consecutive weeks and is increasingly susceptible to consolidation of those gains.

While Hong Kong had similar valuations to mainland China it did not rally in line with the mainland. Part of the reason for this is because of the civil unrest that roiled investor sentiment late last year. In fact while the stock connect is a two-way channel between the mainland and Hong Kong and has been open for six months, the mainland to Hong Kong avenue only hit its limit for the first time this month. Hong Kong is now playing catch up with the mainland listed market.

A considerable number of Chinese companies have sought listings outside China and have chosen a number of different methods to achieve that listing. Some, like Alibaba, have listed ADRs in the USA, others like Baidu, have outright listings while others employed the cheaper option of seeking a reverse merger.

There is no arbitrage between those which hold Hong Kong and US listings. However, what is perhaps more interesting is that those which only have a US listing have not received nearly the same interest as their counterparts listed at home. At least part of the reason for this is that Chinese reverse merger listings received a great deal of negative press in 2013 because of lax accounting standards and outright fraud in some cases. Since then more than a few have delisted. However, it is also true that the USA is the world’s largest capital market and is a particularly fertile source of funding for tech start-ups. This is an additional reason Chinese companies have sought to list here.

I thought now might be an opportune time to review US listed Chinese companies.

Alibaba (Est P/E 36.89, DY N/A) is barely steady at $80.

Baidu (Est P/E 26.38) was the leading decliner on the Nasdaq 100 today. It will need to continue to hold in the $200 region if medium-term scope for additional upside is to be given the benefit of the doubt.

Sina Corp, a social media company (Est P/E 66.53, DY N/A) rallied this week to break a yearlong progression of lower rally highs to confirm a failed downside break.

Youku, an internet TV company (Est P/E N/A, DY N/A) failed to sustain the break above $30 a year ago and fell to post new lows in late March. It has now rallied to break back above the 200-day MA and a while some consolidation is possible in this area, a clear downward dynamic would be required to check momentum.

JD.com (Est P/E 618, DY N/A) IPOed in the USA last year and is among the top three Chinese internet retailers. The share is somewhat overextended in the short-term but a sustained move below the trend mean, currently near $27.50 would be required to question medium-term scope for additional upside.

VIPSHOP (Est P/E 53.11 DY N/A) has been trending higher in a reasonably consistent manner since its 2012 IPO. It is somewhat overextended at present but a sustained move below $25 would be required to begin to question medium-term demand dominance.

E-Commerce China Dangdang, (Est P/E 52.72 DY N/A) has been ranging below $10 since December and a sustained move above that level would suggest a return to demand dominance.

Soufun (Est P/E 16.12, DY 2.39%) an internet real estate portal company hit a medium-term peak near $20 a year ago and found support near $5 in March. It has now rallied to close the overextension relative to the 200-day MA and a break in the short-term progression of higher reaction lows would be required to question recovery potential.

Xinyuan Real Estate (P/E 4.78, DY 5.76%) found support in January near $2 and has since rebounded to break the medium-term progression of lower rally highs.

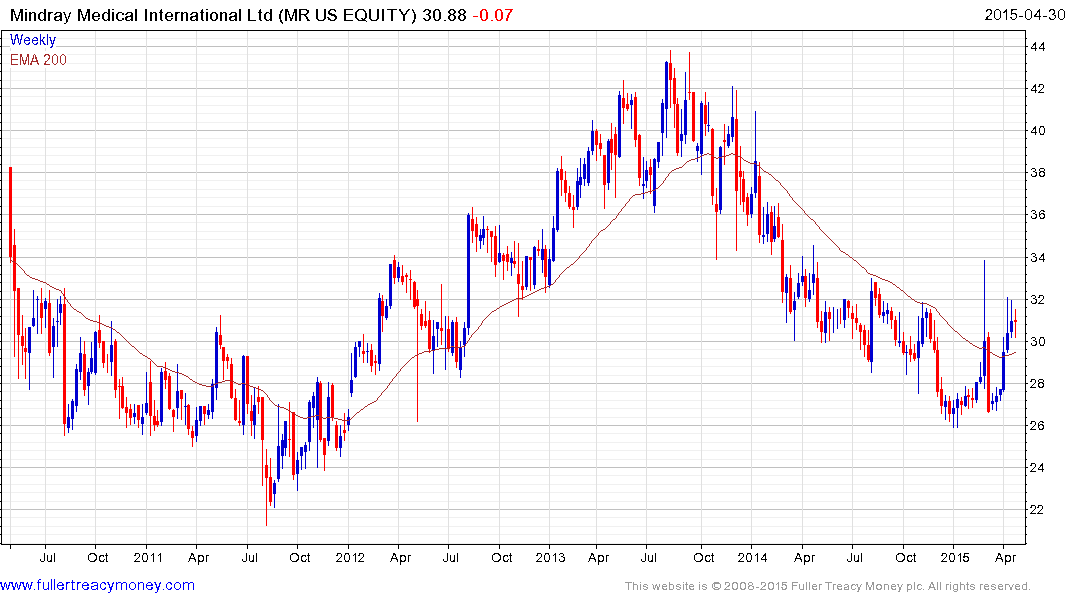

Mindray Medical (Est P/E 17.12, DY 1.3%) trended lower from late 2013 to find support above the psychological $25 area. It rallied three weeks ago to break the progression of lower rally highs.

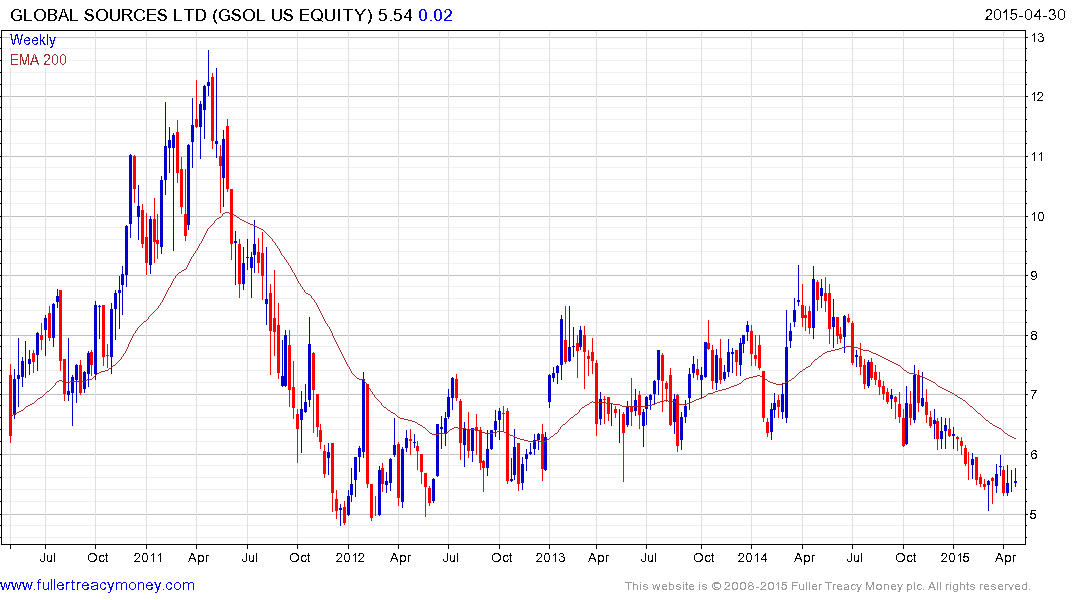

Global Sources (P/E 9.52), a business to business marketing firm which facilitates Chinese companies’ export ambitions has returned to test the region of the 2012 lows and found at least temporary support above $5.

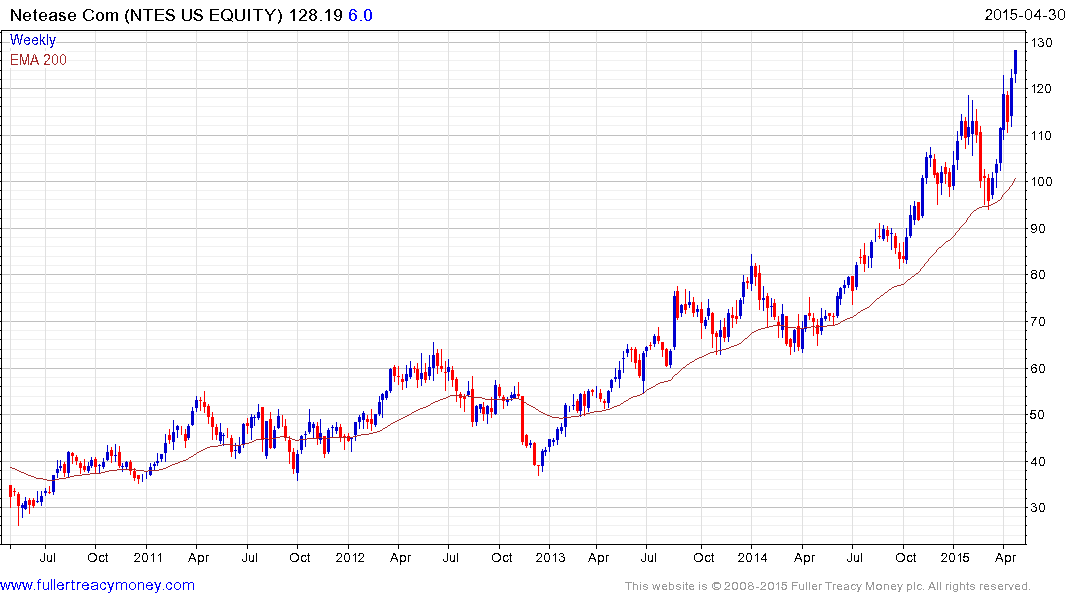

Netease (Est P/E 18.55, DY 1.24%) an online gaming company, is somewhat overbought in the short-term but continues to hold a medium-term progression of higher reaction lows.

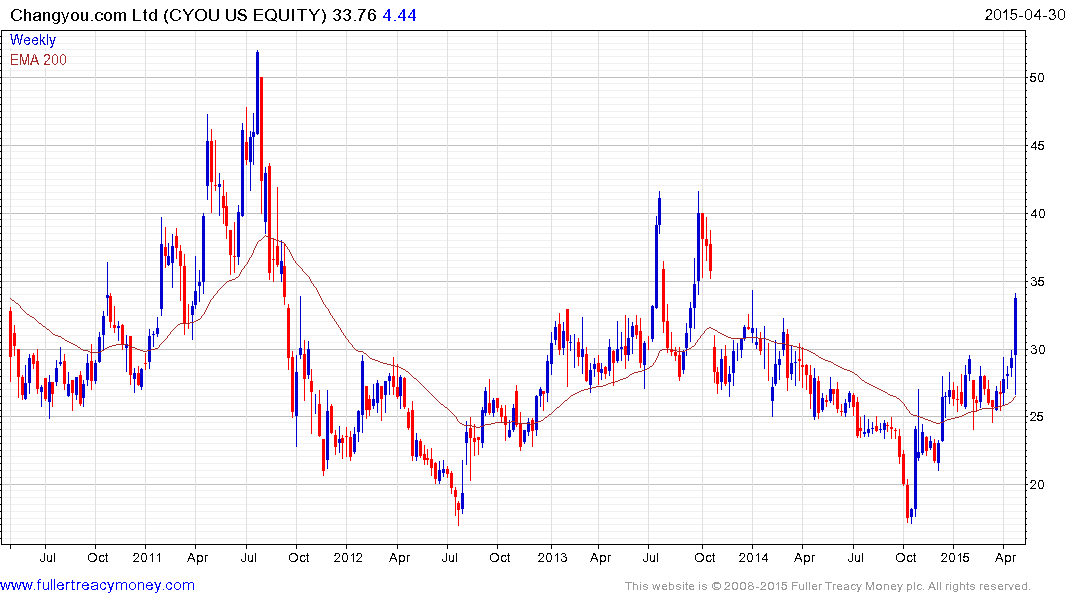

Changyou, an online game company (Est P/E 11.03, DY N/A) continues to rebound from the lower side of a six-year range.

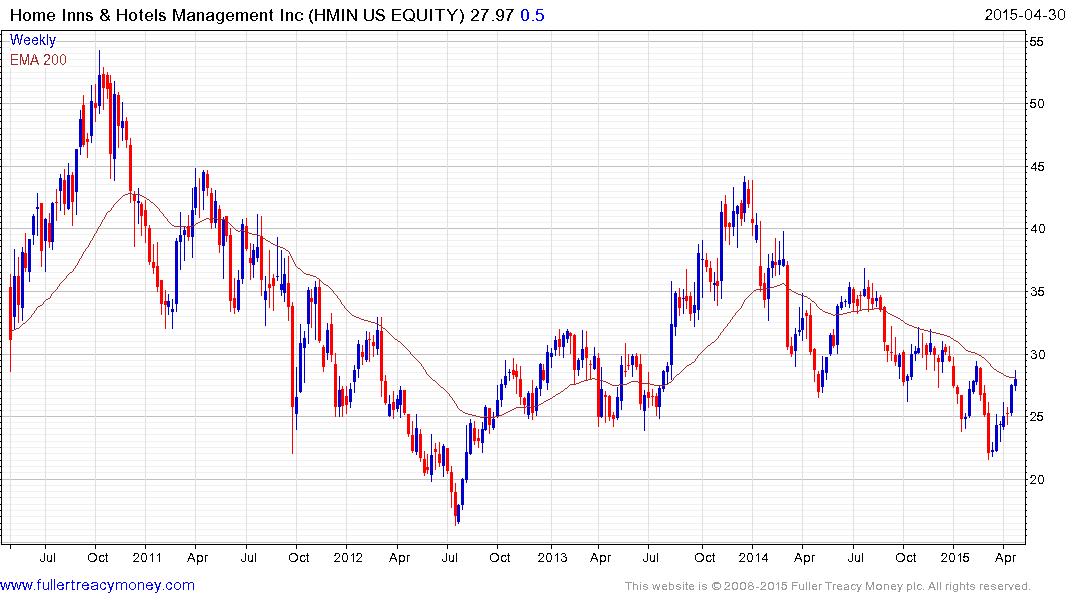

HomeInns Hotel Group (Est P/E 17.16) has been trending lower for more than a year and has now rallied to test the progression of lower rally highs. A sustained move above $30 would suggest a return to demand dominance beyond the short term.

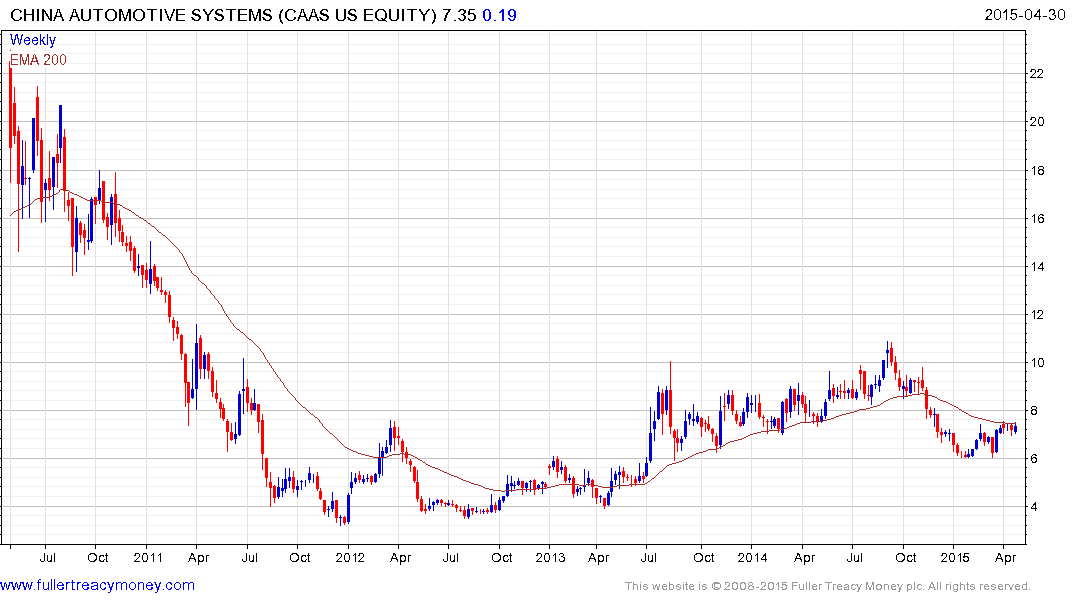

China Automotive Systems manufactures power steering systems (Est P/E 6.73, DY N/A). The share has found at least near-term support above $5 but will need to hold the March low on the next pullback to demonstrate continued demand dominance.

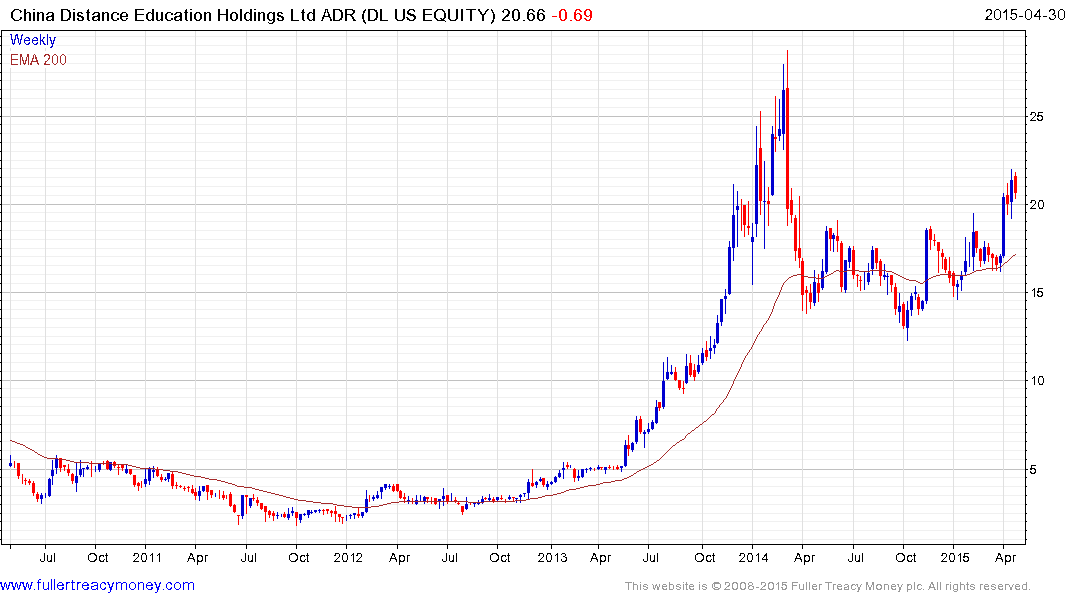

China Distance Education (Est P/E 23.97, DY 3.89%) accelerated to a medium-term peak in early 2014 and pulled back to find support in the region of the 200-day MA. It broke out to new 12-month highs three weeks ago and a sustained move below the MA would now be required to question potential for additional higher to lateral ranging.

.png)

51Job Inc’s , (Est P/E 19.8 DY N/A) a recruitment firm, has been ranging between $30 and $37 for much of the last year and is now testing the upper boundary. A sustained move above $38 would confirm a return to medium-term demand dominance.