Wages in U.S. Show Signs of Picking Up as Job Market Improves

This article by Michelle Jamrisko and Victoria Stilwell for Bloomberg may be of interest to subscribers. Here is a section:

Six years after the recession ended, unemployment may now be low enough to start prompting companies to compete against each other for staff. Bigger paychecks, a missing piece of the expansion, would make it more likely that the slowdown in economic growth last quarter will be fleeting, bearing out Federal Reserve policy makers’ assessment.

“You can feel somewhat more constructive on consumer spending in the next quarter or so given that wages have picked up and given that claims are so low,” said Michelle Meyer, deputy head of U.S. economics at Bank of America Corp. in New York. “There’s still further ammunition for consumers to spend.”

With Wal-Mart and McDonalds raising wages in a bid to avert even more aggressive pay demands later, there is evidence that the slack in the employment market has tightened.

The introduction of the Affordable Care Act has also contributed to the rise in wages. Depending on a worker’s personal circumstances, I believe $34000 is the cut-off, it is possible they would be worse off working because they would no longer qualify for the healthcare subsidy. As a result, working mothers in particular have left the workforce. Wages would have to rise in order to encourage them back.

In addition, radio ads in California continue to talk about the minimum wage rising to $15 an hour by 2020. It is still open to debate whether that can pass through the state legislature and it would obviously have an impact on inflation and demand for workers, but it speaks to a wider issue of rising living costs.

Against this background, the asset price inflation associated with QE cannot simply be ignored and will undoubtedly be part of the conversation at the Fed. There is a great deal of debate about what has been excluded from the Fed’s hedonic approach to monitoring inflation. However, wage inflation is a still a major constituent. If wages continue to rise, the era of ultra-low interest rates is coming to an end.

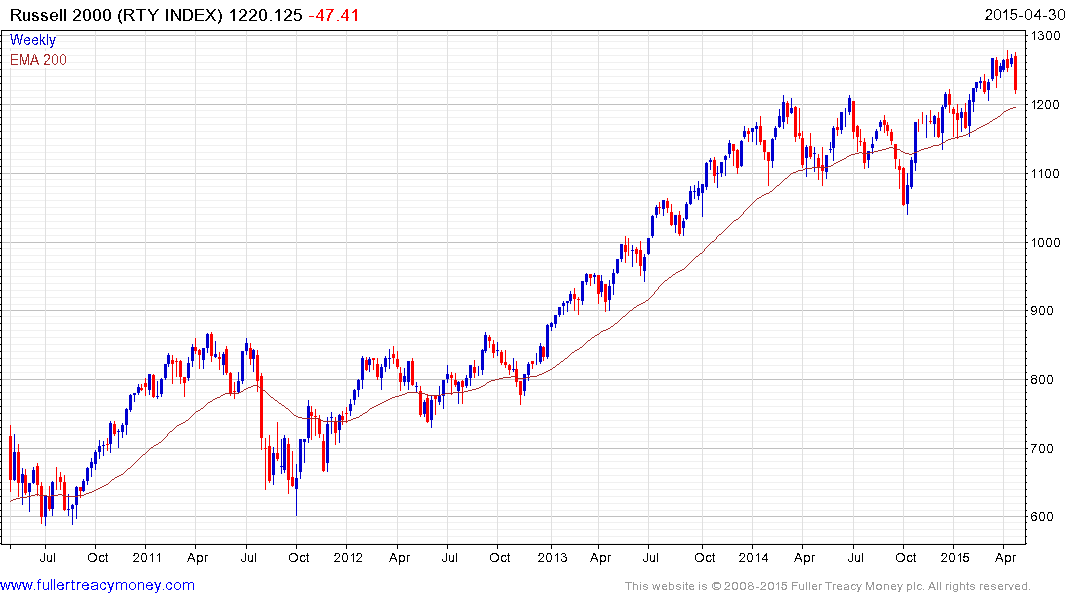

The Russell 2000 has pulled back sharply this week to test the region of the upper side of the underlying range and 200-day MA. A Mid-point Danger Line stop in the region of 1120 might be appropriate at this stage.

The Dow Jones Industrials Average has been ranging in the region of 18,000 since November and has held the medium-term progression of higher reaction lows during this time. A sustained move below 17,500 would suggest a deeper and potentially lengthier corrective phase is unfolding.

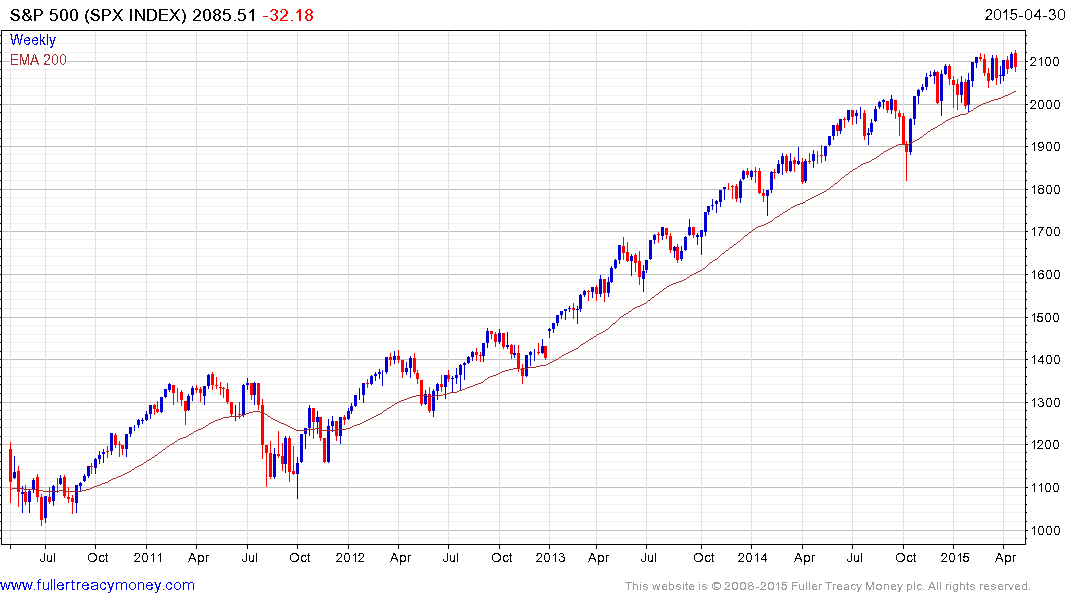

Both the S&P 500 and Nasdaq-100 have rallied from the region of the 200-day MA on multiple occasions since 2011 and that characteristic would need to change in order to signal a peak of more than near-term significance.

The 3.75 2043 US Treasury price has returned to the region of the 200-day MA and will need to bounce from this area if medium-term upside is to be given the benefit of the doubt.

Gold pulled back sharply today from the region of the 200-day MA and closed below the psychological $1200 level. It will need to sustain a move above the trend mean to confirm a return to demand dominance beyond the short-term.

Copper has held a progression of higher reaction lows since January and is now trading in the region of the trend mean. A sustained move back above $3 would suggest more than a near-term low has been reached.