Kiwi Slides as Wheeler Hints at Rate Cut, Dollar Weighed by Fed

This article by Chikako Mogi for Bloomberg may be of interest to subscribers. Here is a section:

New Zealand’s dollar slumped after the central bank said it would cut interest rates if inflation pressures decline and called the currency’s strength while key export prices drop “unwelcome.”

The kiwi fell against all its 16 major peers, tumbling more than 1 percent versus the greenback after the Reserve Bank of New Zealand kept the official cash rate at 3.5 percent. Governor Graeme Wheeler said the currency is unjustifiably high on a trade-weighted basis. A gauge of the U.S. dollar held losses near a two-month low after growth in the world’s largest economy slowed, clouding the outlook for Federal Reserve policy.

“The RBNZ moved to an easier bias,” said Sam Tuck, a senior currency strategist at ANZ Bank New Zealand Ltd. in Auckland. Wheeler’s language on the currency’s level was slightly stronger than in the past, Tuck said.

The kiwi slumped 0.8 percent to 76.18 U.S. cents at 12:01 p.m. in Tokyo after sliding as much as 1.1 percent.

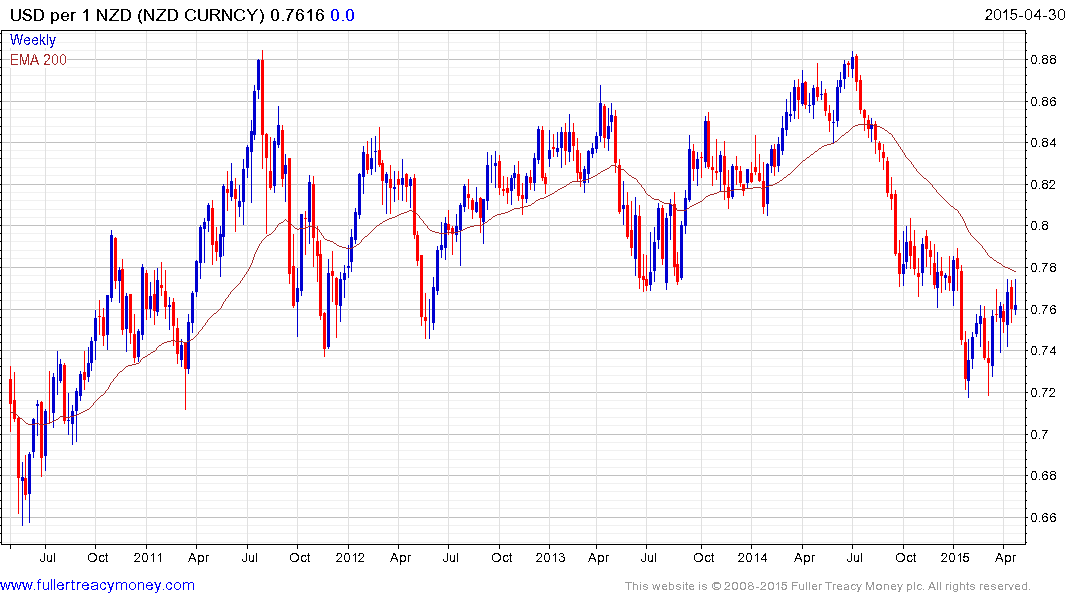

New Zealand’s has been willing to tolerate the strength of its Dollar for quite some time but that policy now appears to have changed, not least as generous interest rate differentials are expected to contract.

The decline from the July peak near 88¢ has broken the medium-term progression of higher reaction lows and the Kiwi is now at least pausing in the region of the 200-day MA. It would need to sustain a move above 78¢ to begin to question medium-term supply dominance.