Love em or Hate em, China Stocks Are Red Hot in Options Market

This article by Belinda Cao for Bloomberg may be of interest to subscribers. Here is a section:

The stock rally has prompted authorities to roll out measures this year that signal an effort to temper gains and prevent another boom-and-bust cycle after a record number of novice investors entered the market. China’s securities regulator started a campaign on Friday to crack down on stock- market manipulation and insider trading, the latest effort to reduce risks.

The China Securities Regulatory Commission will target trading by brokerage employees using non-public information, and market manipulation, including of futures prices, the CSRC said in a Friday statement on its website.

Chinese officials are trying to find a balance between weeding out speculators and encouraging the stock market to play a bigger role in helping companies raise funds as the government reins in credit expansion. The CSRC and central bank Governor Zhou Xiaochuan have endorsed the flow of funds into equities.

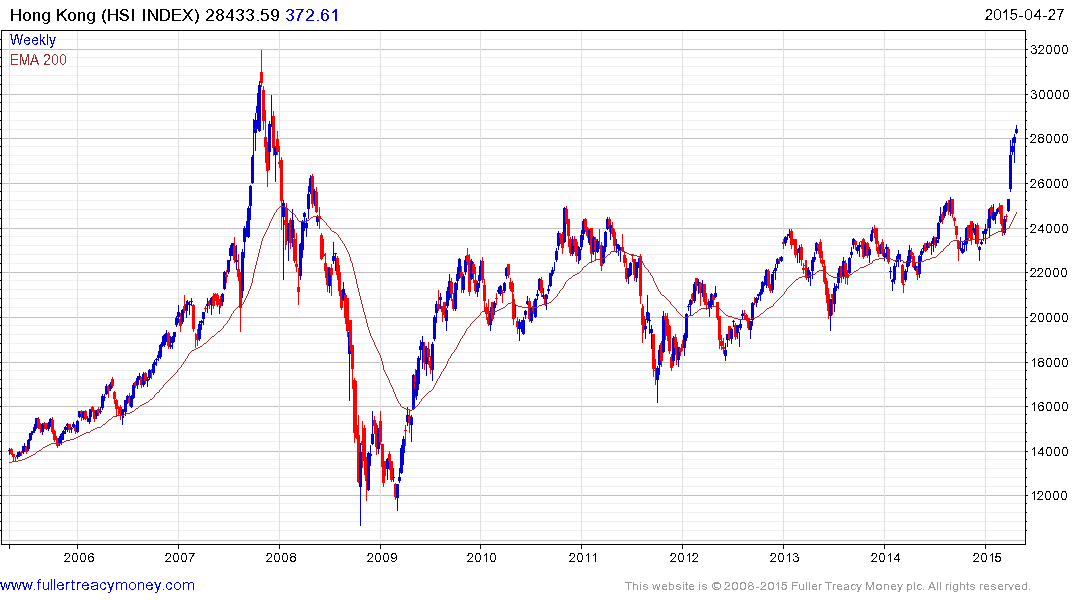

The speed and size of the breakout on China’s stock market creates a quandary for late comers because of the risk that a consolidation of short-term gains could be outsized relative to what one might be used to, but “normal” relative to the size of the breakout.

As with any breakout from a long-term range there is a great deal of trepidation among those who were previously bearish because they are now either losing money or at least receiving margin calls on short positions. The response is either to switch sides and become a bull (Hugh Hendry for example) or to double down and become even more bearish.

The increase in short interest may be a signal that long investors are hedging their exposure, the volatility of the move to date is fertile ground for options strategies and/or that bears are increasing their bets. We will continue to be guided by the price.

While Western media is looking at the US options market, I have seen almost no commentary on the Chinese equity options market which began trading in February. This article carries additional information.

There have been a number of WeChat blog posts complaining about the lack of oversight in the new options market and that there is no regulation of insider trading, front running or market manipulation within it. It is therefore interesting that the above article highlights that the regulator is now responding to these concerns.

The creation of an expansive options market, albeit still in its early stages, is a major bullish consideration for Chinese equities. The ability to hedge exposure using comparatively cheap instruments represents a facilitator to buy-and-hold strategies which should help to ameliorate the short-term trading bias of the market as it stands.

Back to top