High asset turnover no longer a good strategy for developers

Thanks to a subscriber for this report from Deutsche Bank focusing on the Chinese property market. Here is a section:

Mere sales volume recovery would not improve profitability of developers

While we expect further recovery in the physical property market, given policy relaxations, the recovery could just be a "profit-less" or profitless one for some developers (like those with expensive landbank, high gearing, high financing costs). The strategy of high asset turnover to drive earnings growth has proven ineffective as earnings growth has consistently lagged behind sales growth in the past two years. This prompted some developers to start shifting away from the high asset turnover strategy that they had been adopting in recent years. Meanwhile, we see little scope for profitability to rise significantly in the near term without a marked correction in land prices or a sharp rebound in ASPs.

Contracted sales growth not directly translate into corresponding profit growth

Some market participants believe that strong contracted sales growth will lead to corresponding strong earnings growth. However, by comparing contracted sales with earnings, we found that earnings growth has consistently lagged behind contracted sales growth, especially for developers focusing on high asset turnover. Contracted sales for leading developers saw YoY growth of 30% and 17% respectively in 2013 and 2014, but the corresponding core net profit growth was only 21% and -7%, while core EPS growth was lower at 19% and -10% respectively. For developers focusing on high asset turnover, the discrepancy between sales and earnings growths was more severe, reflecting the key industry challenges – land prices rising faster than home prices and rising financing costs from higher debt levels (used to drive higher growth). For example, Country Garden had contracted sales growth of 123% and 22% in 2013 and 2014 but had core EPS growth of only 16% and 10%, while Sunac had sales growth of 61% and 30% in 2013 and 2014 but achieved core EPS growth of only 17% and 4%. Adjusting for some aggressive interest capitalization, core net profits of the key developers were on average 41% and 106% below reported figures, suggesting that actual profitability is even lower

Here is a link to the full report.

There has been a great deal of commentary on the outlook for the Chinese property market over the last decade as prices soared. Two of the primary reasons for the outperformance were the dearth of other investment opportunities and the availability of credit. From 2009 the government clamped down on overbuilding in an attempt to rein in excesses. This had a major impact on property developer shares which spent much of the last five years ranging.

The change of policy that has seen bank reserve requirements cut from very high levels and the removal of some restrictions on property ownership have been welcome developments and help to explain the recent return to outperformance.

The Shanghai Property Index is now susceptible to some consolidation as it tests the 2007 peak near 8000. The pullback in January was approximately 1500 points and a similar drawdown cannot be ruled out for the next consolidation.

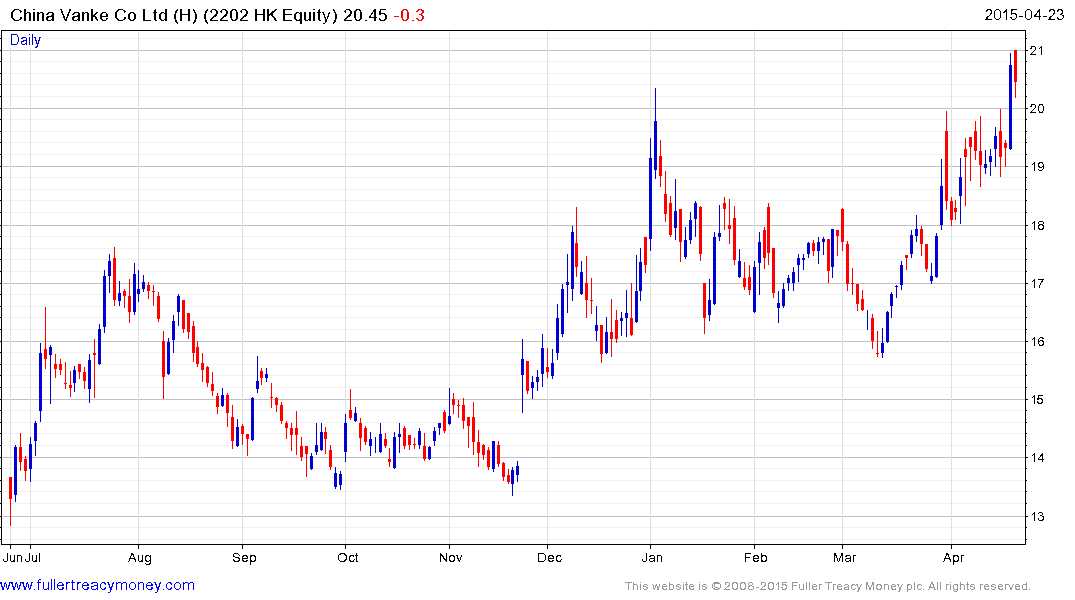

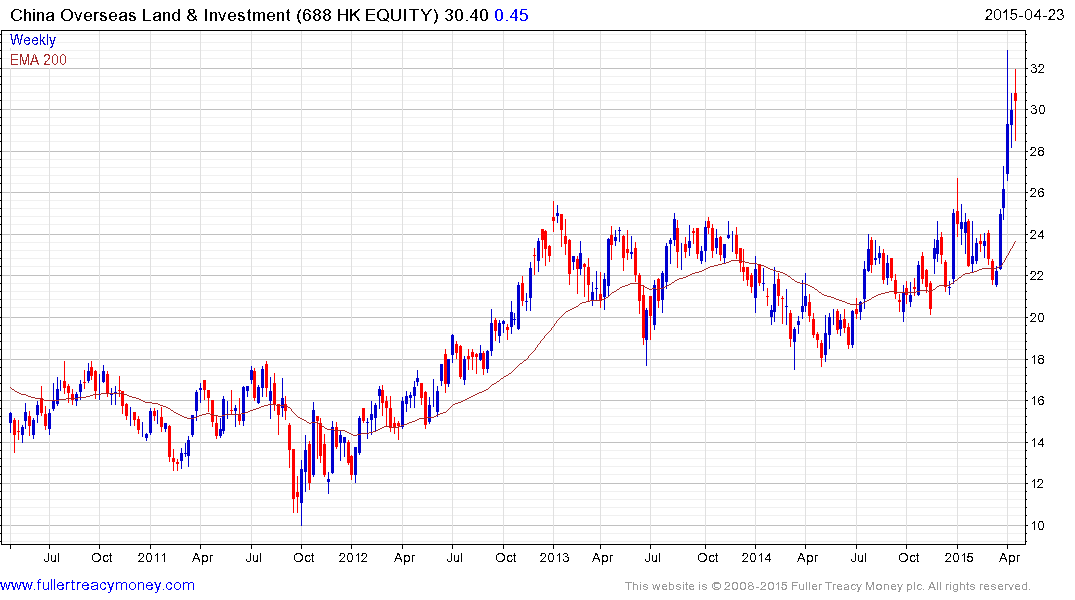

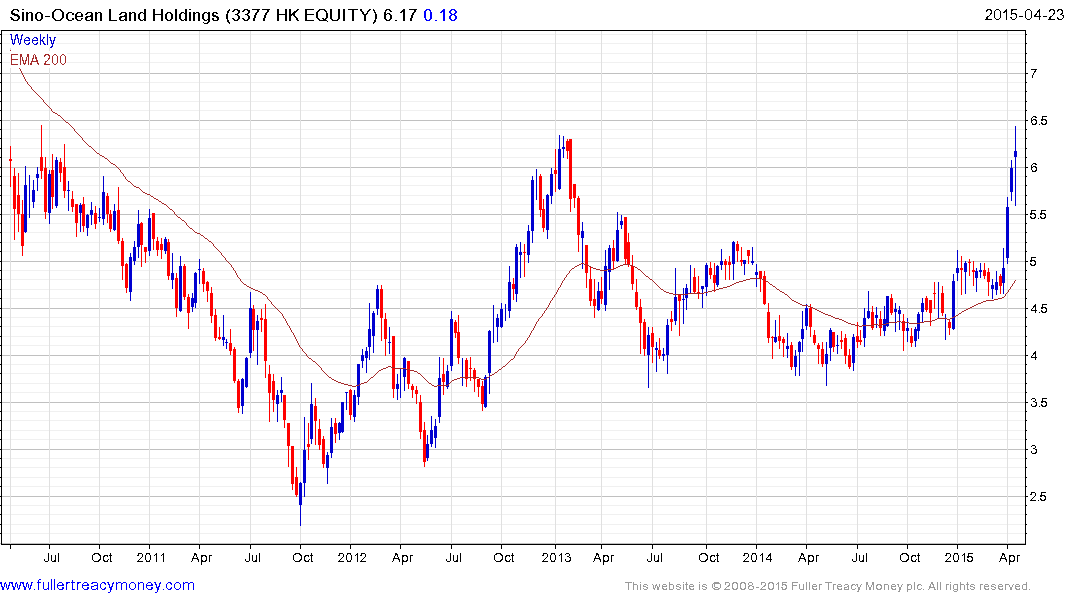

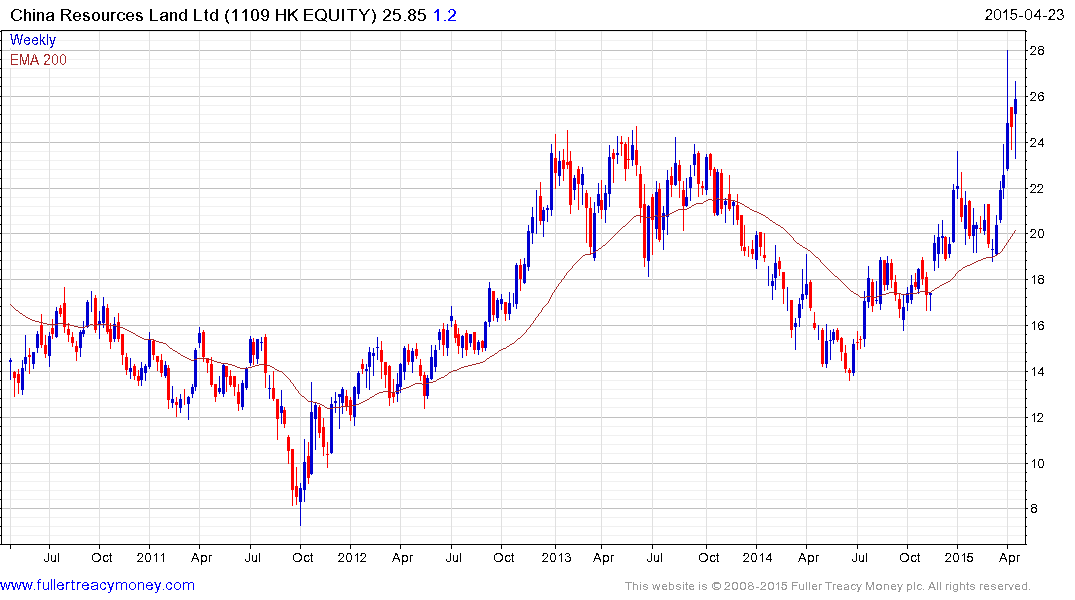

Among some of the more high profile shares. China Vanke (Est P/E 9.35, DY 3.06%), China Overseas Land & Investment (Est P/E 4.25, DY6.31%), Sino Ocean Land Holdings (Est P/E 9.38, DY 3.89%), China Resources Land(Est P/E 11.79, DY 1.91%) are all somewhat overbought in the very short-term but represent medium-term recovery candidates.

Greentown China Holdings (Est P/E 4.25, DY6.31%) has just broken a medium-term progression of lower rally highs and the upside can be given the benefit of the doubt provided it continues to find support in the region of the 200-day MA.

Back to top