Email of the day the onshore/offshore Renminbi rate

Ambrose Evans-Pritchard in his superb piece in the DT today designates the offshore/onshore Yuan rate as the key canary in the coal mine for further financial stress. Where can we find / how can we follow the offshore/onshore Yuan rate in the chart library?

Thank you for highlighting this article which draws parallels with a range of historical events before highlighting that China is where the epicentre of risk lies. Here is a section from the conclusion of the article:

Another stop-go cycle is picking up. Each time it is weaker, but it is still enough to delay the denouement until next year, and next year is an epoch away in market time.

Li Keqiang said on Wednesday that conditions are "bewildering" but that "the exchange rate will be kept basically stable at an adaptive and equilibrium level". He has many levers at his disposal but he is not omnipotent, and his own political future is suddenly in doubt.

Watch the offshore exchange rate for the renminbi. If that keeps spiraling further away from the inland rate, we will know that matters are out of hand, and then we really will have a global currency crisis. We are not there yet.

It has been a frightening summer. In the end you have to make a judgment call on whether this tangle of cross-currents in the world economy really is the start of another wrenching global crisis, or just a tremor. This time I refuse to join the pessimists.

There has been a great deal of debate about the motivations of the Chinese administration in changing how the Renminbi’s level is set. In many respects the why of the argument doesn’t matter. The result is what we have to deal with. We can conclude the reputation of the government as a capable shepherd of the economy has been tarnished.

Here is an article from Business Insider describing the difference between the onshore and offshore Renminbi. This is one of the more relevant sections:

The crucial thing about the offshore Renminbi (referred to as CNH here on), is that it doesn't fluctuate within a tight band like the onshore Renminbi (CNY) and is free of Beijing's control in that regard.

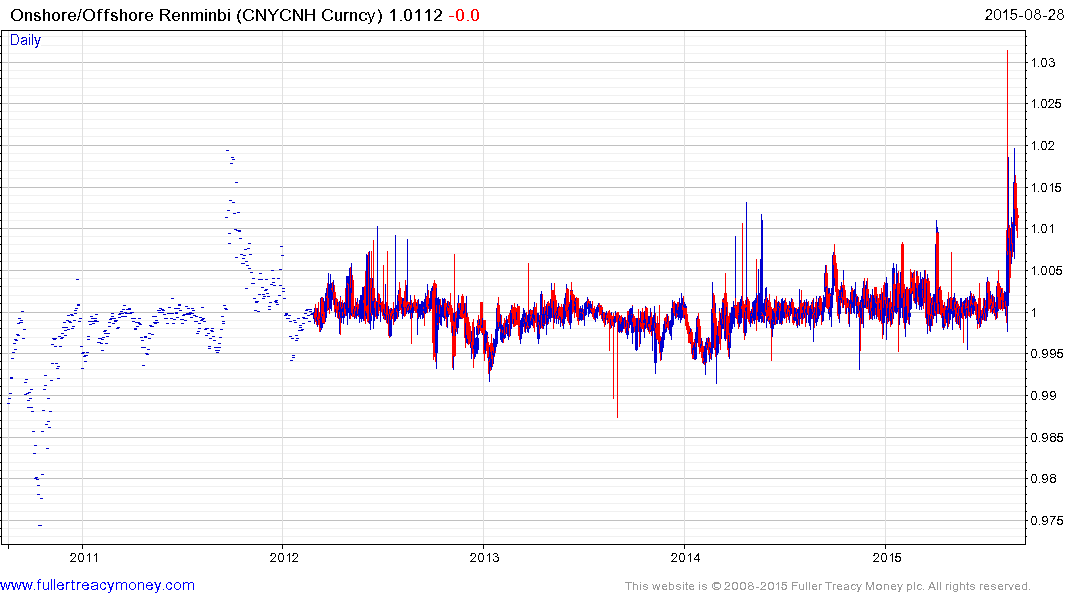

We have both onshore (CNY) and offshore (CNH) charts versus the Dollar in the Chart Library and I added the cross rate today. It had a similar spike higher in 2011 which was quickly retraced but this widening of the spread has been more persistent. Perhaps more importantly there is no evidence that the outflow of foreign capital has stopped. A break in the progression of higher reaction lows would be required to begin to question that trend.

The stock market is bouncing right now, not least because of the administration’s desire to have a rally ahead of its military parade where a host of allies have been invited. There is a Chinese adage that “you put lipstick on your lips not on your backside”. This helps to explain the desire to put on a formidable display when the world is watching. How the market reacts following the event will be much more telling in terms of its response to the stimulus measures already announced.

Back to top