China Click Through

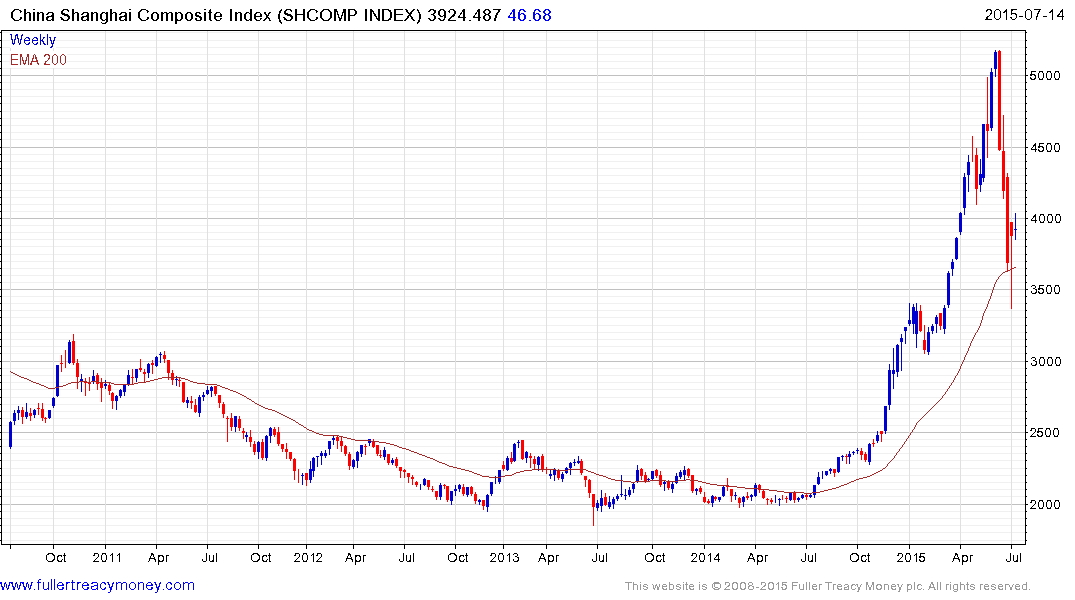

It’s been a tumultuous month with China collapsing then staging an impressive rebound amid some extreme policy measures to stem the decline. This is not a normal situation and China is not a normal market because the state plays such a large role in controlling the trajectory of prices. In an effort to gain a greater insight into how the market is reacting to this situation I clicked through a large number of Chinese shares.

I first started by looking for shares that might have bottomed early so performed a Bloomberg search for those that had hit 52-week lows between July 1st and 8th. The Shanghai Composite hit its low on the 9th. This gave me a list of 300 shares so I filtered it by those that still have a positive performance month to date. I then took a look at all 300 charts.

My motivation was to find some commonality in the performance of shares for a given sector that might lend some clue to which will lead on the way to an eventual recovery. The simple conclusion right now is that the financial sector has had the shallowest reaction and the best bounce to date not least because banks and insurance companies are largely state controlled.

Following my click through of 52-week lows it is evident that recent IPOs tend to have bypassed the turmoil and are moving to new highs. I found this intriguing and added the Bloomberg Chinese IPO Index to the Chart Library. The Index trended lower in a consistent manner between 2011 and 2014 and broke out of a six-month base a year ago. It surged higher and pulled back violently along with the wider market. On examining the constituents of the Index I realised that some of the larger most recent IPOs are not yet part of the Index. For example Anhui Kouzi Distillery, Zhejiang Red Dragonfly (clothing manufacturer), JCHX Mining Management (mine construction) have market caps above CNY 10 Billion, IPOed in the last month, are testing their highs but are not yet part of the Index.

Following such an impressive advance, swift pullback and continuing rebound, the most likely scenario is for a lengthy period of support building. This would allow animal spirits to calm down and for confidence to be rebuilt. Japan’s experience following its breakout in 2012 offers a potential template.

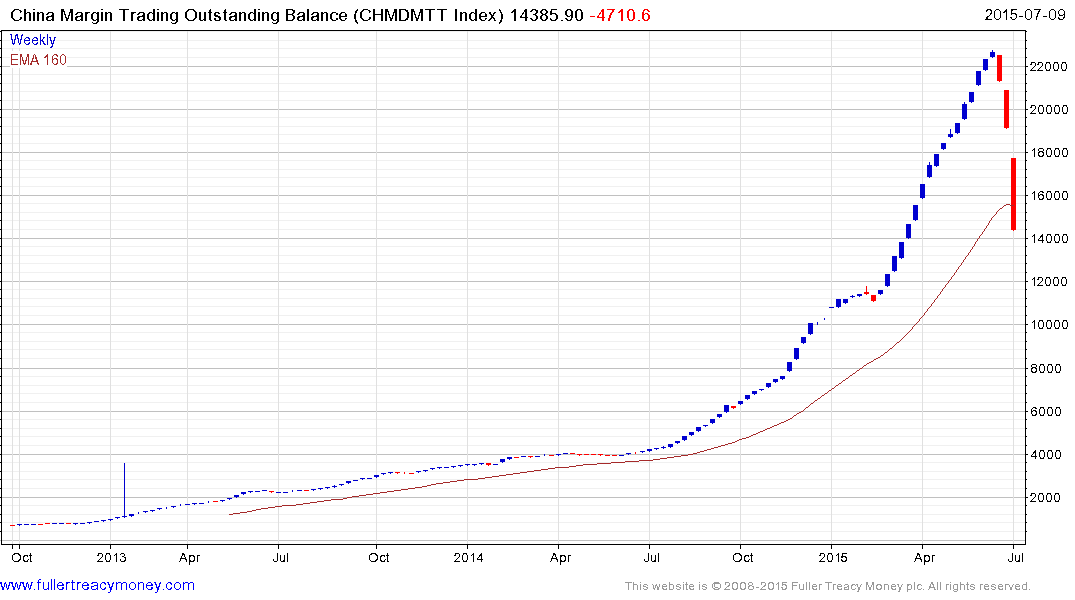

Outstanding margin has contracted considerably over the last month but is still elevated relative to where it was in January. This will be an interesting chart to monitor for when it eventually starts to trend higher once more.