Lindt CEO Says Cocoa Prices Should Decline to Reflect Reality

This note by Thomas Mulier for Bloomberg may be of interest to subscribers. Here it is in full:

Ernst Tanner says in phone interview that speculation has driven cocoa prices up too much.

Supply of beans in market is greater than demand, grindings going down, rather than up: Tanner

Arguments about Ebola have been used to justify higher cocoa prices, though outbreak hasn’t affected industry

Easier to raise prices in U.S. than in Europe

?Lindt, Ghirardelli brands gaining share in U.S., integration of Russell Stover on track

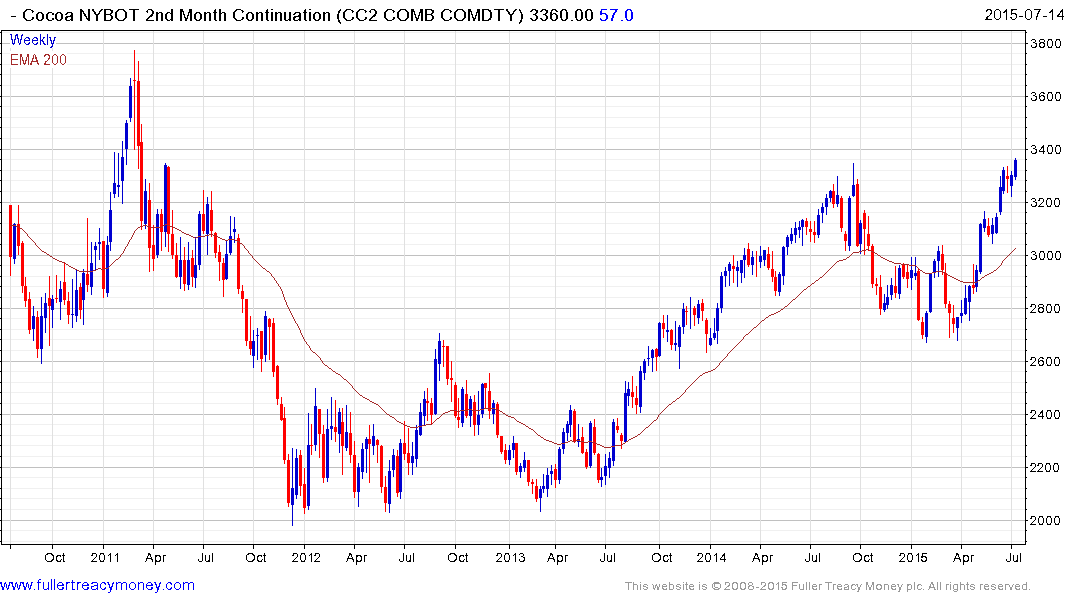

Cocoa is trading in mild backwardation suggesting there is more to the recent run in prices than pure speculation as the above quotes would indicate. US Cocoa prices are currently testing the 2014 peak near 3400¢. On the run up from 2700 reactions have been limited to approximately 100¢ so a pullback larger than that would be required to signal more than temporary resistance in the current area.

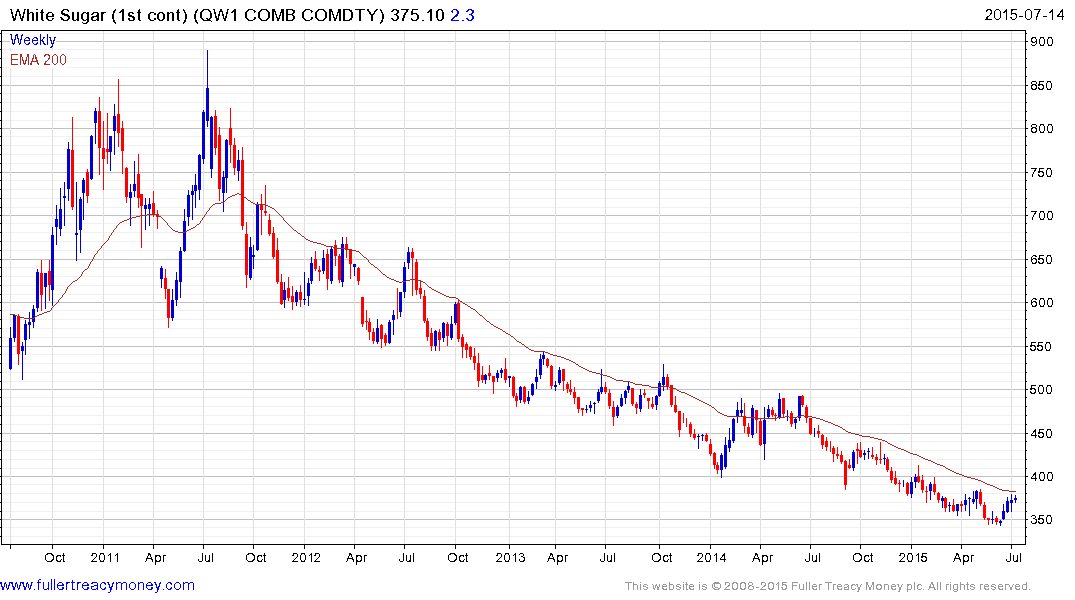

Elsewhere, London listed White Sugar has been trending lower for four years and is now testing the region of the 200-day MA. A sustained move above $385 would begin to suggest a return to demand dominance beyond the short term.

Arabica coffee has lost momentum in the region of 120¢ but the progression of lower rally highs remains in place. A move above 135¢ would begin to pressure shorts and suggest a return to demand dominance beyond the short term.