It is End of Era for Yuan Appreciation, Says Ex-PBOC Adviser Yu

This article by Bloomberg News may be of interest to subscribers. Here is a section:

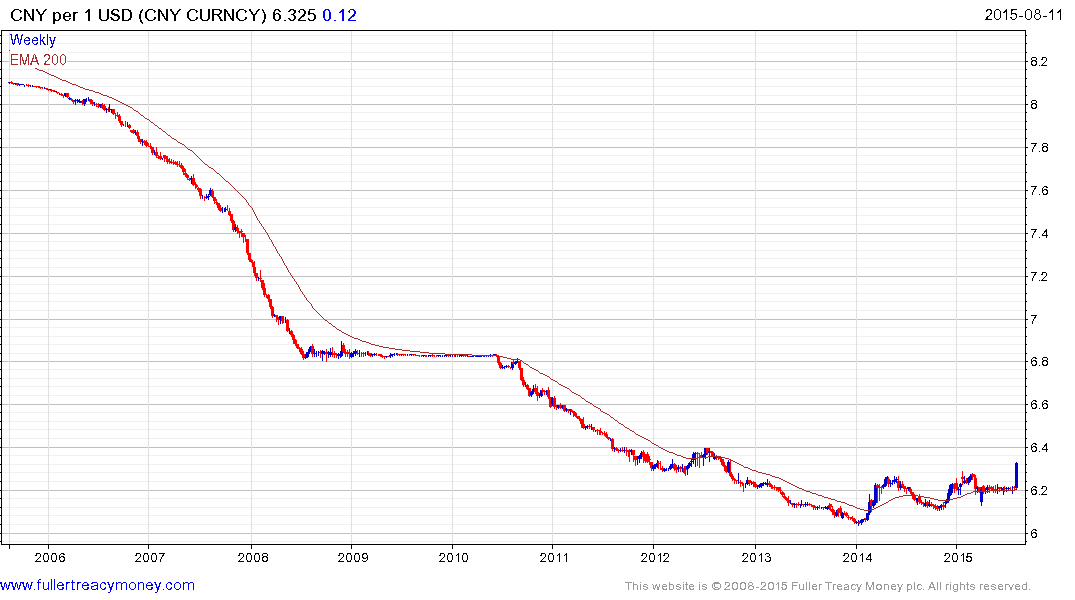

The era of yuan appreciation has come to an end with China’s move to lower the daily reference rate by 1.9 percent, said Yu Yongding, a member of China’s monetary policy committee when the currency was revalued in July 2005.

The yuan exchange rate will enter “a period of stabilization or even depreciation,” said Yu, now a researcher with the Chinese Academy of Social Sciences. The People’s Bank of China’s reduction to the daily fixing was a “symbol” for the change, although signs of yuan depreciation were evident before Tuesday’s move, he said.

?The biggest slide of yuan since the peg ended a decade ago is a one-time adjustment, the PBOC said in a statement, adding it will strengthen the market’s role in the fixing and promote the convergence of the onshore and offshore rates. The move comes as sliding exports add to slowdown pressure and may add to concerns more capital will flow out of the nation.

While a weaker yuan may bolster exports in the short term, it’s a dangerous long-term way to increase shipments, Yu said.“It would be a very wrong and stupid way to boost exports, and I don’t think China’s central bank will opt for that,” he said. “The depreciation is more of a recognition and respect of market forces.”

“The PBOC should reduce its intervention in the yuan,” Yu said. “If the market believes the yuan should be weaker, then just let it weaken.”Yu said the yuan’s change will “for sure affect other currencies of emerging markets,” although the biggest deciding factor will be the policy stance of the U.S. Federal Reserve.

At The Chart Seminar in Singapore in April there was a great deal of interest in how one could hedge exposure to the Euro following its decline but not many people were interested in hedging the Renminbi since it was viewed as such a stalwart. Nevertheless, the time to hedge a currency is before the devaluation rather than after. Today’s move is not very large but it represents a powerful indication that the trend of Yuan appreciation is most definitely over.

China’s neighbours have little choice but to follow suit and allow their respective currencies to fall. To do otherwise would be to lose competitiveness and they cannot afford that particularly as commodity prices remain weak.

The Asia Dollar Index accelerated lower today and a clear upward dynamic would be required to lend credence to an argument for mean reversion.

Some of the repercussion of this move is that Apple devices just got a little more expensive in its largest market. The share bounced last week from the $112 area but remains on shaky ground until it sustains a move back above the 200-day MA.

Gold on the other hand just went up in Renminbi and from comparatively depressed levels.

Back to top