The State Of U.S. Listed China Based Companies Going Private

This article from Benzinga may be of interest to subscribers. Here is a section:

We believe part of the motivation for management teams to welcome going private deals is the belief by many investors that the China "A" share stock market may see a sharp correction within the next several months.

The Chinese "A" share stock market contains exchanges such as the Shanghai Stock Exchange and the Shenzhen Stock Exchange, where shares of China mainland-based companies are listed. "A" shares are generally only available for purchase by China mainland citizens.

Thus, ChinaHyrbid management teams and private equity firms may be scurrying to take advantage of the huge valuation gap between ChinaHyrbids and "A" share companies – before the "A" share market corrects – by going private and then eventually re-IPOing in China at much higher valuation multiples.

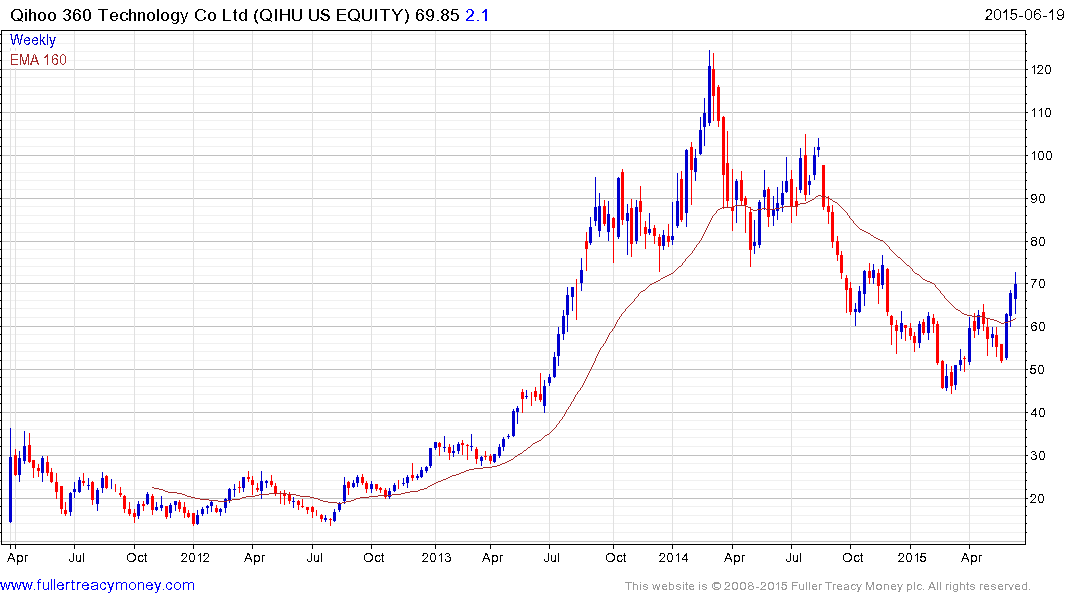

For example, the Chinex Price Index (SHE: 399006), which is the index that includes small cap growth companies in the China A share market, has an average P/E of 115 as of June 18, 2015. However, the non-binding go private price of QIHU of $77.00 is only 22 times of the analyst estimated EPS in 2015.

The Chinese government views the internet as just another organ of the Party’s apparatus like roads or TV stations. The challenge they have is that private sector entrepreneurs who have spearheaded the development of the Chinese technology sector have lower participation rates in the Party than other sectors. An effort has been underway to recruit more people from the technology sector into the administration. Wishing to see more companies take out listings on the mainland rather than decamping to the USA, Singapore or Hong Kong can be seen in these terms. It also helps explain the rationale behind the sweeteners currently on offer for returning companies.

The wide arbitrage in valuations between the still mostly depressed US listed Chinese companies sector and the mainland represents a compelling argument for moving. The actions of Alibaba over the last few years, first listing in Hong Kong to initial fanfare only to delist later and relist on New York suggests Chinese CEOs are more than open to changing location when the opportunity presents itself. I last reviewed the sector on April 30th and here is a link to the US listed Chinese companies section of the Chart Library.

So far the only US listed companies that have performed similarly to A-shares have been the ADRs of major State-Owned Enterprises (SOEs). Qihoo Technology found support above its March low three weeks ago and a sustained move below $60 would be required to question potential for the taking private bid to be successful.

Soufun, China’s largest real estate internet portal, had a reasonably similar pattern. It broke out of a short-term range last week but pulled back sharply today. It will need to hold the region of the 200-day MA if recovery potential is to be given the benefit of the doubt.

Today’s sharp pullback on mainland Chinese indices has had a knock on for related shares. The Shanghai A-Shares Index posted is largest downward dynamic in years this week, suggesting at least a near-term peak has been reached. A clear upward dynamic will be required to check momentum and to suggest mean reversion will be limited to a ranging consolidation.

Back to top