Email of the day on Chinese consumers

This is entertaining but the most worrying report that I’ve read about China’s economy. Could the situation have changed so much since your visit?

Thank you for this article highlighting how many commentators are now using Alibaba as a barometer for Chinese consumer sentiment. Here is a link to the report I wrote on my most recent trip to China in April.

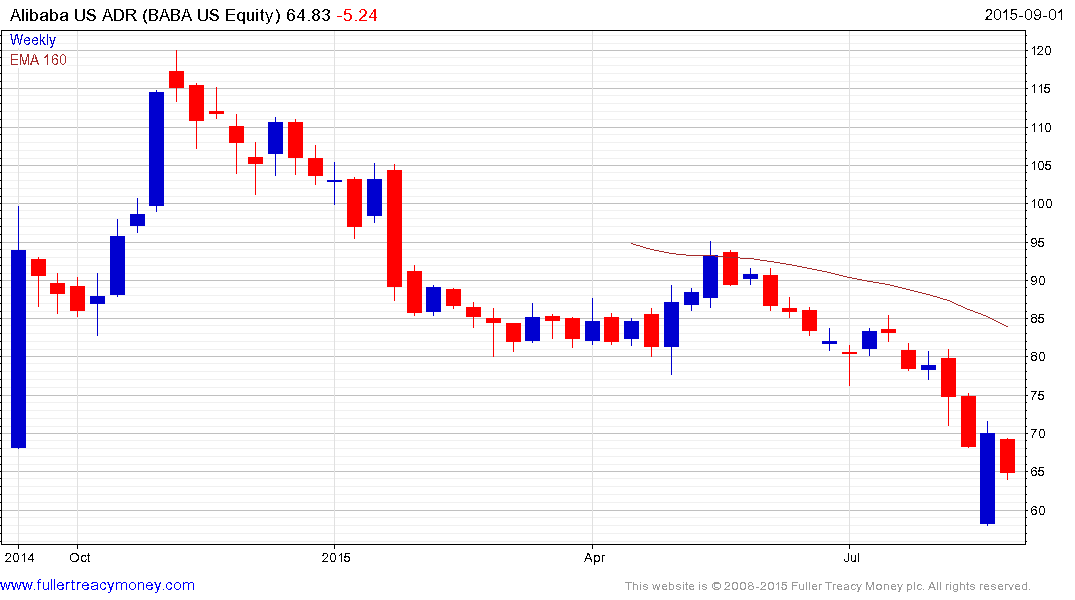

I didn’t write about Alibaba in the report but I’ve been leery of the share since its most recent IPO not least due to governance considerations. It is for that reason I don’t think solely looking at Alibaba is a satisfactory way of assessing the health of the Chinese consumer market.

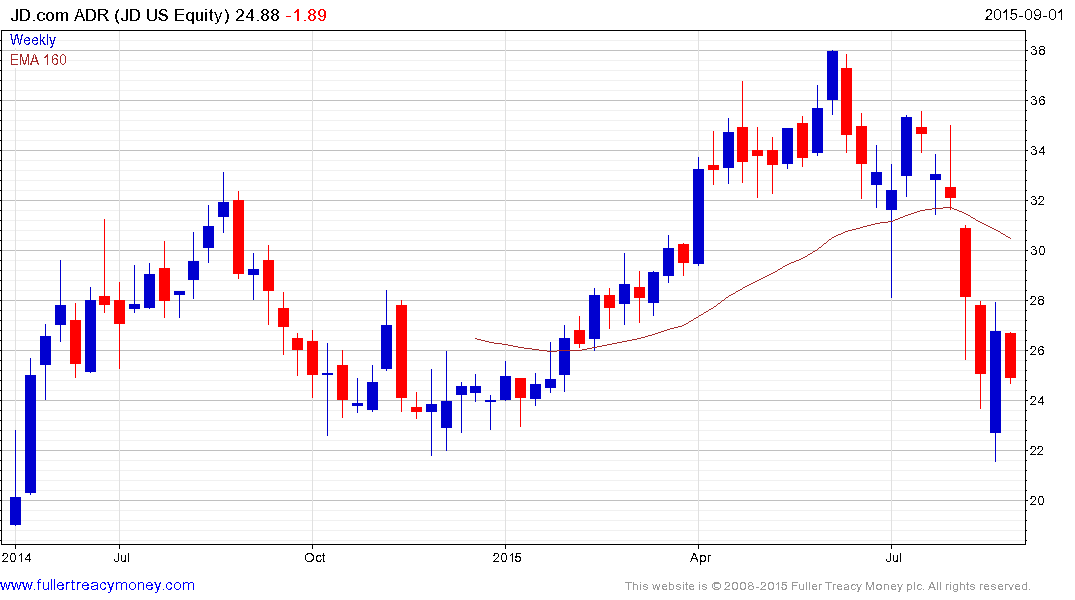

Tencent Holdings and JD.com are better measures in my view but both have also experienced a loss of consistency. Despite short-term oversold readings, additional evidence of demand returning to dominance will be required to rebuild confidence. I think it is worth highlighting how much bullish news had been priced in at the peak for these shares. The impact of their declines to date should not be exaggerated especially in what is an emotional environment.

.png)

The FTSE/Xinhua China A600 Banks Index has been the subject of some of the government’s most aggressive supports ahead of tomorrow’s military parade; rallying for the last five consecutive sessions. The big question is how will the Index behave when the market reopens? Last week’s low will need to hold on any pullback to demonstrate a return to demand dominance beyond the short term.