Hong Kong Dollar Forwards Sink to Weakest Since 1999 on Peg Bets

This article by Saijel Kishan and Dominic Lau for Bloomberg may be of interest to subscribers. Here is a section:

The city’s government bonds tumbled, pushing the 10-year yield to the highest level in 15 months and Hong Kong’s Hang Seng Index of shares dropped the most since Aug. 24 and as rising local borrowing costs threaten to further brake an economy reeling from a collapse in Chinese shares and the slowest growth in the mainland in 25 years. The yuan’s slide to a five-year low in the first week of January triggered weakness in emerging Asian currencies this month, led by a 3.4 percent drop in South Korea’s won.

“It’s like an attack all fronts on Hong Kong,” said Nordine Naam, global macro strategist at Natixis in Paris. “Investors are getting more and more risk adverse, especially with regards to China and so they’re getting out of the region. For the time being, Hong Kong has lost its safe haven status.”

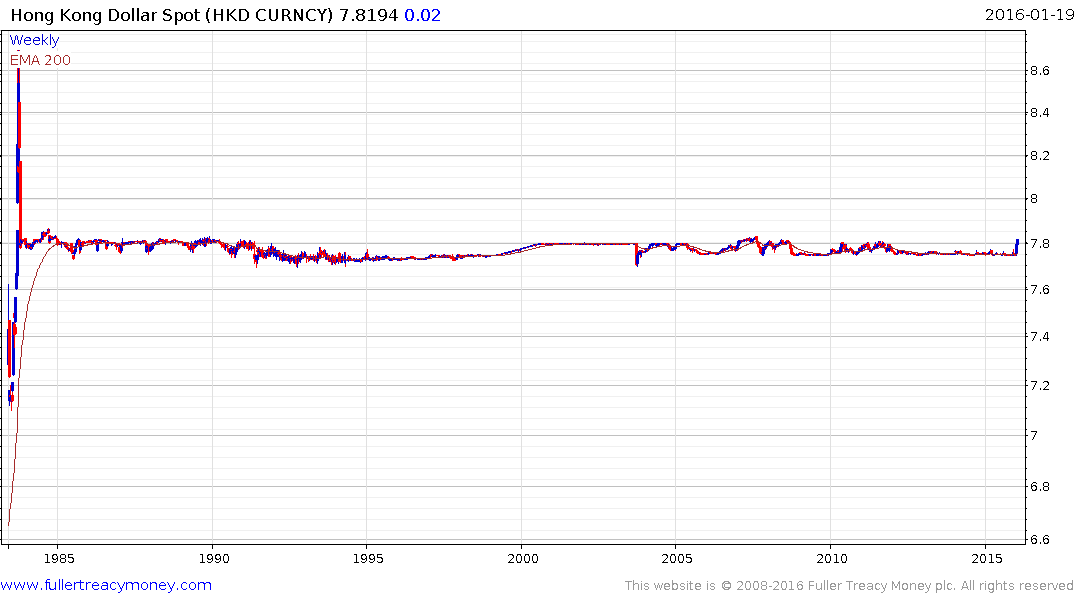

Hong Kong Monetary Authority Chief Executive Norman Chan said Monday he expects the local currency to decline to the lower limit and reiterated his commitment to keeping the linked exchange-rate system. It had traded at the strong end of the range as recently as Jan. 4. He said Wednesday that the International Monetary Fund is also a supporter of the mechanism.Hong Kong brought in the peg in 1983 after a 30 percent plunge in the local dollar’s value led to panic buying of rice and other staples. Former HKMA chief Joseph Yam in 2012 called for a review of the peg, having in 1998 conducted $15 billion of stock purchases to fend off speculative attacks on Hong Kong’s equity and currency markets.

“The Hong Kong dollar is a victim of all the risk aversion across global markets given what’s happening with China,” said Tommy Ong, managing director for treasury and markets at DBS Hong Kong Ltd. “Dollar pegs across the globe are under pressure but I trust that the Hong Kong peg will stay in place because there are no better alternatives given the volatility we’ve seen with the yuan.”

Following a visit to Hong Kong in October I came away with the impression that housing was drastically overvalued and the impending change in the US interest rate cycle would be bad news for the sector. There is a running argument on the ability of the US economy to tolerate the strength of the Dollar but a consensus is evident in the belief a number of countries and regions maintaining Dollar pegs can ill afford currency strength at the present time.

The Hong Kong Dollar is now at a level where monetary officials will have to intervene if they are to successfully support the peg. They are going to have to employ significant resources to do so and the impact on the domestic economy will be painful. There is almost no possibility of the Hong Kong Dollar moving to a free float, not least because Beijing would not allow it and would much prefer the city be brought to heel and a peg to the Renminbi be imposed. That suggests we are very close to some form of intervention because to do otherwise would endanger what independence Hong Kong has.

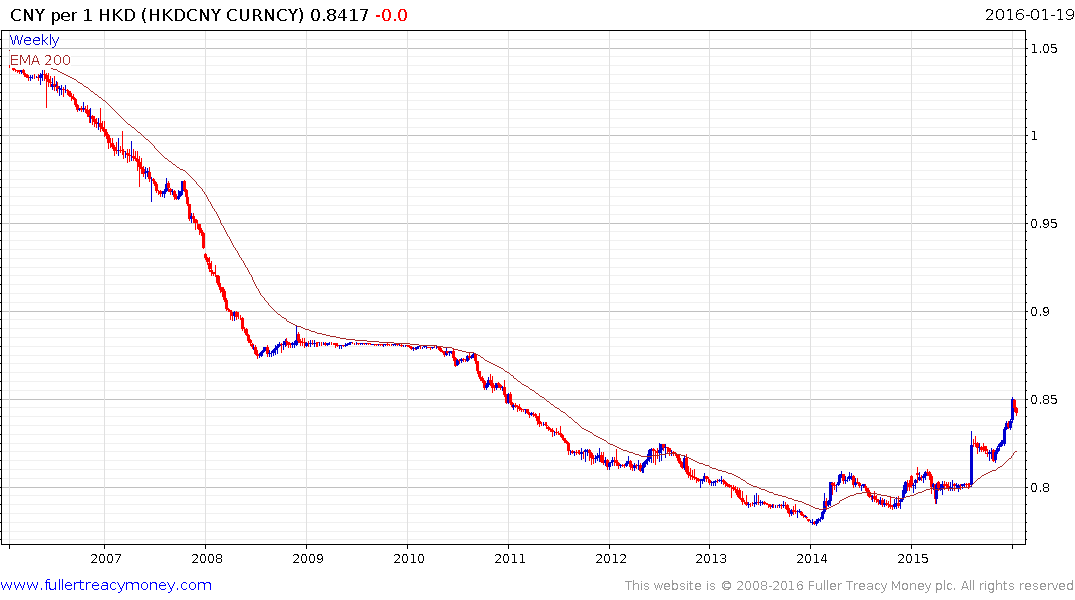

The cross rate is currently rallying towards parity and a break in the progression of higher reaction lows would be required to question potential for further upside.

The Hong Kong Property Index is testing the region of the 2014 lows, having fallen 5000 points since the beginning of the year. While a short-term oversold condition is evident, a clear upward dynamic, visible on a weekly chart, would be required to check momentum.

Hong Kong has long had a boom/bust property market and nothing has occurred to question that view. In fact Li Kai Shing spun off the property arm of Hutchinson Whampoa into Cheung Kong Holdings last year suggesting major Hong Kong property developers are also of the opinion that the property cycle has turned. The share has trended lower since inception.

The Hang Seng failed to sustain the move to new recovery highs in April, dropped to break the medium-term progression of higher reaction lows in August and dropped to a new reaction low this week. This represents significant technical deterioration and a period of support building will be required before investors can have confidence the selling pressure has stopped.

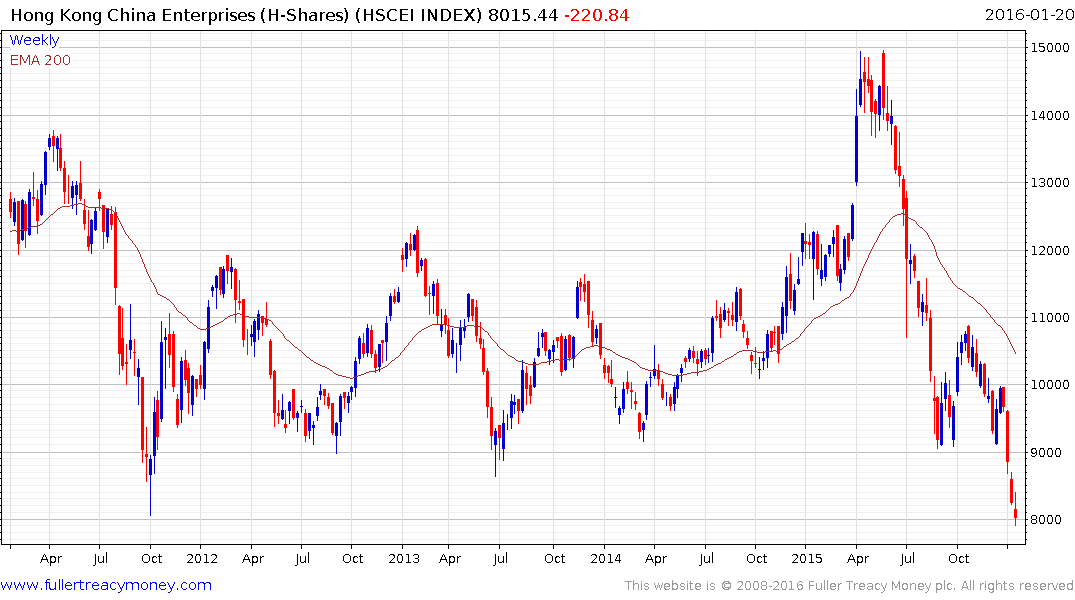

The China Enterprises Index (H-Shares) which is mainland focused, dropped to test the 8000 area today and a clear upward dynamic similar to that posted in 2011 following the last retest of this level will be required to signal demand returning in this area.