Gold and Safe Haven Status

Gold prices are down about 43% in US Dollar terms since the 2011 peak but have been notably quiet over the last few months as volatility has picked up in just about every other asset class. Sometimes just doing nothing is enough to attract attention when the emotionality of the market spikes higher and this has certainly been the case for gold.

For example the gold/oil ratio is now at an all-time peak following the continued plunge in oil prices. This is a clear example of acceleration and the unsustainable beyond the short-term.

.png)

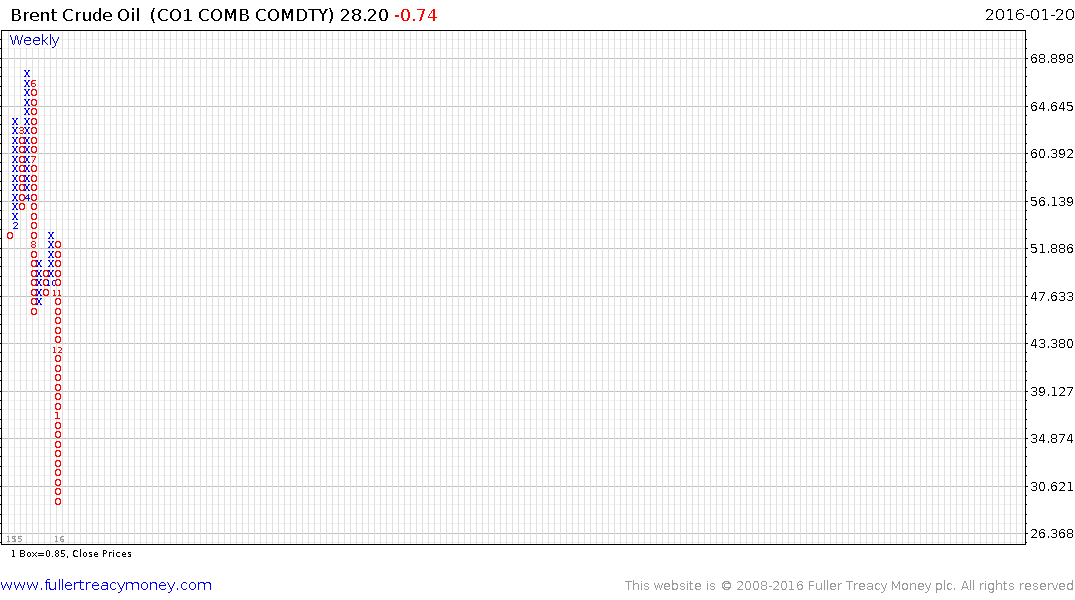

Nevertheless a look at this p&f chart of Brent Crude suggests a rally of more than $2.55 would be required to check momentum and signal at least a short-term reversal.

Gold is particularly strong against the currencies of countries with real problems such as Russia, Brazil or South Africa.

.png)

.png)

.png)

That is perhaps the biggest takeaway because the cocktail of Dollar strength, plunging commodity prices and below trend Chinese demand are conspiring to create serious issues for countries and particularly companies, with excessive foreign debt. With inflation running rampant how long can countries like Venezuela and others sustain their debt when oil prices are so low. I checked a large number of yield curves on Bloomberg this morning and Venezuela is where the greatest stress is evident with a sharply inverted pattern.

Petrobras with its large quantity of outstanding debt also has an inverted yield curve.

Stock markets firmed off their lows today suggesting some demand returning following a traumatic week and some climactic selling this morning. There is scope for steadying but the inverted yield curves above suggest there are medium-term issues that remain headwinds to a broad based recovery in global markets. These issues are likely to come to a head when Venezuela and/or Petrobras need to refinance.

Gold continues to close its overextension relative to the trend mean but needs to sustain a move above it confirm a return to medium-term demand dominance.

Back to top