China Unleashes More Steps to Stem $3.2 Trillion Stock Rout

This article from Bloomberg News may be of interest to subscribers. Here is a section:

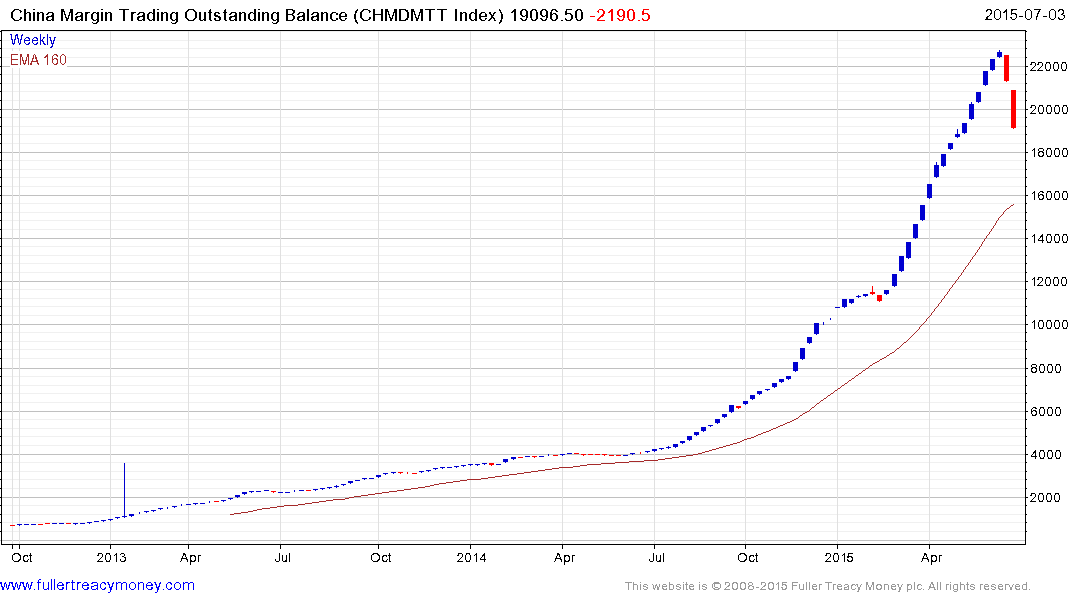

The outstanding balance of margin loans on the Shanghai Stock Exchange dropped for a ninth day on Thursday, sliding to 1.29 trillion yuan in the longest stretch of declines since the city’s bourse began compiling the data. A fivefold surge in borrowing had helped propel the benchmark stock index to a 150 percent advance in the 12 months through June 12.

The authorities are determined to shore up the $6.9 trillion stock market even if it means reversing reforms, according to Partners Capital International Ltd. The Communist Party’s Central Committee pledged in 2013 to make markets “decisive” in allocating resources and to limit the government’s role to maintaining stability.

“They have the whatever-it-takes mentality,” said Ronald Wan, chief executive officer of Partners Capital International in Hong Kong. “Early on Monday, the market may show a knee-jerk reaction to the measures but I am not sure how sustainable it will be. Whether it’s a rally or a decline, it’s policy driven, not market-oriented.”

And

There won’t be any new IPOs in the near future and the number and value of share sales will be significantly reduced once they resume, the CSRC said in a statement on its website Sunday.

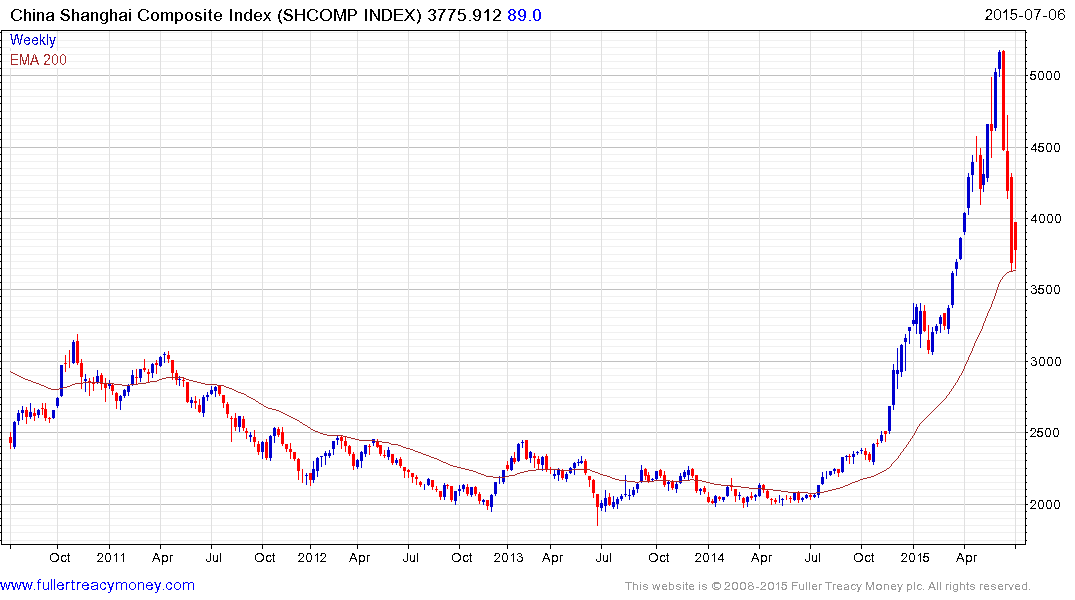

The 21 brokers pledged not to reduce any proprietary investments in the equity market as long as the Shanghai Composite Index stays below 4,500, the association said. The measure closed at 3,686.92 on Friday. Listed brokers will actively buy back outstanding shares, while encouraging their parent companies to increase holdings, according to the statement.The plan by trading firms to boost shares may have only “a fleeting effect” given daily turnover is nearing 2 trillion yuan, said Hao Hong, China equity strategist at Bocom International Holdings Co. in Hong Kong.

“This 120 billion yuan won’t last for an hour in this market,” Hong said by phone from Beijing Saturday. “It might benefit blue-chip stocks, as investors may see them as value, but the bursting of the bubble in small-cap/tech stocks is likely to continue.”

China remains a policy driven market but is presented right now with the unwinding of what has been an historically large build up in leverage. This is now declining and measures are underway to remove supply from the market in order to support prices. Allowing the state pension fund to buy shares, cancelling IPOs, funds and brokerages intervening to buy are all aimed at imposing a floor.

The Shanghai Composite Index, in common with just about every other mainland Index, is now testing the region of its 200-day MA following a steep decline. 4500 is quite a bit above today’s close and suggests the ideal scenario from the perspective of policy makers is a range that allows some of the excess built up over the last six months to be unwound.

The most overvalued companies are obviously at the most risk so the attraction of reasonably priced shares is likely to become more of a factor going forward. The recent return to outperformance of the banking sector is a case in point.

The FTSE Xinhua A600 Banks Index rebounded impressively from the region of the 200-day MA and a sustained move below the trend mean would be required to question potential for additional higher to lateral ranging.

.png)

ICBC was the only large cap mainland listed share to hit a new closing high today and a clear downward dynamic would be required to question potential for additional upside.

Back to top