Bond Market Storm Finally Hits Junk Debt as Buyers Flee ETFs

This article by Lisa Abramowicz for Bloomberg may be of interest to subscribers. Here is a section:

While ETFs are a small slice of the junk-bond market, they’re usually a telling gauge of sentiment, and the outflows are significant compared with the $6.7 billion of total deposits into these funds so far in 2015, Bloomberg data show.

Government yields in Europe and the U.S. are rising in the face of improving economic data and signs inflation is picking up (or, in Europe’s case, that there’s any inflation at all.) Yields on 10-year Treasuries have surged past 2.4 percent, reaching the highest level since Oct. 6, from 1.8 percent in April.

And now the $2.2 trillion world junk-bond market is losing steam, at a time of growing questions about how long stocks can keep rallying. The debt tends to be a leading indicator, and its deterioration bodes poorly for stock investors, Tchir said.

While the selloff is short-lived enough that it may just prove a blip in a market propped up by central-bank stimulus, it may also portend broader pain ahead.

Corporate bonds of every hue are priced against a government benchmark. This means when Treasury yields rise corporate yields follow. We see this in the yield of BB bonds which are now breaking out of a two-year range.

The spread, however, suggests that the yield on high yield is not rising faster than Treasuries.

The Credit Suisse High Yield Index reflects the sector’s total return since 1985. The Index has lost momentum over the last year but a sustained move below 1200 would be required to question the integrity of the overall uptrend.

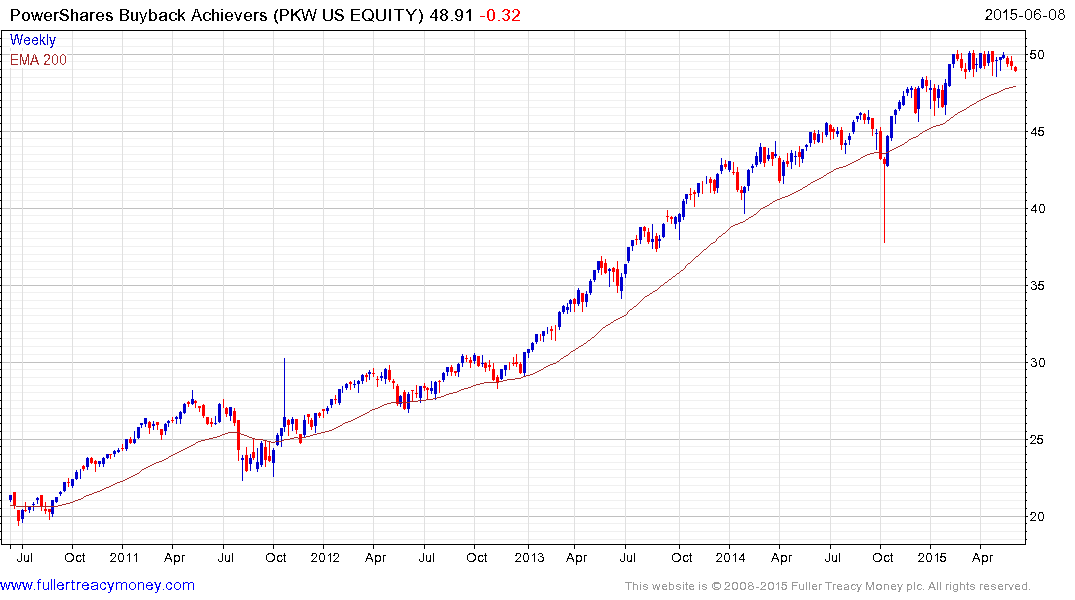

The absolute level of yields is important since the stock market has been so dependent on the ability of companies to raise cash cheaply in order to buy back their own shares. Anything that interrupts that flow of liquidity is likely to weigh on stock market performance.

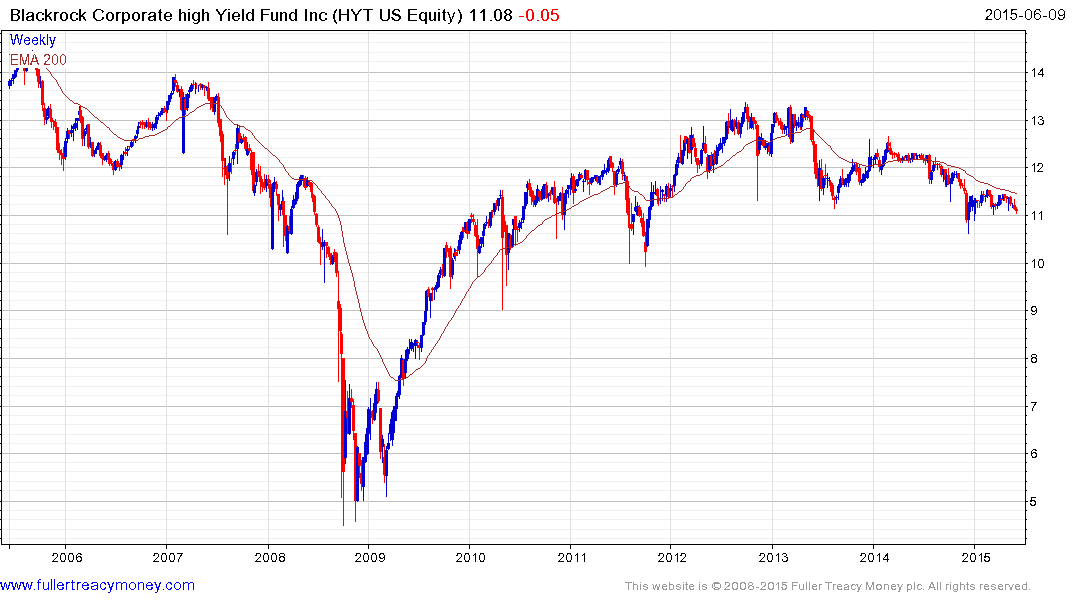

The Blackrock Corporate High Yield Fund is trading at a discount to NAV of 12% and yields approximately 7% but that pay-out has been falling. The share continues to hold a medium-term progression of lower rally highs and a sustained move above the 200-day MA would be required to question medium-term supply dominance.

The PowerShares Buyback Achievers ETF has been confined to a tight range for much of the last four months in what has been a relatively gradual process of mean reversion. A sustained move below the 200-day MA would be required to question medium-term uptrend consistency.