European Shares Rebound From Four-Day Rout as Carmakers Rally

This article by Alan Soughley and Sofia Horta e Costa for Bloomberg may be of interest to subscribers. Here is a section:

“This rebound could be a sign that global markets are calming down a little,” said Pedro Ricardo Santos, a broker at X-Trade Brokers DM SA in Lisbon. “We expect to see a recovery for equities this week, though we’re not yet talking about a strong rally from here. Concerns about commodities prices will persist, and pressure on those sectors continues to be very high.”

Investor fear that turmoil in China’s stocks and currency will spread to the global economy has spurred declines in world markets this year, wiping about $5.4 trillion off the value of international equities. Mining companies have suffered the most in Europe, with a gauge of regional commodity producers sliding 15 percent so far in 2016.

The Eurozone is not raising interest rates. In fact since the ECB has only one mandate and that is to achieve inflation close to, but not above, 2% it is looking more likely than not monetary will be looser rather than tighter for the foreseeable future. Despite turmoil on a number of fronts monetary policy is likely to be a tailwind more often than not over the coming years.

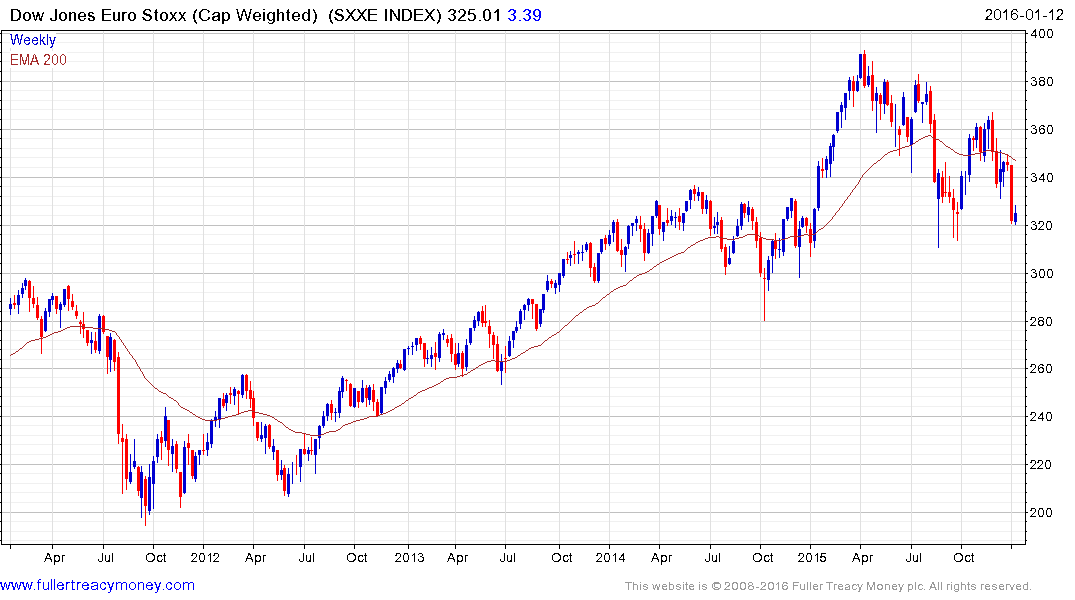

The DJ Euro STOXX Index has at least steadied in the region of the August and September/October lows. There is potential for a reversionary rally to unwind the short-term oversold condition but a clear move above 350 will be required to confirm a return to demand dominance beyond the short term.

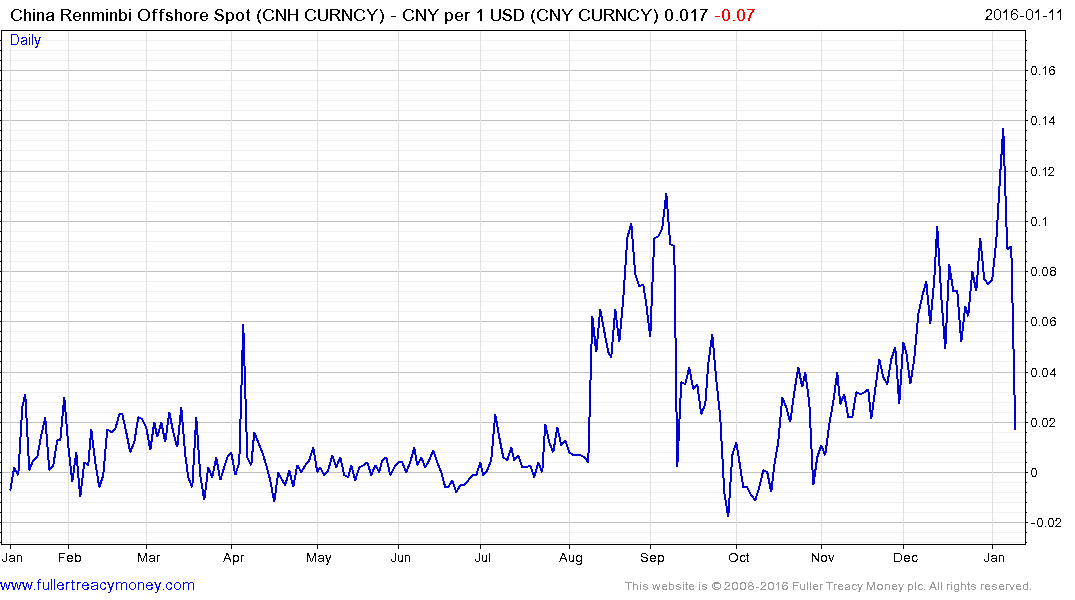

Right now many investors are more concerned with what is going on in China than what the ECB is doing. Targeted efforts to pressure shorts and stamp out speculation have seen the arbitrage between the offshore and onshore Renminbi close, but for how long? China needs to do more to restore confidence not least following how badly regulation of the stock market has been managed over the last year. Perhaps the greatest problem is that Xi Jinping has stated in no uncertain terms that politics comes first. In other words the Party comes before everything else. With kind of mind set the stock market is not his first priority and that is not good for sentiment. With that in mind the major indices are dependent on government efforts to support them.