Musings From The Oil Patch January 12th 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB which may be of interest. Here is a section:

The creator of the “lower for longer” scenario, BP plc’s (BP-NYSE) CEO Robert Dudley was interviewed at year-end by a reporter with the BBC during which he began to qualify his view. “A low point could be in the first quarter [of 2016].” Given developments in the global oil market during the first few days of 2016, this looks like a good call. Mr. Dudley went on to say, “But 2016’s third and fourth quarters could witness a more natural balance between supply and demand, after which stock levels could start to wear off.” If that proves to be the case, it implies that oil prices should begin rising during the second half of 2016. However, there remains the overhang of global oil inventories that continue to swell due to the global overproduction. According to the International Energy Agency’s (IEA) latest total (crude oil plus refined products) inventory figures for the OECD countries as of October 2015, there were 2,971 million barrels in storage. Crude oil inventory totaled 1,181 million barrels. As shown in Exhibit 14, the amount of crude oil in storage grew dramatically last year.

A different way of looking at the crude oil inventory situation is to measure it on the basis of days of inventory in storage. Exhibit 15 (next page) shows this data for 2012 through August 2015. While one might think that 30-31 days of forward inventory cover is not meaningful, if we compared the July data when 2015 was at 30 days and the prior three years that were at 27 days, those three additional days represent nearly 300 million extra barrels of oil. To eliminate that additional supply, global oil demand needs to increase by nearly one million barrels a day, or 1% growth in existing oil demand, which just happens to be the long-term average increase in global oil consumption experienced since the 1980s. While consistent with the oil market’s long-term growth rate, reducing the oversupply assumes that supply stops growing, which we know may not happen due to the return of Iranian production plus efforts of other producing countries to boost output to offset lower oil prices.

Here is a link to the full report.

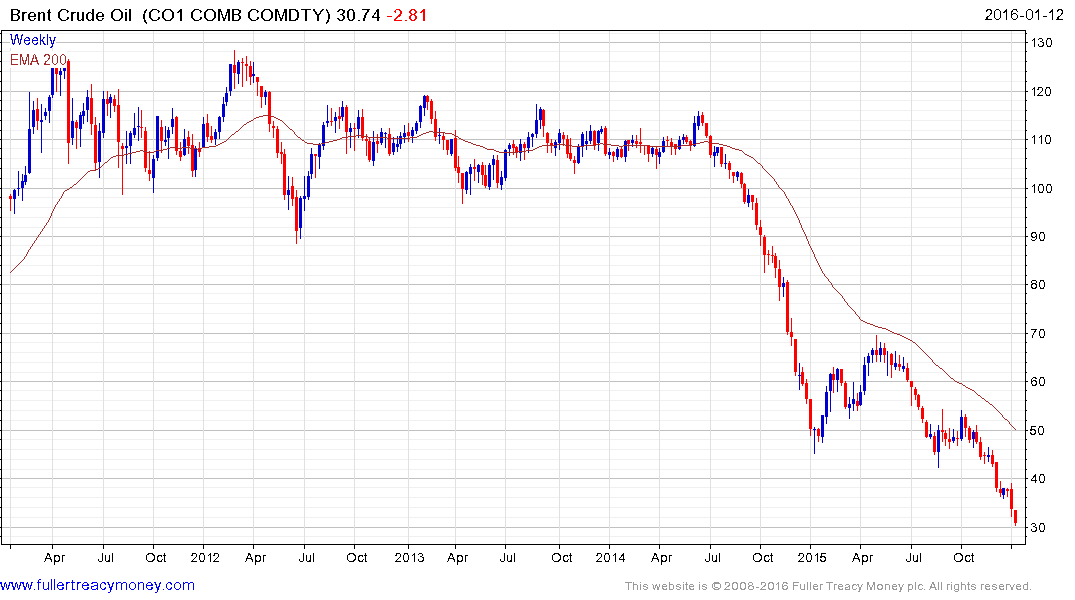

With deteriorating geopolitical considerations and no sign yet that supply has peaked, the futures market for Brent Crude is in contango right across the curve. For prices to rise a catalyst will be required. That may take the form of a major bankruptcy in the highly leveraged unconventional oil and gas sector or a marked deterioration on the geopolitical front. Both are possible and this is particularly poignant considering the fact that oil prices are accelerating lower and have already had a large decline.

Brent crude tested the round $30 area today and is approximately 66% overextended relative to the 200-day MA. Those percentage overextensions are exaggerated by the fact prices are moving so quickly, but they help to emphasise how extreme the current market environment is. A clear upward dynamic would pressure shorts and potentially signal a reversionary rally is underway.