A Simple China Trading Rule to Trounce the State-Run Market

This article from Bloomberg News highlights the extent to which the Chinese market is being supported at present. Here is a section:

The open-to-close strategy on CSI 300 Index contracts has returned 18 percent since July 8, when the mainland market bottomed. That compares with about 6 percent from buy and hold, after accounting for the rollover of contracts in the middle of this month.

?“It seems to be an exploitable and workable strategy in the futures market, unless there is some unexpected big news,” said William Fong, an investment director for Asian equities at Baring Asset Management in Hong Kong.

The Shanghai Composite rose 2.4 percent at the close on Thursday, after opening with a 0.1 percent drop.

Like any pattern, its lifespan will diminish as more investors catch on, said Bernard Aw, a Singapore-based strategist at IG Asia Pte Ltd. There’s also the risk that state- backed buyers disappear as the Shanghai Composite approaches 4,500 -- a target Chinese brokerages cited when they unveiled a market support fund on July 4.

By loading purchases into the latter half of the day the Chinese authorities are buying a strong close which is what we continue to see in the chart below. On more than a few occasions since the low earlier this month the market has opened lower only to finish higher. This is achieving a rebound in the domestic market but the big question is to what extent the market can function without massive intervention.

In the melee of selling that overtook the market from June one of the rules announced was that insiders would not be allowed to sell and that the government would keep buying until the Shanghai Composite got to 4500. The Index hit a low on the 9th at 3371 and closed today at 4123. It is now more than half way to that stated first area of potential resistance.

It is reasonable to expect that there will be some additional volatility as more shares come back onto the market and as short-term traders seek to take profits. However the key indication of whether the medium-term demand dominated environment will persist is in how well the early July lows hold on a significant pullback.

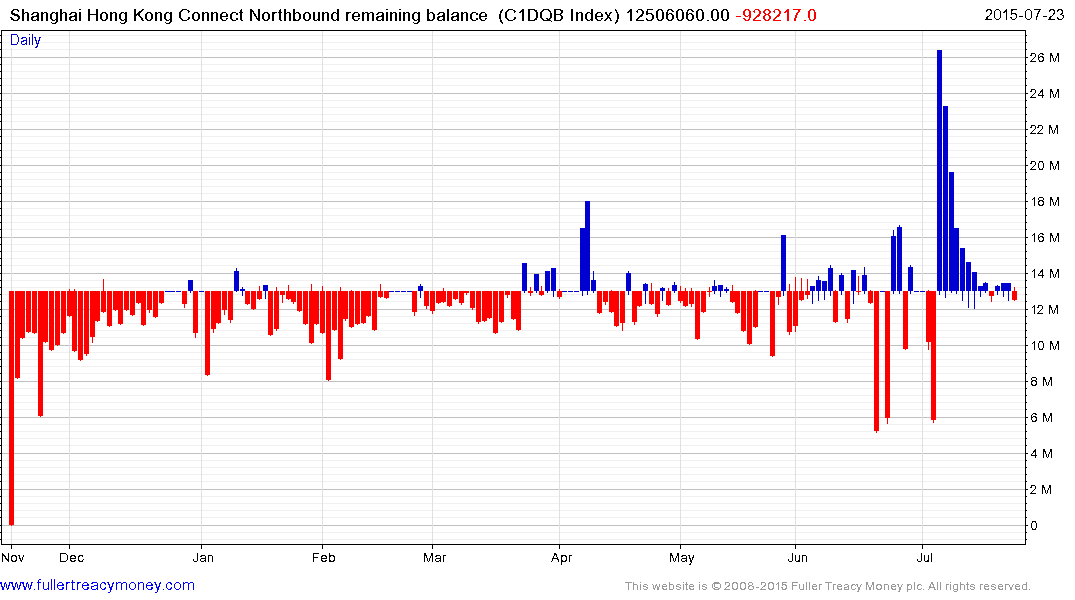

I added the Shanghai-Hong Kong Connect daily flows both northbound and southbound to the Chart Library. The red lines pointing downward on the Northbound remaining balance indicate flows moving from Hong Kong to Shanghai so the spikes higher earlier this month are reflective of concerted selling but the move to negative territory this week suggests tentative positive flows once more.

.png)

The Southbound flows only hit their limit on two days in April and a sustained move below 8 million would be required to signal concerted buying.

.png)

The Hong Kong China Enterprises Index continues to firm above the early July low and a clear downward dynamic would be required to question current scope for additional upside.

.png)

The Hang Seng has experienced a more impressive bounce and exhibits a better defined short-term progression of higher reaction lows. A sustained move below 25,000 would check this rebound.