Lloyd George Advisory

Thanks to a subscribers for this report which makes a number of interesting points on the potential for Chinese overseas investment. Here is a section:

I have compared Shanghai in 2015 to Boston in 1970 with the genesis of the investment industry led by Fidelity and other major fund management houses. Apart from the US$3.5 trillion of China’s official reserves, there is another US$9 trillion in Chinese household bank deposits. In November, I expect that the IMF will certify the renminbi as one of the 5 global reserve currencies in the SDR (Special Drawing Rights). China must respond, by liberalizing its capital account over the next 12 months, and allowing its citizens to invest more overseas. Even if (a conservative estimate) 20% of the total savings in China were to be invested overseas, it will have the effect of a major wave of capital coming into global financial markets led by Hong Kong (which we see as the prime beneficiary), but followed by London, New York, and other major financial centers.

This time Chinese capital will not only target property, it will be invested in companies, in technology, in western consumer brands, and in good quality dividend paying shares in the US, Canada, UK, Australia, and elsewhere. The example of Li Ka-shing is not irrelevant. He has been criticized by commentators for taking money out of China and investing it in these Anglo-Saxon jurisdictions, in telecom, water, and power utilities. In my view, he is a very smart, canny, and far-sighted investor. (This month, our research team visited Mr Li’s flagship company, CK Hutchison and were encouraged that their Watson’s pharmacy chain is opening 365 new shops each year in China.)

I believe that the liberalization of the Chinese financial sector is the biggest thing happening in the global capital markets in the next decade. Comparisons may be drawn with Japanese capital in the 1980s, but this Chinese wave is 10 times bigger and will last a lot longer. As yields on RMB deposits are steadily reduced (and the same in Indian rupee deposits), so the thirst for yield will bring Chinese investors, as it once did Japanese investors (the famous Mrs Watanabe) into western equities.

Here is a link to the full report.

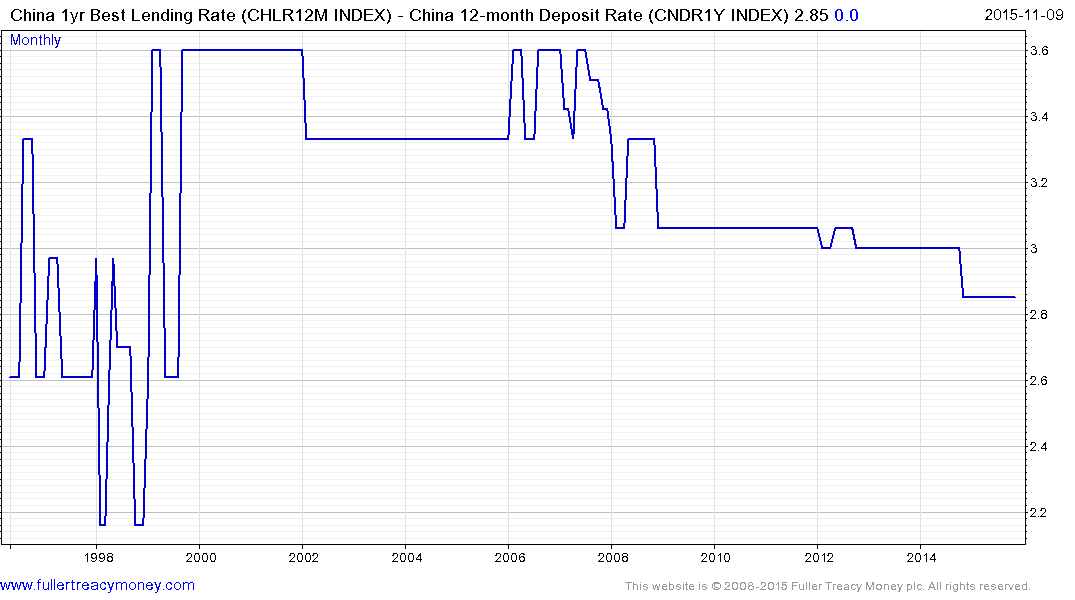

The announcement last month that the wide difference between the Chinese lending and deposit rates would be liberalised is a major step for financial sector but if the below spread is any guide there has been little progress so far.

At a spread of 275 basis points the banking sector does very well from this situation but depositors are de-incentivised from holding cash. This has contributed to the casino nature of the stock market and also to the growth of the shadow banking system. Allowing banks to compete for deposits by raising interest rates would be a positive development for the economy and would help dispel some of the opacity that plagues the sector.

The Chinese now have a vested interest in allowing their currency to float more freely because it would, in all likelihood, trend lower. More than any other factor this is likely to be a tailwind for further liberalisation of the exchange rate but simply assuming that Chinese savings will be encouraged to invest overseas anytime soon is hopeful at best.