PBOC Past Shows Multiple Moves as Analysts See More Cuts

This article from Bloomberg News may be of interest to subscribers. Here is a section:

In his 12 years as People’s Bank of China Governor, Zhou Xiaochuan has never stopped at a single shift to benchmark interest rates once prompted into action.

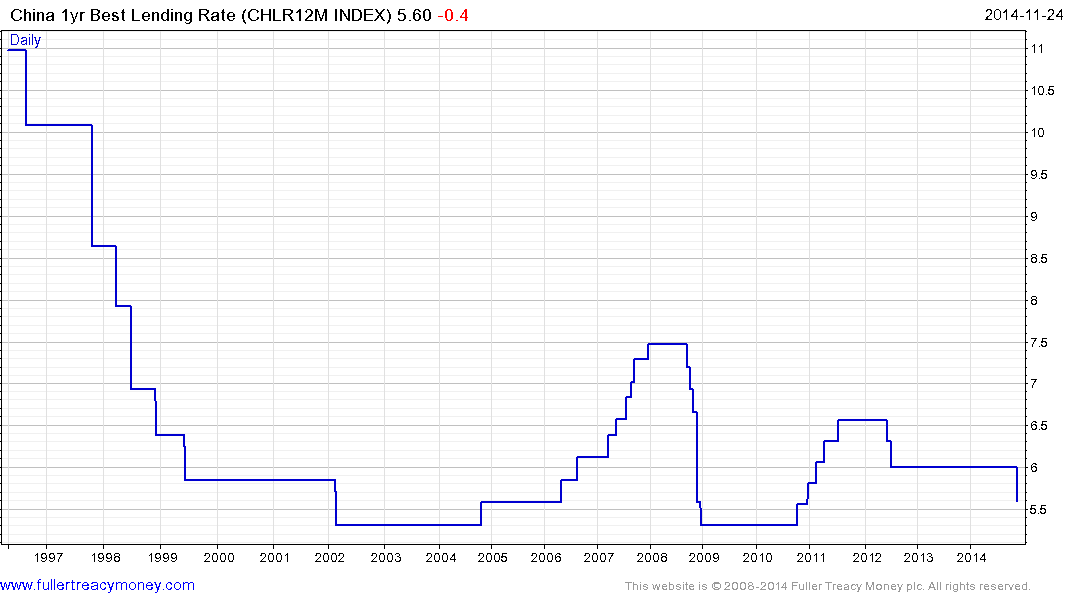

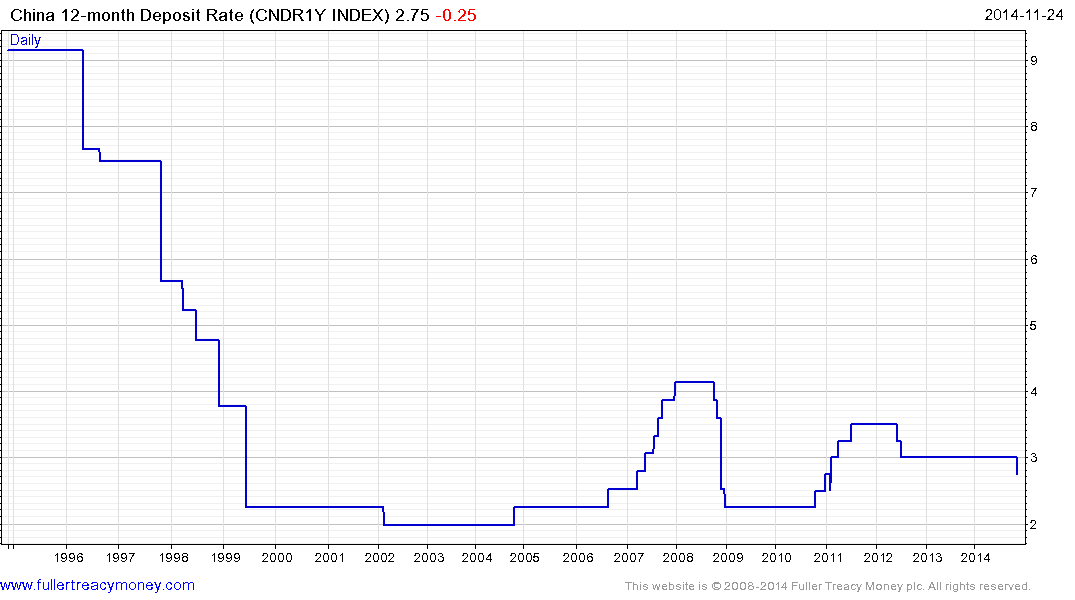

Zhou, who took office in 2002 when Alan Greenspan was still chairman of the Federal Reserve, has overseen two tightening and two easing cycles for a total of 22 moves to the one-year lending rate and 20 to the one-year deposit rate. Simple math suggests his latest cut is unlikely to be a one-off.

By joining Mario Draghi and Haruhiko Kuroda in the global stimulus camp, Zhou signaled deeper concern over China’s outlook and recognition that targeted measures alone weren’t going to be enough to revive growth. A Bloomberg survey conducted late Nov. 21 through yesterday showed economists forecast further monetary loosening by the middle of next year.

“Expect more interest rate cuts ahead,” said Shane Oliver, who helps oversee about $125 billion as Sydney-based head of investment strategy at AMP Capital Investors Ltd.

“China’s rate cut highlights that global monetary conditions are still easing with monetary easing in Japan, Europe and China taking over from the end of quantitative easing in the U.S.”

?The one-year lending rate will be 5.35 percent in the second quarter of 2015 and the one-year deposit rate will be 2.5 percent, according to the median forecast of economists surveyed by Bloomberg. AMP’s Oliver has the lowest forecast, predicting the lending rate will fall to 4.5 percent by the end of next year; by contrast four of 15 economists see no further reduction.

China is one of the only countries in Asia where currency market volatility has not impeded capital market appreciation potential for foreign investors over the last year. However as the easing cycle in monetary policy reignites, the prospect of additional strength for the Renminbi is looking increasingly unlikely.

While it is true that Zhou Xiaochuan has not stopped at one cut when entering an easing cycle, the above chart illustrates that the medium-term peak in lending rates was in 2012 at 6.56% and the recent cut is an extension of that easing policy following a hiatus. The lows near 5.3% have not previously been exceeded and it will be a measure of how much assistance the central bank thinks the economy needs whether they will cut rates below that level.

The 40 basis point cut to the lending rate and 25 basis point cut to the deposit rate also helps reduce the wide disparity between the rates which has also been an ambition of the financial sector reforms of the last few years.

Today’s Dollar rally against the Renminbi potentially represents the first higher major reaction low in since the 2005 devaluation. With just about every country in Asia seeking a weaker currency, China is unlikely to want to see the Renminbi continue to appreciate.

The CSI 300 Index extended its rally today and a sustained move below the 200-day MA would be required to question recovery potential.

The FTSE/Xinhua China A50 Index continues to firm, having found support in the region of the 200-day MA. The Hong Kong listed iShares A50 China ETF (2823 HK) tracks this index.

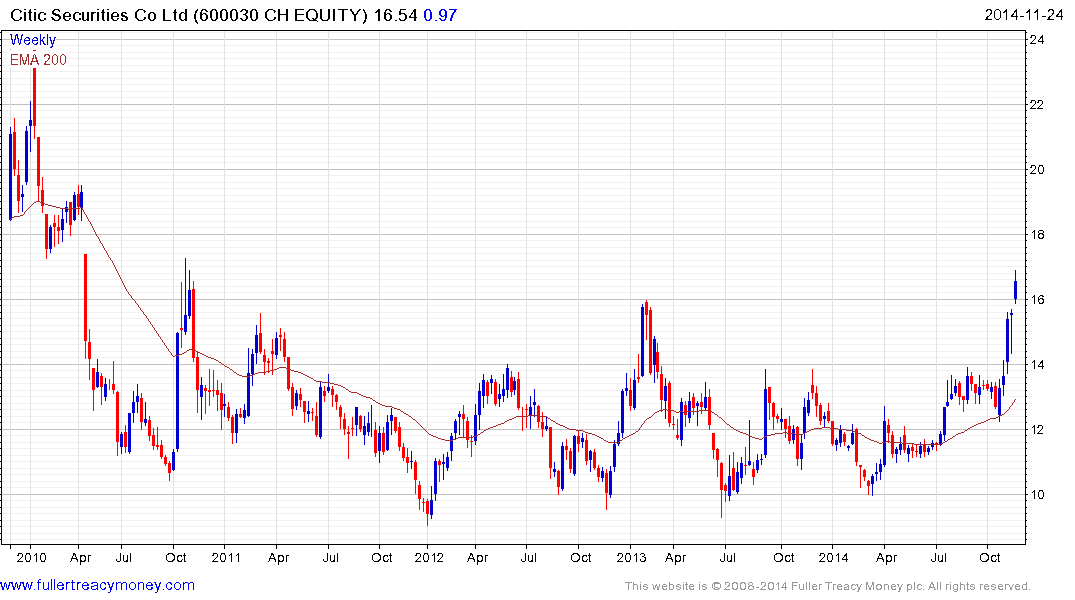

Broker dealers are among some of the clearest beneficiaries of the opening up of the Hong Kong Shanghai Stock Connect as they will see increased volumes. Citic Securities’ A-Share hit a new 4-year high today while the Hong Kong listed H-Share hit a new 12-month closing high. In the interests of full disclosure, Citic Securities is my largest holding in China.

Back to top