China ADRs: Long Way Home

Thanks to a subscriber for this report by Vivian Hao for Deutsche Bank which may be of interest to subscribers. Here is a section:

The year 2015 has thus far seen a frenzy of privatization offers to US-listed Chinese companies, some with an intention of subsequent re-listing back home. Questions, however, have arisen about the practicality of this scheme, with virtually no successful precedents yet. In this report, we analyze major hurdles like legal complexities, IPO procedures and timing issues. VIE set-up and unwinding, and the new foreign investment law may further hinder the privatization process. Even with early signs of relaxation of some restrictions, developments are at a premature stage. Nonetheless, we shortlist and assess 'likely go-through bids', those that screen well for a bid and "maybe not's".

Going home is more easily said than done: challenges in privatization and…

Privatization requires a significant amount of immediate funding for the share repurchase, repatriation tax and professional fees. Funding, usually raised through equity capital and debt borrowings from a consortium, largely depends on the target’s ability to generate cash flow, its franchise value and to a lesser extent, its balance sheet strength. Further, the entire process is lengthy (a minimum of 6-12 months) to complete. In addition, the offerors could face litigation from unsatisfied minority shareholders on matters such as abuse of super voting power that might even derail the whole programme.….challenges in re-listing: complications with the VIE structure

While some controls have been eased, there is still a long way to go for the Chinese supervisory bodies to continue their relaxation of key restricted areas such as ICP (internet content provider) license, which is a pre-requisite for almost all Chinese internet companies. Those intending to unwind these structures and return home face the risk of being disqualified on other key regulatory pre-requisites, including but not limited to: a) a continued track record of profitability after repatriation tax liabilities, b) unchanged ownership structure, c) consistent historical business operations for the entity intended for listing, d) autonomy of the company over its operations and decision-making power, and e) fairness in related party transactions.

Here is a link to the full report.

It is possible that the extreme volatility on China’s mainland market will deter executives from taking the decision to delist from the USA and relist in China in the same way that the surge in mainland prices encouraged them to make the decision to relocate in the first place. Generally speaking US listed Chinese companies did not participate in the run-up experienced by their mainland counterparts but have experienced declines though perhaps not as extreme as the mainland. The potential for greater upside potential for the owners is therefore perhaps the most likely motivation for relisting.

Among the more notable chart patterns:

Netease rebounded emphatically from last week’s low. Some consolidation is likely but a sustained move below $120 would be required to question medium-term potential for continued higher to lateral ranging.

Vipshop Holdings posted an upside weekly key reversal last week and has held the majority of the gain so far this week. A sustained move below $20 would be required to question medium-term scope for additional upside.

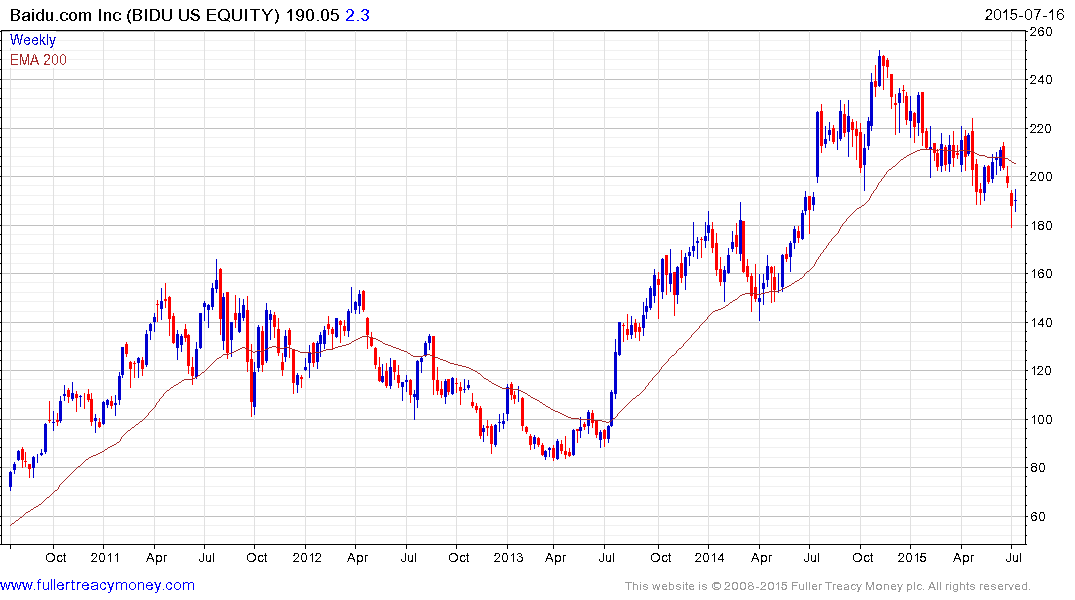

Baidu has held a progression of lower rally highs since November and a sustained above $210 would be required to question medium-term supply dominance.

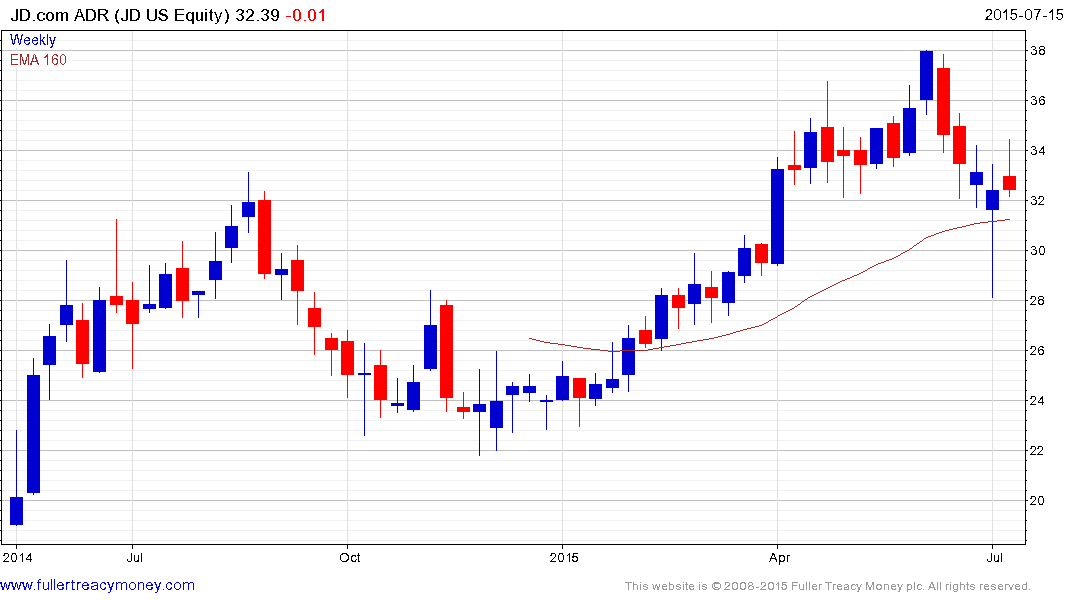

Though not mentioned in the above report JD.com is worthy of mention. The share found support last week in the region of the 200-day MA and a sustained move below $31 would be required to question medium-term potential for additional upside.

Back to top