Macau, Hong Kong See Slowing Golden Week Tourism From China

This article by Lisa Pham and Annie Lee for Bloomberg may be of interest to subscribers. Here is a section:

“There’s still pent up demand coming into the market, especially over holiday periods,” Vitaly Umansky, a gaming analyst at Sanford C. Bernstein, said by phone referring to arrivals in Macau. “It would be a bad indicator if there were no growth or a decline in visitation.”

There are also indications that betting volumes in Macau got off to a “strong start” during Golden Week, according to an Oct. 7 note by Daiwa Securities Group Co.

The picture in Hong Kong may be grimmer. Some retailers there saw sales shrink, sometimes by a double-digit percentage, during the first two days of October, compared with a year earlier, according to the Hong Kong Retail Management Association. And the comparison wasn’t coming off a high base because shops in the city last year were hit by pro-democracy protests that blocked key shopping districts and prompted some stores to shut.

Signs also point toward Macau and Hong Kong losing their luster among Chinese tourists. Though they were the top choices last year, Japan and South Korea became the most popular destinations for Chinese tourists during the first four days of Golden Week, according to a recent Credit Suisse Group AG report.

Hong Kong benefitted enormously from the Fed’s low interest regime but has been through a tougher time recently with democracy protests, Li Kai Shing taking flak from the Communist Party, the potential for interest rates to rise, the strength of the US Dollar and the slowing Chinese economy. Add to this the fact the Yen and Won, which enhanced their attraction as tourist destinations, and the domestic market has been under pressure.

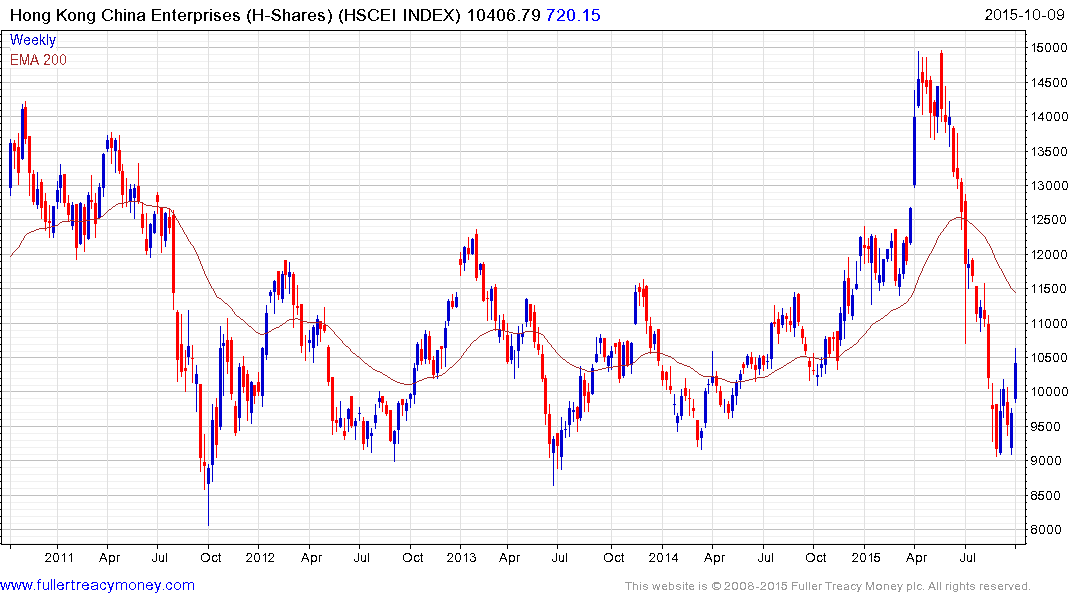

A great deal of this news is already in the price with the Hang Seng (P/E 9.58, DY 3.81%) and H-Shares (P/E 7.38, DY 3.77%) trading back at attractive multiples. The pullback in the Dollar is also a benefit for the city.

The Hang Seng found at least short-term support, near the psychological 20,000 level, following an accelerated decline and a mean reversionary rally remains in evidence.

The China Enterprises Index continues to bounce from the lower side of a four-year range.

There have been a number of stories over the last few days discussing the fall in the size of the PBoC’s balance sheet which is hardly surprising since they are now supporting the currency rather than holding back. Today there have been stories about the stress in China’s equivalent of high yield as the slowing economy bites into the margins of small businesses. So let’s take a look at the banking sector.

.png)

The FTSE Xinhua A600 Banks Index bounced emphatically from the psychological 10,000 level in late August and remains steady above 12,000. The banks can be viewed as one of the administration’s primary vehicles for supporting the economy and the inert trading evident over the last month is suggestive of continued government support.

China’s 10-year bond yield is back trading in the region of the 2010 and 2012 lows and is oversold in the short term. Potential for a reversionary rally is increasing but a clear upward dynamic would be required to signal stops being hit.

China has substantial resources with which to deal with the challenges it faces and the above two charts will be important in monitoring how successful they are.

Back to top