China Closed End Funds

Investors and traders headed for the doors in China related investment vehicles as mainland and Hong Kong shares crashed lower over the last month. Foreign flows reversing through the Stock Connect were a major influence in the speed of the decline and contributed to the panicky environment. However the government is pulling out the stops and there were more than 100 shares on the Index up their 10% limit today.

At The Chart Seminar we teach that “Acceleration is an ending of unspecified duration”. There is no doubt that the Chinese markets accelerated lower and that this has the look and feel of climactic action. Today’s strong rebound following yesterday’s steadying suggests shorts are under pressure and bargain hunters are active.

In order to prove that this is more than short-term steadying the main indices will need to find support at progressively higher levels on pullbacks once this rally run its course. Considering the scale of the pullback a period of support building is likely required; allowing confidence to be repaired. The gradual resumption of trading in suspended shares may contribute to a ranging environment once the initial rally loses impetus.

Closed end funds offer an insight into just how bearish investors have been over the last month. David highlighted JP Morgan Chinese Investment Trust’s 18.9% discount to NAV last night. These figures are changing rapidly considering the volatility on Chinese markets but I thought it might be instructive to point out the commonality in similar investment trusts globally.

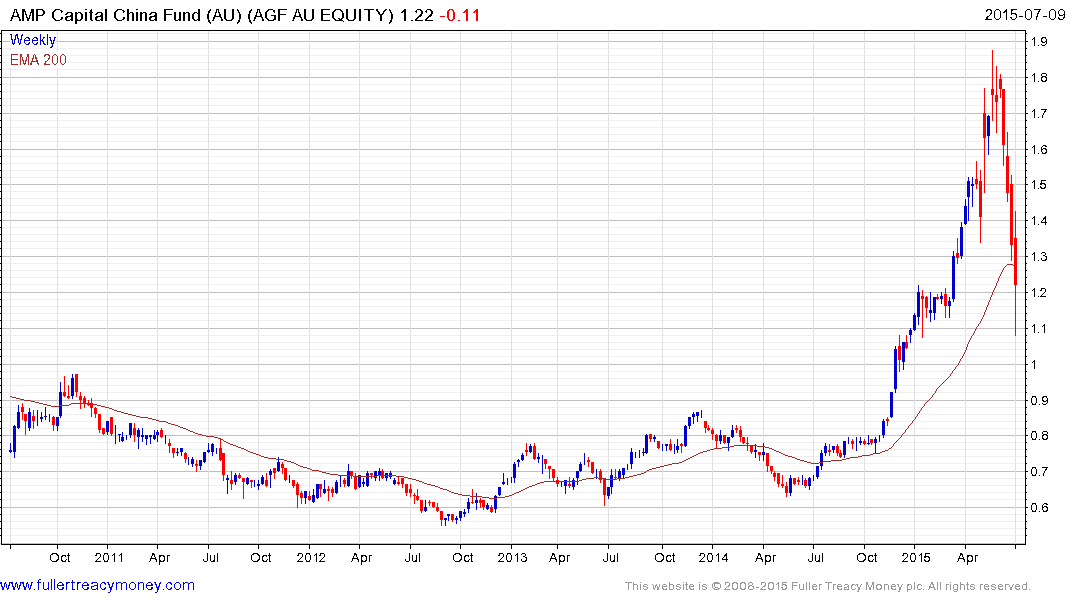

Australian listed AMP Capital China Fund is trading at a discount of 33.3%.

US listed China Fund Inc. with its strong record of paying special dividends in Decembers is trading at a discount of 9.622%

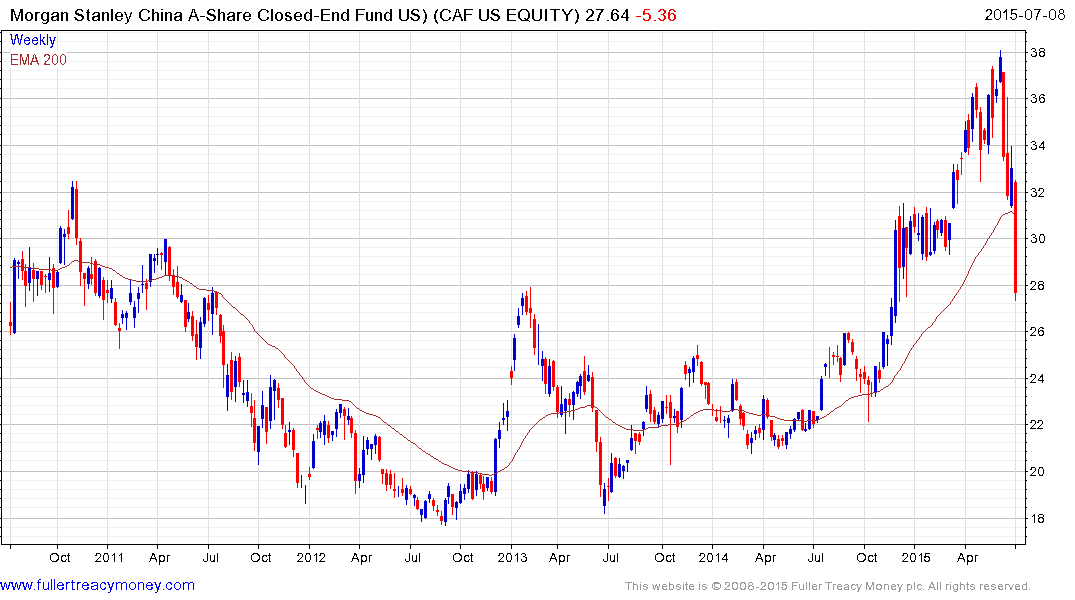

US listed Morgan Stanley China A-Share Closed-End Fund is at a 17.78% discount.

.png)

US listed Aberdeen Greater China fund Inc. is trading at a discount of 13.01%

US listed Templeton Dragon Fund trades at a 12.06% discount.

Hong Kong listed HSBC China Dragon Fund trades at a 14.84% discount.

The above data suggest there is ample scope for discounts to NAV to contract over the next few

months. All of these funds can be found in the Closed end funds section of the Library.

Back to top