Email of the day on China and market complexion

The following article, seeking to explain China's recent missteps in handling its domestic stock market, is quite interesting: And congratulations on writing some excellent (& cool-headed) analysis this week

Thank you for your kind words and I’m delighted you’re enjoying the commentary. David and I have been working together since the winter of 2003 and I started filling in for him on Comment of the Day in the summers from 2004 when he used to embark on his annual Land’s End to John O’ Groats cycling holidays. Back then you could be reasonably assured of quiet markets during the sleepy summer months but that all changed in the aftermath of the credit crisis when the role of algorithmic traders took centre stage.

Historically, traders use public holidays and vacation periods to initiate counter trend positions in the hope of triggering stops for a quick profit. Computer programs have taken this process to the extreme. The most recent instance was in late July when gold sank to a new low during Asian trading while Japan was on holiday. All too often we now see times most people are on holiday and market liquidity is low fuels volatility and this is particularly true of moves in single stocks.

Johnson & Johnson, General Electric, Colgate Palmolive to name a few have experienced wild swings this week which have nothing to do with fundamentals. They have all recouped the majority of this week’s decline but the question now is to what extent the lower side of the overhead trading range will represent resistance. This kind of intraweek volatility is just not good for sentiment.

Returning to China this article highlights the difficulty established bureaucracies have in assimilating new people regardless of how well-qualified they are. This is as true of China as of any other country I’m afraid.

Let’s look at an example. A good friend of mine had been pursuing his PhD in Dublin in econometrics and was recruited by the central bank to run models. Unfortunately while his direct recruiter was fully on-board, no one had informed the IT department that his requirements for technology and bandwidth dwarfed anything else in the building. They did not have the budget for additional expenditure so he had to bring in his own equipment and was still unable to fulfil the role he was hired for.

Institutional culture and standards of governance really are everything. China’s headlong pace of development has been enormously successful in raising hundreds of millions of people out of abject poverty but the pace of institutional reform has been much less swift. Considering the enormity of the transition from an infrastructure, property development and low cost manufacturing model to a consumer and services led, higher margin manufacturing model a similar reform of the institutional framework was required.

For the last couple of years Mrs. Treacy’s network have compared Xi and Mao. They didn’t do that with any of his predecessors. Generally speaking the President and Premier share responsibilities but Xi has concentrated control in his hands not least by assuming the economic portfolio from Premier Li Keqiang. This is despite the fact that Li has a PhD in economics while Xi’s background is in chemical engineering and public policy.

Considering his hold on power, the widespread but selective crackdown on corruption, planning on moving the capital of China from central Beijing, the upcoming triumphalist 70th anniversary of the end of the war against Japan, building a range of ski resorts for the winter Olympics, continued island building in the South China Sea, first fuelling the surge in equities, panicking at the decline, supporting the market, removing support, then re-imposing it and simultaneously upsetting the mechanism that sets the value of the currency suggest an portfolio with some highly diverse aims.

.png)

The Shanghai A-Share Index priced a lot of this bad news in during the decline and it found at least near-term support today in the region of 3000 suggesting a reversionary rally is looking more likely.

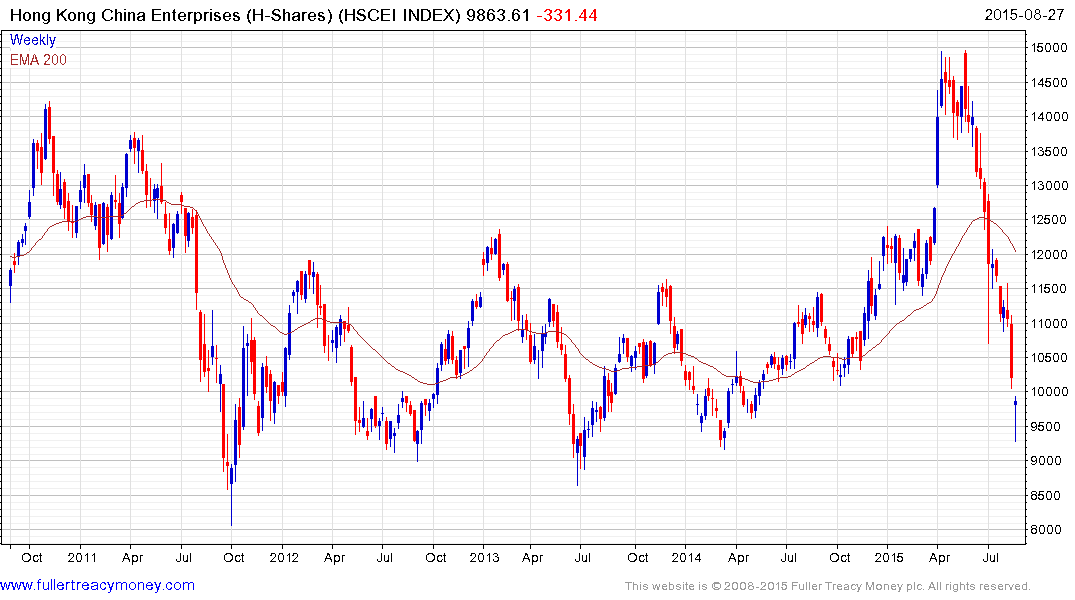

The Hong Kong listed H-Share Index is bouncing from a previous area of support near 9,000 and has similar potential to unwind what is a deep oversold condition relative to the trend mean.