I've spent some long days and nights this week on this very subject (work as an investment actuary in DB [Ed. Defined Benefit] pension fund space)...

Fiscal policy context: mini-budget, with expected energy price cap but surprise revenue cuts (tax, NI, duty, etc.); cost of the latter might be in the vicinity of c£40bn pa (without OBR numbers its hard to say though).

Monetary policy context: TBC regarding rate hikes from November MPC meeting; QT expected to be of the order of c£80bn over next 12months, in an effort to combat inflation. So we have fiscal loosening amid a longer term aim from the BoE to tighten.

As above, the surprise cuts cost, and the DMO has therefore had increase it's expected gilt issuance significantly. This huge increase in supply led to an increase in gilt yields, which move inversely vs price and hence inversely vs relative demand. But, that was only the start...

DB pension schemes facing substantial deficits post-GFC typically have portfolio divided into two parts:

one part seeks excess return in order to make good the deficit

the other part "hedges" the liabilities, which behave like typically long duration bonds (insomuch as they have interest and inflation sensitivities) - their long duration makes them susceptible to quite large changes in value (e.g. 20y duration with a 1% increase in rates at that duration would lead to a 20% fall) - it's therefore a good idea to minimise risk, but you need to minimise risk relative to your specific liabilities (i.e. jurisdiction, duration, realness, etc.)

But, if you're trying to hedge 100% of your liabilities (or even something less) with <100% of your assets (in practice this number is often in the 25-50% range), then you need to use leverage. Two (not exhaustive) ways of gaining exposure to interest rates and inflation using leverage are:

To enter into swaps whereby I agree with you that I'll pay you x% each period and you'll pay me whatever a floating interest rate or inflation is. I haven't actually bought anything in doing so and therefore haven't actually used any money = leveraged exposure

Another option is that we use a "repo". I sell you my gilt on the understanding that I'll buy it back on a known future date at a specified future (higher) price. In other words, I am paying to borrow over the period whilst still exposed to the price move of the asset repo'd. With that borrowing I can go and buy another gilt. I've therefore effectively doubled my exposure to gilt price moves = leveraged exposure.

In practice, to ensure that these synthetic hedges don't pose excessive credit risk either way, you are usually required to maintain a pool of collateral (the gilt in the repo, or a pool of assets backing a swap portfolio).

With both these techniques, if rates rise/fall, then the value of my liabilities falls/rises. So too do my assets. If I had used these synthetic techniques to ensure my asset sensitivity = liability sensitivity then the move will be similar on both sides, so my deficit won't have changed.

So, what's the problem? As yields rise, the value of my gilts fall. So, when I close out the positions on a repo for example: I make a loss on the second gilt; I then can't repay the lender in the repo arrangement. You can see how this ends if I hadn't repo'd once, but more...

That means then that when yields rise people are forced to close out positions and you end up with a load of gilts sold. Those additional sales push the price down further (DB funds are massive players in the gilt markets - less so in other risk asset markets - so move prices materially). This forces those next up the chain to close out, pushing the price down further. Repeat. You end up in a spiral that collapses pretty spectacularly and pretty quickly.

The only way to avoid having to close out in such situations is to keep posting more collateral. But, that means selling those assets you're using to seek excess returns. Can you do that quickly enough, allowing for settlement times and the necessary transfer of cash over to your leveraged gilt portfolio? Normally yes when markets are moving gradually, but not in the last week and certainly not in a fully fledged spiral sell-off.

So far, it's not a pension fund solvency issue - just a liquidity one - they have the cash/liquid assets but can't put them to work in time. But, you really don't want to be the last one out in these spirals as you come out at the worst price without much ability to get back in for the ride back down (in yields/up in prices). You either want to be out from the start or in all the way and still in at the top. If you do end up closed out in the spiral, then you most likely will struggle to buy back in before yields fall. And that is where the long term damage is done: when yields fall back down, the value of your liabilities is going back up, but you no longer have the hedging assets to match that rise, so your scheme funding worsens.

In this week's episode, we eventually saw the BoE step in. Probably a day late and after much pressure, but understandable given to calm things they are committing to buying gilts to whatever extent is necessary - effectively QE, and the opposite of what they are trying to do medium term to curb inflation. But, their purchase has calmed things substantially, so that's good. It's just unfortunate that there will have been some casualties on the way - we'll find out over the coming days. There will be large variation: those that were "underhedged" a month ago will have won big time; those that were forced sellers immediately before the BoE statement will be big losers; others will be somewhere between.

Here's the 20y nominal gilt yield. You can very clearly see when the budget was and when the BoE stepped in around 11am this morning. Worth also flicking to "all" to see quite how sharp this is in historical context.

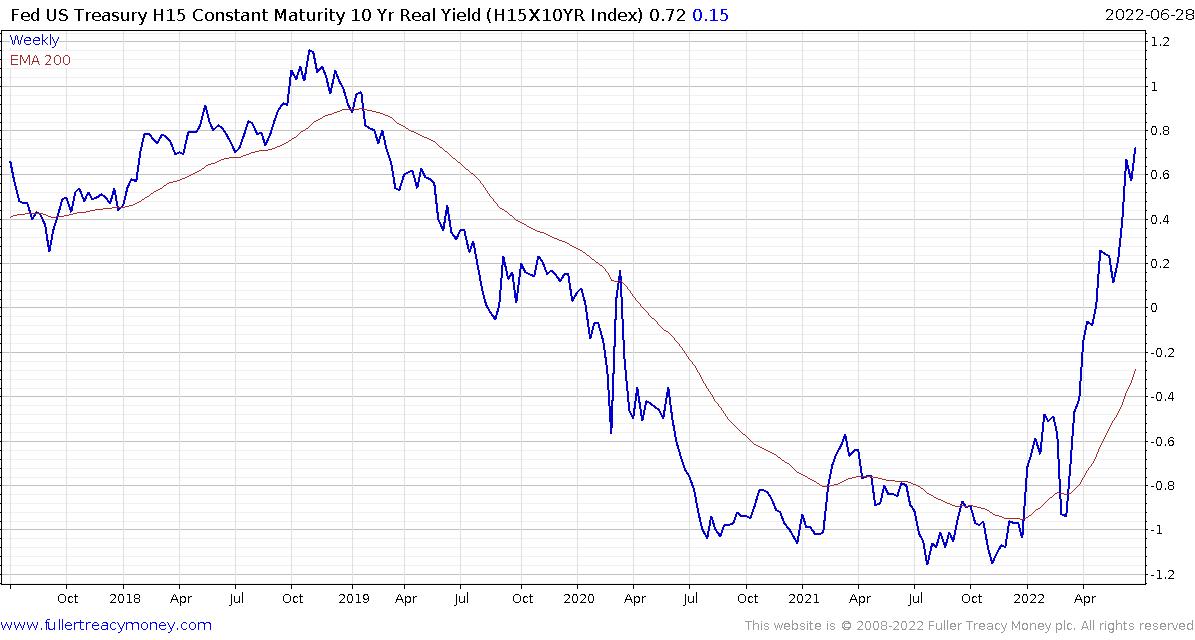

Eoin Treacy's view - When people talk about how central banks have distorted the fixed income markets this is a perfect example. Pensions need reliable returns to meet their obligations. That’s especially true of defined benefit programs which occupied 45% of the UK market in 2019. The alternative to goosing returns with leverage or moving further out the risk curve into private assets.

The price of refusing to take these risks would be to demand much higher contributions to cover the shortfall and nobody wants to do that. Faced with the possibility of angry retirees, at the prospect of not receiving their dues, or relying on the central bank to bail them out, the answer is always going to be the latter. Quantitative easing introduced significant moral hazard and yesterday Bank of England action, while necessary, compounded it

This section continues in the Subscriber's Area.

Back to top