Thoughts from the Road

Thanks to a subscriber for this report from Mike Wilson at Morgan Stanley. Here is a section:

After the discussion around earnings trajectory for the S&P 500, the focus then typically turned to how to trade it. Here, we have some sympathy for the view that markets may potentially hold up very tactically until the EPS cuts actually happen. As already noted, conference season is upon us and investors are ready for some bad news at least with regard to how 3Q is progressing. However, the degree of that deterioration is more debated now given the recently announced $500 billion student debt forgiveness and extended moratorium on loan payments until December, combined with the energy subsidy announced this past week in the UK to help consumers through the winter. Both of these are rather large fiscal stimulus packages that could keep the "tone" of company commentary less bearish than feared, and potentially delay the eventual cuts. Nonetheless, we have high conviction that EPS cuts will play out in earnest over the next 2-3 months, and as a reminder from our note last week, mid-September through October is a particularly challenging seasonal period for EPS revisions.

Here is a link to the full report.

.png)

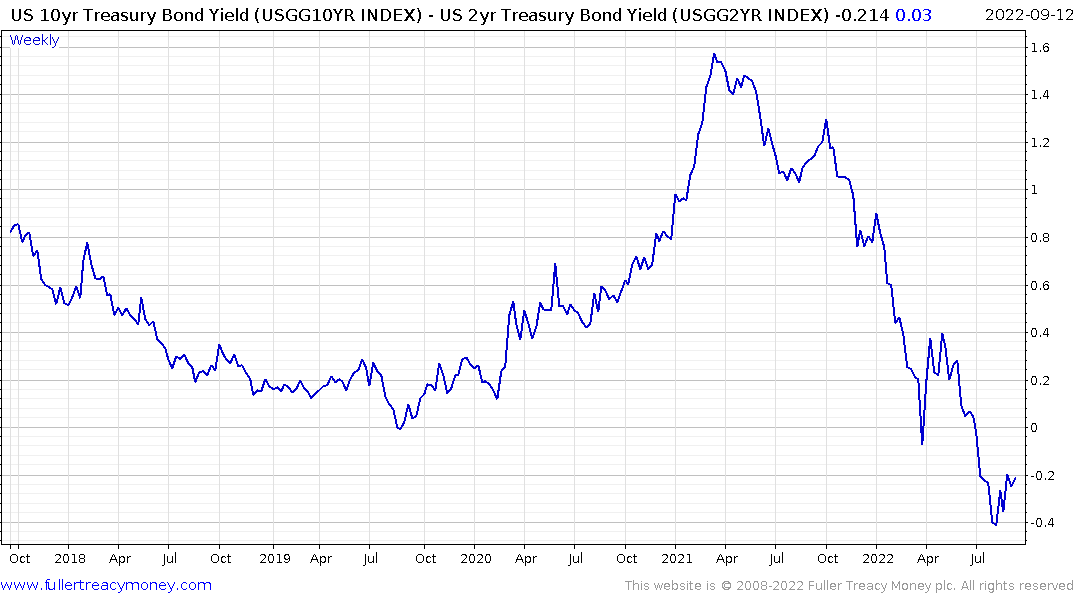

The yield curve (10-year – 2-year) inverted for a week in April and has been persistently inverted since June. The classic version of the yield curve (10-year – 3-month) is not yet inverted but it is still trending lower. This spread collapsed from an artificially elevated level in May. It tends to be much more volatile than the longer-dated version because short-term interest rates can whip around a lot.

The longer the yield curve stays inverted the more likely it is that it will be a reliable lead indicator for a recession. Historically that lead has been anything from six to eighteen months. The most important point is the countdown has started.

The pattern of activity around a yield curve inversion also tends to repeat itself. The first reaction is to highlight what a good lead indicator it is, so markets sell off. However, removing liquidity also tends to be welcomed by investors because it tackles rising inflation pressures. Then tightening monetary conditions take time to show up in earnings. When corporate profits hold up better than expected following an inversion, it is quite normal for the stock market to rebound. Arguably, that is where we are in this cycle now.

The rally further enhances the central bank’s fear of overheating, so they keep raising rates. Eventually the cumulative impact of tighter liquidity does hit corporate profits, perception of recession risk spikes and stocks sell off hard.

So, what could derail this cycle once initiated? The Fed would need to stop raising rates and shrinking the balance sheet now.

The US Reserve Balance with the Fed has fallen from a peak near $4.27 trillion in December to $3.28 trillion now. That’s the clearest evidence of liquidity being drained from the system. Jay Powell stated in June they look at the size of the balance sheet relative to GDP.

The Fed’s balance sheet relative to GDP is contracting and if we look at the same ratio but using the US Reserve Balances data as the numerator when also see some contraction. If this is how the Fed measures the extent of their tightening policy, it suggests they have unwound the excess liquidity from 2021 but now 2020.

This represents a dilemma. If they stop now, there is a clear risk inflationary pressures will become entrenched, and an asset bubble will become even more inflated. If they don’t stop, a recession is inevitable within the next 12 months.

The reality of the now is the stock market has rebounded for three consecutive days and the net commercial futures position on the S&P500 is at about as low as it has traded in the post GFC era. That suggests much of the bounce has been short covering. Some clear fundamentals will be required to lend additional fuel to this move.

This article focusing on the mechanics of quantitative tightening may also be of interest.

Back to top