Sluggish CLO Markets Hit by Departure of Major Japanese Investor

This article from Bloomberg may be of interest to subscribers. Here is a section:

Nochu dominated the CLO market until 2019, when it exited amid regulatory and political scrutiny. The Japanese bank would buy all the top-rated securities in a deal. It returned to the US market in late 2021 and to Europe in recent months, but it was buying far fewer securities.

But with Nochu backing out again, a critical buyer is gone, potentially slowing down CLO sales, money managers said. And others are buying existing deals in the secondary market.

“In a tight CLO liability market the loss of any buyer makes a difference,” said Dagmara Michalczuk, an investor at Tetragon Financial, in an interview. CLO issuance for the remainder of the year is likely to be more uneven than in the last quarter of 2021, she said.

Big institutional buyers will buy every day as long as they are making money. When a favoured strategy stops working it causes a crisis of confidence. Whole business lines have been developed to thrive from the trade. When it stops making money the best performing sector becomes an internal problem that requires a remedy.

The first thing management will do is stop buying. They will want to wait and see if the market improves before recommitting. There is precedent for that because they stopped in 2019 when leverage and valuations were already high and liquidity tightening.

Everyone seems to have forgotten that in 2019, the yield curve inverted and it was looking like a recession was likely in 2020 because of high valuations and tightening credit and monetary conditions. Then the pandemic panic poured an epic quantity of cash into the system, valuations went way higher and tightening response is the fastest in a generation.

When a big institutional buyer exits, it robs the market of a large source of demand. Bull markets thrive on strong demand and supply increases to meet it. That is exactly what happened in the leveraged loans market over the last 14 years. Low interest rates created demand for higher yielding products and funds gobbled them up. Now liquidity is tightening up and demand is faltering. That suggests companies wishing to sell debt are going to run into funding issues.

This issue becomes even more intense when owners of leveraged loans sell. The holders of leveraged loans now represent a potent source of supply rather than demand. Norinchukin Bank is a private entity so its funding is opaque and it is difficult to ascertain just how much leverage has been taken on. Bloomberg has its assets at around $14 billion with most in property and buyout debt. That’s nowhere near enough to dominate the leveraged loan market, so there is some inconsistency in the data. The firm’s CDS are not trading at troubled levels so it is relatively insulated at present.

European Leveraged Loans are at 88 cents and trending lower.

China's high yield US Dollar bonds are in worse shape.

Meanwhile the iBoxx USD Liquid Leverage Loan Total Return Index is still holding support in the region of the 1000-day MA.

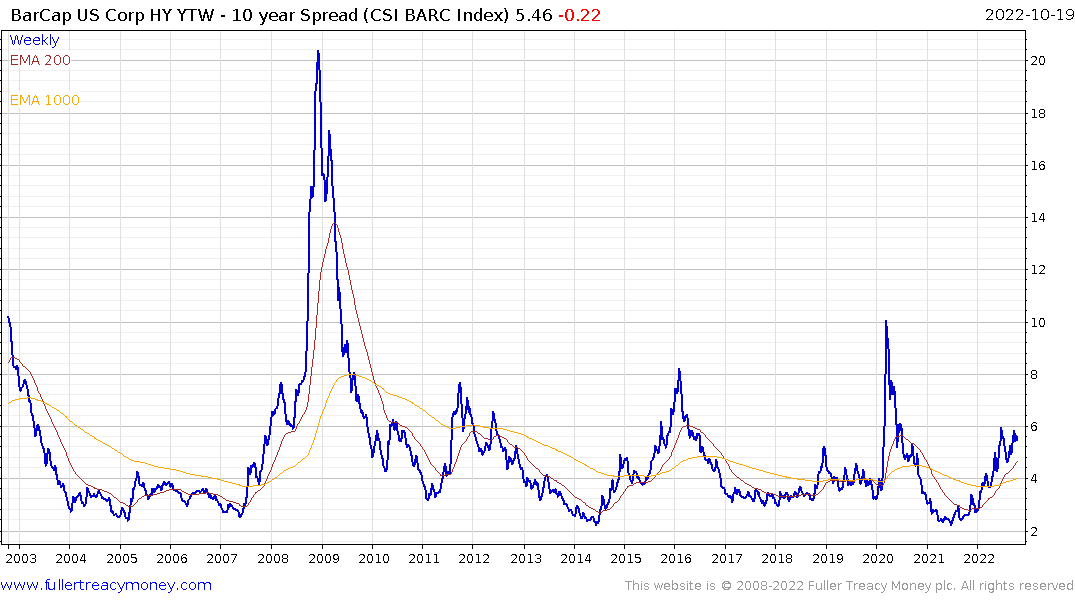

US high yield spreads are testing their uptrend. As long as yields remain elevated USD Leveraged Loans are susceptible to additional weakness.

US high yield spreads are testing their uptrend. As long as yields remain elevated USD Leveraged Loans are susceptible to additional weakness.

Citigroup took a $110 million loss on its leveraged loans in the 3rd quarter.

A month ago the steep discount offered on $1.4 billion of new Citrix debt raised eyebrows.

These are straws in the wind ahead of deeper issues with credit as liquidity conditions tighten. Nevertheless, it takes time for these stresses to cause observable pain. Treasury yields are susceptible to some consolidation from a short-term oversold condition and that is currently helping to support stock prices.

Back to top