Email of the day on annuity pensions

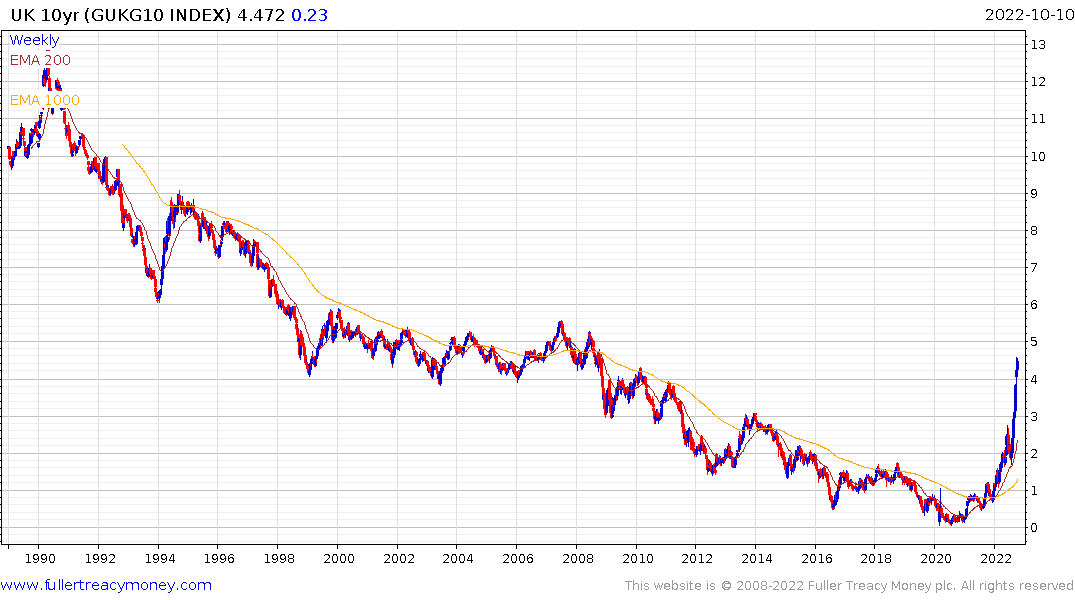

It will be interesting to see whether the higher gilt yields (and turbulent stock markets) lead to an increased demand for fixed pension annuities and thus a new demand for gilts

Thank you for this email which may be of interest. Annuity sales in the USA set a record in the 2nd quarter of this year at $79.4 billion. With so much volatility in stock markets there has been significant demand for guaranteed returns and particularly now since bonds pay a modest yield.

The best time for bond investors is when bonds have sold off, yields have jumped and inflation starts to come down. That locks in attractive yields that benefit from tighter spreads over the balance of the remaining term on the bond. With 10-year Gilts at 4.43% and the 30-year at 4.78% UK annuities will be offering attractive rates for risk averse portfolios. The wisdom of buying these products will be heavily influenced by whether the Bank of England continues to defend the 5% level on the 30-year over the medium term.

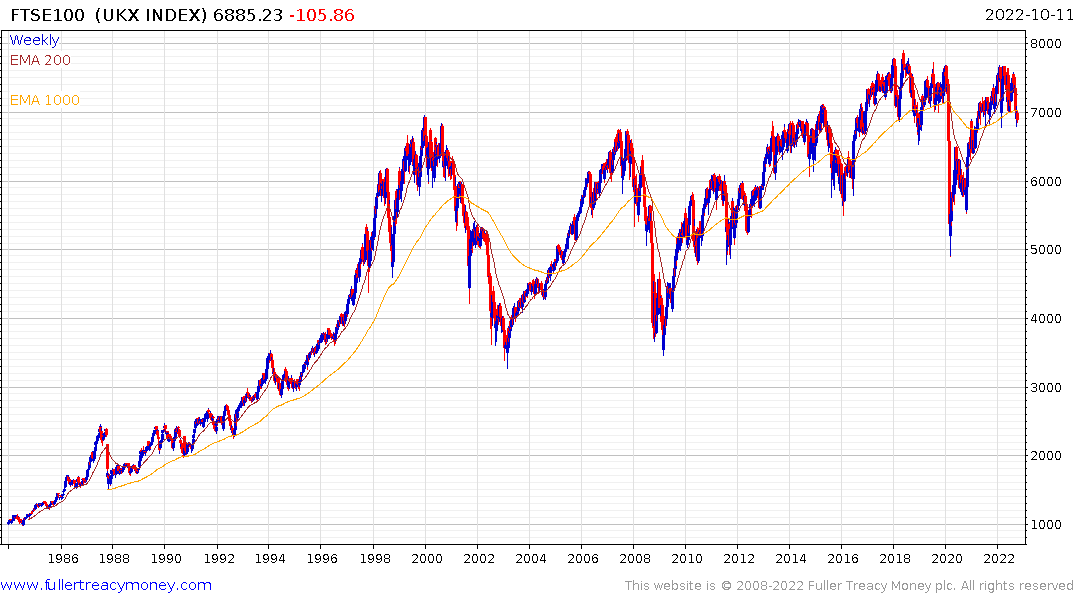

The FTSE-100 currently yields 4.06%. Stocks have enjoyed a yield premium over sovereign debt for most of the last decade and that period is now over. Generally, stocks have to provide sufficient capital appreciation to overcome the yield differential if investors are to participate. Since the FTSE-100 has been mostly ranging for 22 years, the alternative is prices will need to decline for yields to provide an attractive relative value opportunity.