Social Security COLA update coming this week - and it could be huge

This article from Fox Business may be of interest to subscribers. Here is a section:

Should Social Security beneficiaries see an 8.7% increase in their monthly checks next year, it would mark the steepest annual adjustment since 1981, when recipients saw an 11.2% bump. An increase of that magnitude would raise the average retiree benefit of $1,656 by about $144 per month or roughly $1,729 annually, the group said.

"A COLA of 8.7% is extremely rare and would be the highest ever received by most Social Security beneficiaries alive today," Mary Johnson, a policy analyst at the Senior Citizens League who conducted the research, said. "There were only three other times since the start of automatic adjustments that it was higher."

However, the decades-high benefit increase is not always good news for recipients, according to Johnson.

Higher Social Security payments are a bit of a Catch-22. They can reduce eligibility for low-income safety net programs, like food stamps, and can push people into higher tax brackets, meaning retirees will pay more taxes on a bigger share of their monthly payments.

There is a lot of complication in the US tax code but one thing is certain, if you make more you pay more. That both increases compliance costs and ticks people off when they believe they should not have to pay taxes. It’s likely to become a political factor in coming elections.

The increase in the payout rate will also coincide with an increase in the hurdle rate that qualifies for taxes to pay for it. However, one does not offset the other. With inflation high this year, the slated increase for 2023 will also be a big one. By some estimates another big increase would reduce the time left for the Social Security fund to cover full benefits to 12 years from 13.

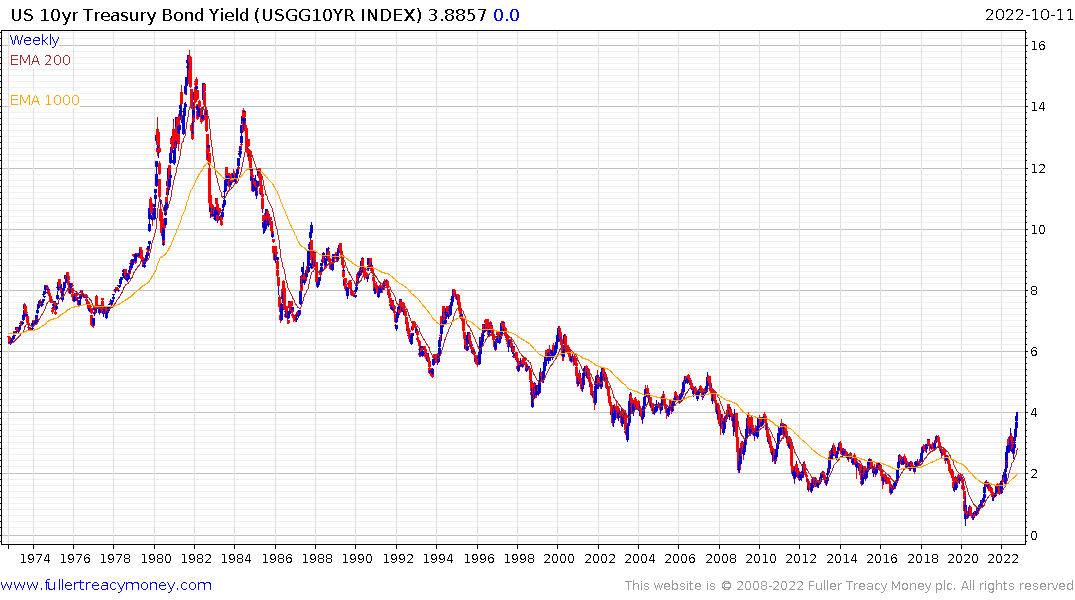

Many investors are still of the mindset that a jump in yields represents a buying opportunity because the Fed will have to ride to the rescue eventually. The Bank of England’s experience is being proffered as a foretaste of what that could look like.

The counterargument is the Fed already has its crisis strategy in play. The standing repo facility already supplies as much liquidity as is required to the interbank market and the facility sits at $2.25 trillion at present, up from zero in 2021.

The risk is that stashing money in repo markets starves liquidity hungry portions of the market. The biggest risk is private equity/pension funds go through a forced mark-to-market cycle in the unlisted sector which rapidly compresses valuations. That would act as a catalyst for a Fed pivot and act to support Treasuries.

10-year yields are pausing at the psychological 4% but a sustained move below 4.35% will be required to question the consistency of the uptrend.

Gold’s steadier action of late supports the view the market is beginning to price in the possibility we are approaching the end of the hiking cycle. Nevertheless, the necessary catalyst to ensure that move has not yet been provided.