Euro Tumbles to 20-Year Low, Putting Parity With Dollar in Sight

This article from Bloomberg may be of interest to subscribers. Here is a section:

“It is hard to find much positive to say about the EUR,” said Dominic Bunning, the head of European FX Research at HSBC. “With ECB sticking to its line that we will only see a 25bp hike in July – at a time when others are hiking much faster – and waiting for September to deliver a faster tightening, there is also little support coming from higher yields.”

Money-market traders are betting ECB will deliver around 140 basis points this year, down from more than 190 basis points almost three weeks ago. The repricing gathered pace after a string of weak economic data last week, with traders trimming bets again on Tuesday after French services PMI was revised lower.

Investors have also been more cautious on the euro due to the risk of so-called fragmentation, when economically weaker nations see unwarranted spikes in borrowing costs as financial conditions tighten. The ECB is expected to deliver further details of a new tool to backstop more vulnerable countries’ debt at their policy meeting later this month.

The losses Tuesday were compounded by poor liquidity and selling in euro-Swiss franc, according to three Europe-based traders. The euro fell as much as 0.9% against the Swiss franc to 0.99251, the lowest level since 2015.

“The FX market is not back up to full liquidity given the US holiday,” said Mizuho’s Jones. “Any given size of trade is likely to have a greater impact on market movement.”

Russia’s calculus is simple enough. They are betting the economic pain European countries are enduring because of their support for Ukraine will be so great they will be willing to make a deal sooner rather than later.

The unfolding energy crisis exposes the soft points in Europe’s economies. First off, Europe is an energy importer. Reliance of imports has risen over the last few decades because of antipathy towards both coal and nuclear.

The creation of the Euro resulted in a debt binge which the region is still dealing with. Since banks are largely held captive by their respective governments, there is no potential for recapitalisation or free capital markets.

The expansion of NATO is an escalation of the unfolding great power competition with Russia. The EU relies on the USA for military support. Increasingly the region will rely on the willingness of the USA to export gas and oil.

At a minimum, NATO members will need to re-arm. Germany, in particular, will need to significantly increase military spending. Sending antiquated material to Ukraine frees up space in arsenals for additional equipment so spending will follow.

Investors will also be watching for any sign that the European growth shock is leading to a rapprochement with Russia among the most exposed Eurozone countries.

Energy prices are a political issue in the USA at present. The government could bring prices down with the stroke of a pen by banning exports. They can’t do that because of commitments to allies. As the de facto leader of NATO, the USA is duty bound to counter Russia efforts to destabilized Europe. In June, the USA sent more gas to Europe than Russia for the first time.

Nevertheless, Freeport LNG has been banned from repairing or restarting its LNG liquefaction plant in Texas until they meet “public safety concerns”. That is the primary reason US natural gas prices are under pressure while European prices are still rising.

That is keeping pressure on European economies and the harsh reality is interest rate hikes will do nothing to alter it. The Euro breaking lower today reflects that conclusion. The energy crisis is destroying demand without the aid of interest rates.

Bund yields are coming down quickly as recession risk is priced.

Bund yields are coming down quickly as recession risk is priced.

Copper’s accelerating decline is an additional signal global growth is likely to surprise with its weakness.

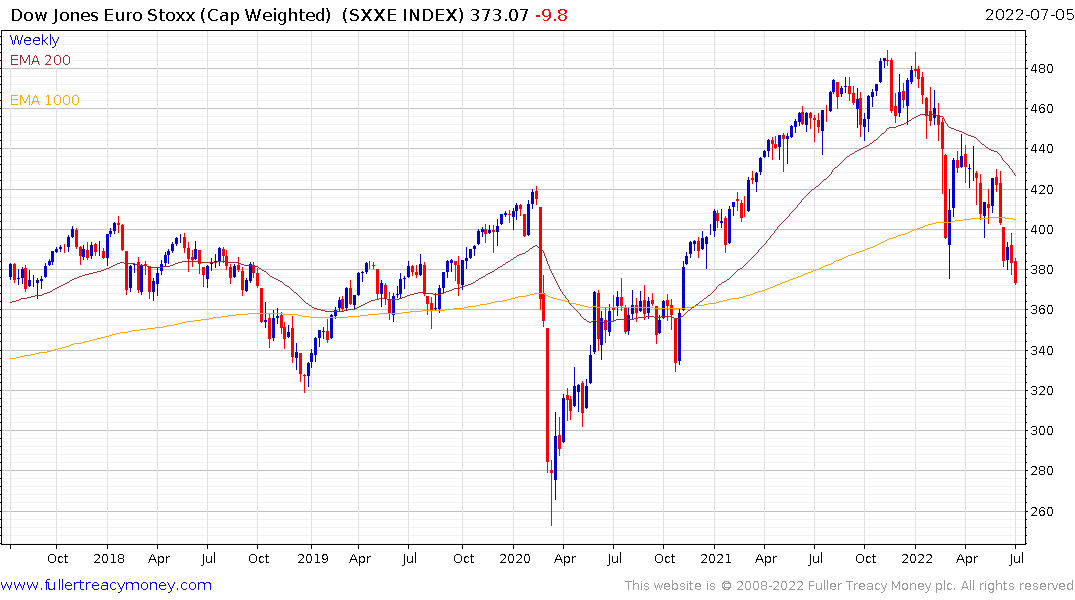

The Euro STOXX Index broke below the March lows today to extend the bear trend. A sustained move above the 1000-day MA, near 400, will be required to check potential for further downside.

The Pound also broke lower today for much the same reason as the Euro.

The Pound also broke lower today for much the same reason as the Euro.

The FTSE-100 was led on the downside by yesterday’s leaders. The large downward dynamic on Brent crude oil clearly suggests traders are more concerned with demand destruction than shortages in the near term.