Central banks haven't bought this much gold since 1967

This article from Quartz may be of interest to subscribers. Here is a section:

Turkey was the biggest buyer of gold during the quarter, followed by Uzbekistan (26.13 tons) and India (17.46 tons). Not all countries report their gold purchases regularly, so it’s difficult to know how much, for example, China and Russia bought during this same period.

India is also shoring up its gold reserves.

Indian consumers habitually purchase gold jewelry ahead of the festive season every October. But that aside, the Reserve Bank of India (RBI) bought 13 tons of gold in July and 4 tons in September, pushing its reserves to 785 tons, according to the WGC.

Any foreign exchange and gold reserves Russia had overseas have been confiscated. That’s a big lesson for every country that is suspicious of NATO’s motives now and in the future. It is therefore reasonable for countries to favour gold over holding foreign currency because at least the gold is a physical entity that can be held internally. Nuclear weapons are now also a must have to defend against invasion for any country that holds opposing views to NATO.

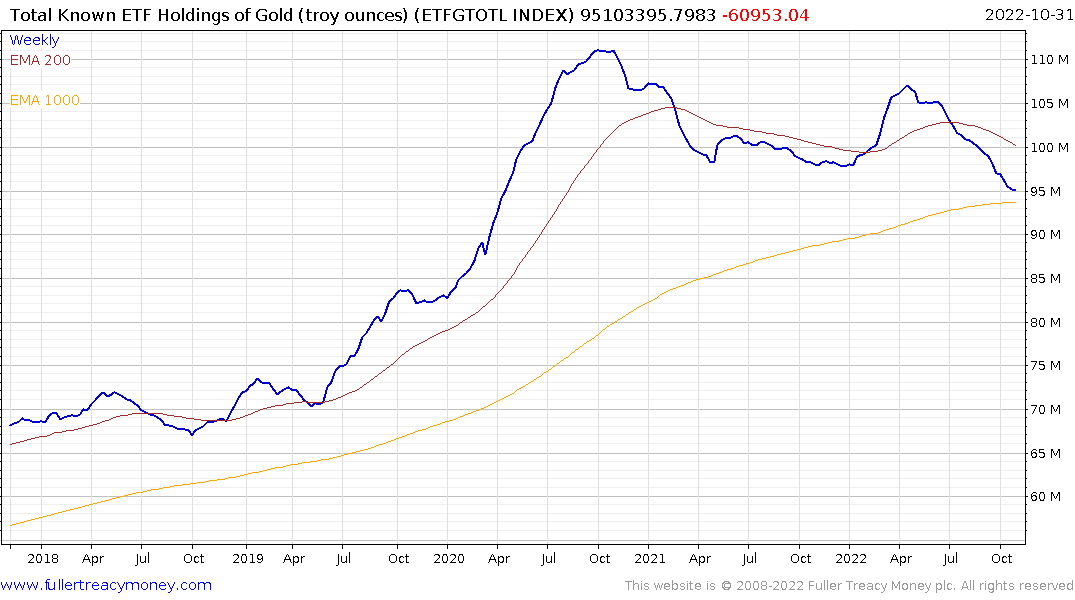

Meanwhile both the dollar denominated price of gold and ETF holdings are back in the region of the 1000-day MA. Investors are less concerned about the geopolitical implications the theft of foreign reserves represent. Instead they see the Fed’s aggressive monetary tightening, tight monetary conditions, contracting US deficits and resulting strong dollar. That’s detracting urgency from the willingness to buy gold.

Meanwhile both the dollar denominated price of gold and ETF holdings are back in the region of the 1000-day MA. Investors are less concerned about the geopolitical implications the theft of foreign reserves represent. Instead they see the Fed’s aggressive monetary tightening, tight monetary conditions, contracting US deficits and resulting strong dollar. That’s detracting urgency from the willingness to buy gold.

I received this email from a subscriber today

“After seven consecutive months of falling prices, gold rose $27 in October. Is the bottom in?”

As we can see from the above chart, the gain in October barely registers. It is not enough on its own to signal a low.

At present the Federal Reserve is doing a reasonably credible job of trying to get inflation under control. That’s weighing on the gold price. However, most people don’t believe the Fed is really willing to make the tough decision to continue to hold rates at a high level when the economy contracts so gold is still holding up reasonably well.

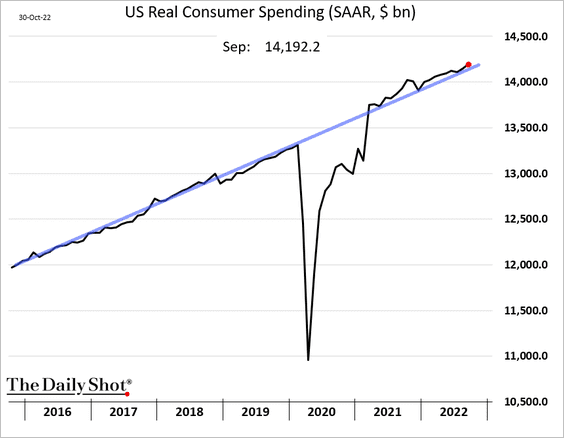

Inflation adjusted spending has remained robust despite the fact wages have not kept pace with inflation. Consumers have paid for sustaining their spending patterns by spending their pandemic savings which are now back to 2008 levels in absolute terms and relative to disposable income.

As savings are spent down, demand for credit has been hitting new highs. This is a recipe for a less than benign outcome because a recession is inevitable that this stage.

I remain of the view a sustained move below 110 on the Dollar Index will be a clear catalyst for bullish interest in gold to return.

Back to top