Wall Street Sees 'Devil's Bargain' in Powell's Rate Comments

This article from Bloomberg may be of interest to subscribers. Here is a section:

“This is a devil’s bargain,” said Steve Chiavarone, senior portfolio manager at Federated Hermes. “Size of rate hikes will likely fall, but terminal rate is likely higher -- the implication is a greater number of smaller rate hikes. That is not dovish.”

Jay Powell said in plain English it is better to overtighten, and cut later, than to under tighten and risk allowing inflation to become entrenched. That’s about as hawkish as it gets. The Fed wants a recession and they will keep going until they kill demand.

The reality is that there are more than 10 million job openings and no workers to fill them. There has been a massive wave of retirements and legal/skilled immigration has trended down from 1 million per annum in 2016 to less than 200,000 this year. That is putting upward pressure on wages and inflationary thinking is already entrenched.

It is almost tongue in cheek to say that a soft landing is still possible even if the window for achieving that is narrowing. A soft landing at this stage is impossible.

Sometimes you have to listen to the universe. Two weeks ago I received an invitation from a hedge fund to a swanky restaurant so they could talk about alternative investments. Mrs. Treacy and I went along last night to hear what they had to say. The presenter was an ex EDF Man/MF Global trader and the firm is now owned by ABN AMRO. They purport to have a star programmer who takes leveraged bets with 30% of the portfolio and they let Goldman hedge the other 70% via alternatives.

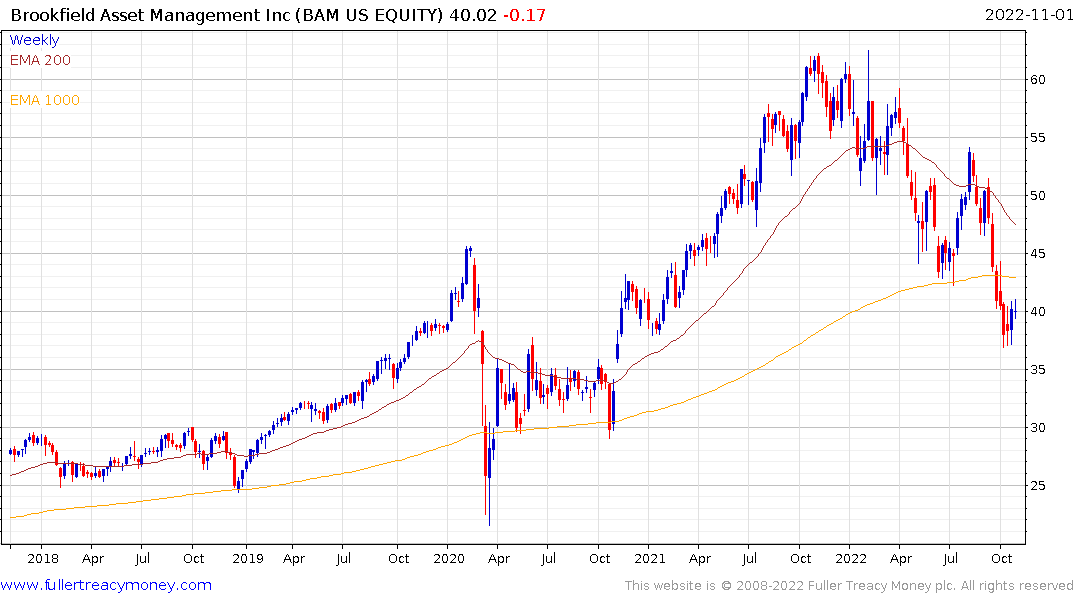

When hedge funds are sending me mailshots as a prospective “qualified investor” it strikes me as a very toppy phenomenon. Alternatives are by far the riskiest asset class at present and Brookfield Asset Management is the canary in the coal mine.

When hedge funds are sending me mailshots as a prospective “qualified investor” it strikes me as a very toppy phenomenon. Alternatives are by far the riskiest asset class at present and Brookfield Asset Management is the canary in the coal mine.