JPMorgan Is Worried About Who's Going to Buy All the Bonds

This article from Bloomberg may be of interest to subscribers. Here is a section:

Even if new buyers step into purchase these bonds, they’re likely to demand a higher yield for doing so — potentially adding to government deficits and mortgage rates at a time when they’re already soaring.

“All this points to a somewhat higher resting level for the mortgage/Treasury basis—and potentially for other related assets like IG corporates, which finally caught up with some of the mortgage widening over the past few days,” the analysts conclude.

2-year yields at over 4% are sufficient incentive to drag cash into the sovereign markets. When the alternative is to lose double digits in the stock market and see cash eroded by inflation, the allure of a guaranteed 4% is reason enough to invest.

The bullish case for bonds rests in negative global money supply growth contributing to deflationary forces which will result in recessions and lower interest rates over the next 12 months.

The big question for investors is how the markets will account for the significant uptrend in the interest expense of the US government. The St Louis Fed’s 2nd quarter annualised estimate for the interest expense is $648.5 billion versus the peak of $590 billion in 2019.

The big question for investors is how the markets will account for the significant uptrend in the interest expense of the US government. The St Louis Fed’s 2nd quarter annualised estimate for the interest expense is $648.5 billion versus the peak of $590 billion in 2019.

In 2019 rates peaked at 2.5% and at the end of the 2nd quarter were at 1.75%. Since then, the Fed Funds rate has climbed to 3.25% and will likely be over 4% by the end of the year. That suggests a significant acceleration in the interest expense of rolling over debt by the end of Q4.

Government coffers are flush with tax revenues from a still healthy economy, so the question of tax hikes to fund interest expense is not a topic of public discourse.

A recession will change that and will force a rethink of rampant spending expansion. That’s inherently deflationary and could eventually see yields contract with the Dollar.

For now the Dollar is pausing following a steep short-term advance but a sustained move below 110 on the Dollar Index would be required to question the consistency of the uptrend.

10-year Treasury yields tested the upper side of the underlying range near 3.5% today but a sustained move below that level would be required to signal a return to demand dominance beyond short-term steadying.

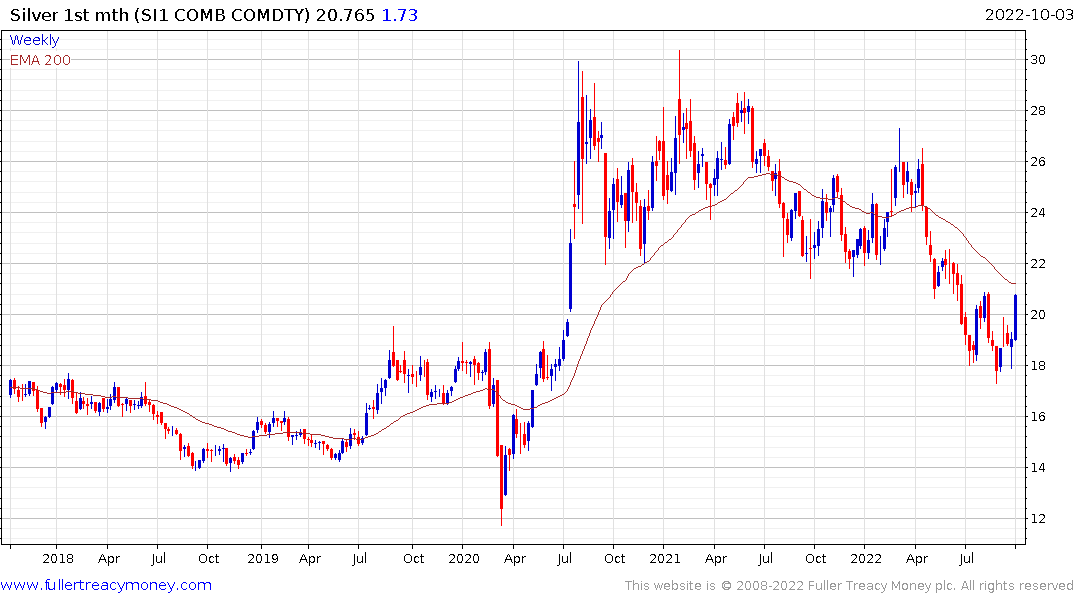

Today’s strong performance by silver suggests investors are beginning to position for a lengthier negative real interest rate environment and dollar weakness over the medium term. The price is approaching the region of the both the 1000-day and the 200-day MAs. A sustained move above $21.50 would confirm a return to medium-term demand dominance.

Today’s strong performance by silver suggests investors are beginning to position for a lengthier negative real interest rate environment and dollar weakness over the medium term. The price is approaching the region of the both the 1000-day and the 200-day MAs. A sustained move above $21.50 would confirm a return to medium-term demand dominance.