Fed's Yield-Curve Barometer Starts Flashing Recession Risk

This article from Bloomberg may be of interest to subscribers. Here is a section:

Inversions of this segment of the Treasury curve typically occur late in Fed tightening cycles as three-month bills track the policy rate while longer-term borrowing costs reflect expectations for economic growth and inflation. While other widely-watched yield curve segments such as the two- to 10-year and five- to 30-year have been deeply inverted for much of this year, the Fed follows this one more closely.

“We are certainly in territory with the Fed’s official barometer of the yield curve that will raise concerns,” said Gregory Faranello, head of US rates trading and strategy at AmeriVet Securities. “The Fed will definitely watch this, and there is a sense in the bond market that they will soon throttle back the pace of rate hikes and take a step back.”

The 10-year – 3-month spread spent part of today inverted following an 11.65 basis-point contraction. The spread was at 223 basis points in May so this tightening has been the fastest in decades. The fact there was such a wide divergence between the 10-year – 2-year and the 10-year – 3-month was regarded as an oddity but reflected the stresses in the bond market.

.png) The run-up in yields at the long-end of the curve resulted in an exodus. Anyone who could parked their assets in the repo market. Those whose mandate meant they had to be invested in fixed income bought the shortest dated paper they could find. That depressed short-term yields and inflated long-term yields which widened the spread. The inexorable rise in the Fed Funds Rate has forcible pushed the short end higher.

The run-up in yields at the long-end of the curve resulted in an exodus. Anyone who could parked their assets in the repo market. Those whose mandate meant they had to be invested in fixed income bought the shortest dated paper they could find. That depressed short-term yields and inflated long-term yields which widened the spread. The inexorable rise in the Fed Funds Rate has forcible pushed the short end higher.

Now, 10-year yield is back testing the psychological 4% level and the Dollar is below the 110 area. That link between the currency and the guaranteed return from Treasuries is likely to remain in place.

Now, 10-year yield is back testing the psychological 4% level and the Dollar is below the 110 area. That link between the currency and the guaranteed return from Treasuries is likely to remain in place.

Meanwhile, the correlation between stocks and bonds is unlikely to hold up as the tide of demand recedes and corporate profits come under pressure.

Gold continues to firm from the region of the lows above $1600.

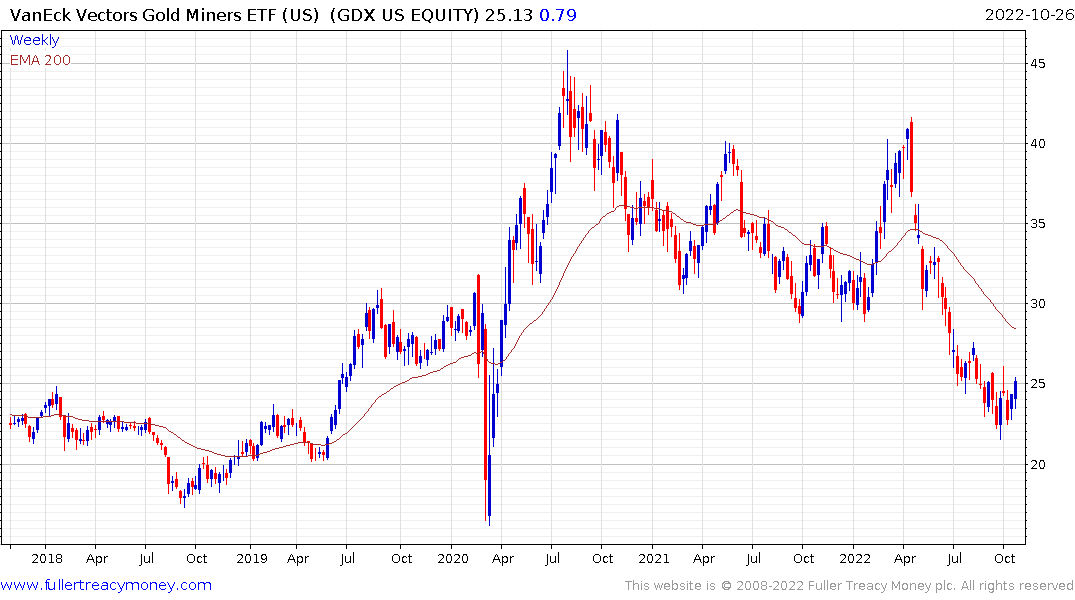

The VanEck Gold Miners ETF is also firming.

Both bitcoin and ethereum extended their rebounds today. Sustained moves above their respective trend means would confirm a return to demand dominance and possibly suggests they are being viewed as alternatives to the dollar during a time stress.