Email of the day on Chinese property developer US Dollar bonds

Thanks a lot for another very informative Friday video. Could you please kindly comment on the Chinese Construction Companies’ default situation. How serious and general are the defaults of their international bonds. Thanks in advance.

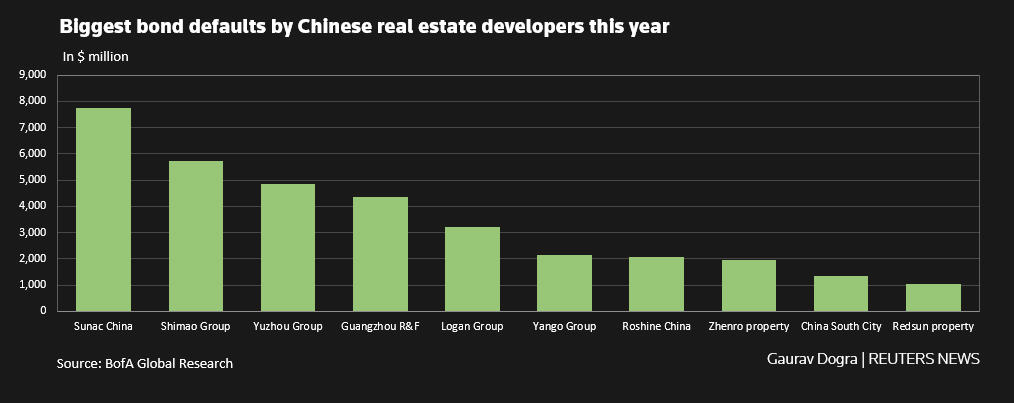

Thank you for this topical question which may be of interest to the Collective. This Reuters article, dated September 2nd, included a table of the biggest bond defaults up to that point in 2022.

Sunac, at over $7 billion was the largest. While that sum is large, it is a fraction of the Evergrande default last year. The announcements over the weekend focusing on new measures to support the property market and reorient the COVID-zero policy suggest greater care is being taken to prevent additional defaults and to support the market.

Sunac, at over $7 billion was the largest. While that sum is large, it is a fraction of the Evergrande default last year. The announcements over the weekend focusing on new measures to support the property market and reorient the COVID-zero policy suggest greater care is being taken to prevent additional defaults and to support the market.

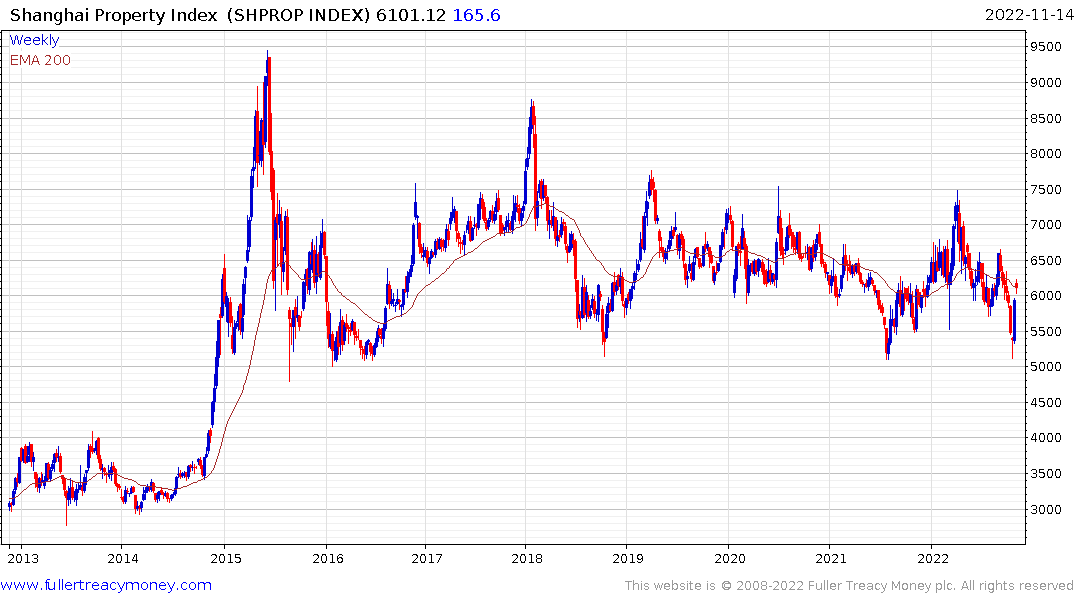

The Shanghai Property Index has completely unwound the post Party Conference breakdown and is back testing the lower side of the overhead range. 6000 is the first area of potential resistance so additional upside follow through will be required to confirm a return to demand dominance.

The Shanghai Property Index has completely unwound the post Party Conference breakdown and is back testing the lower side of the overhead range. 6000 is the first area of potential resistance so additional upside follow through will be required to confirm a return to demand dominance.

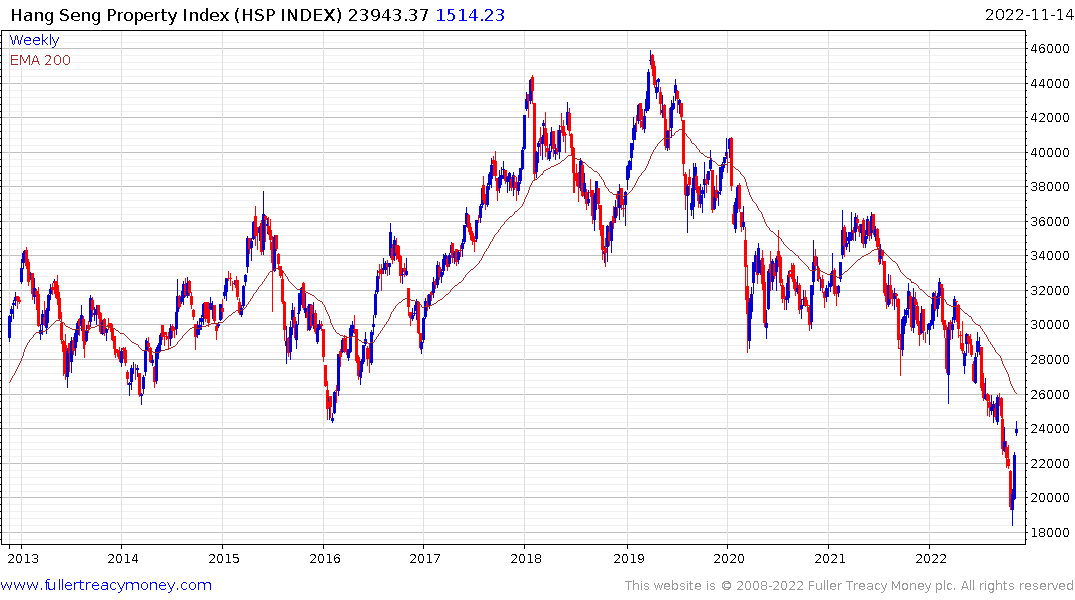

The Hang Seng Properties Index is also back testing the lower side of the overhead trading range.

The defaulted US Dollar debt of troubled property developers will need to go through the normal cycle of reclamation. To date the Chinese government has been silent on the claims of foreign investors even as measures have been implemented to shield domestic investors.

That stance is untenable if the Chinese corporate sector ever wants to borrow from foreign investors again. The most likely scenario is the assets of defunct companies will be acquired by those with connections to the state and some arrangement will eventually be made with creditors, but it will be a lengthy process.

Back to top