Email of the day on the big question

Q: Are we in a bear or a bull?

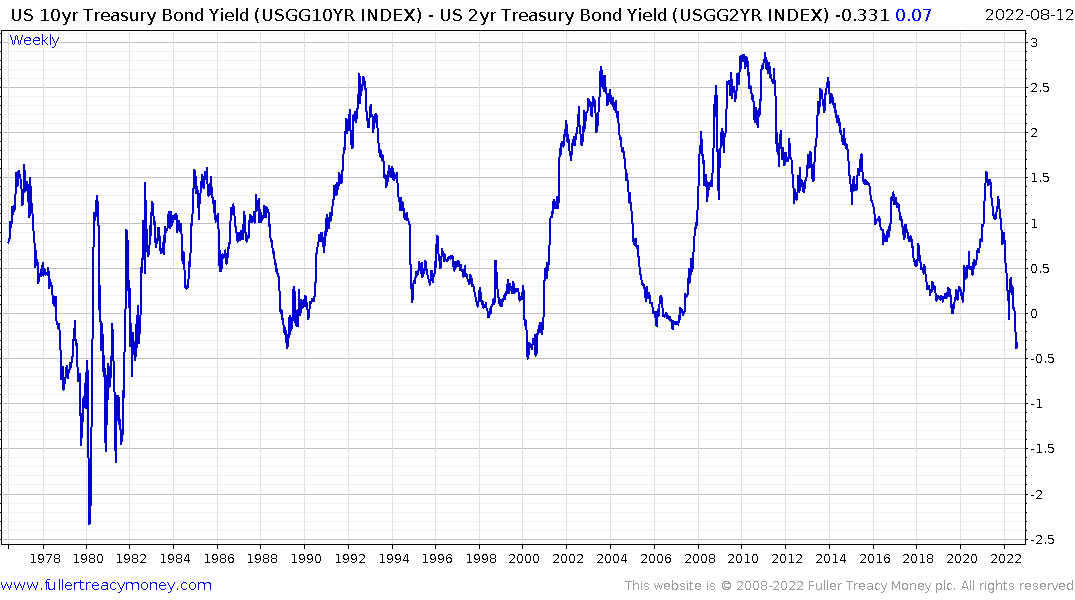

Thank you for voicing the question I believe everyone is asking. The short answer is yes, the long answer is more nuanced. Let’s frame this discussion in terms of the yield curve spread. The 10-year – 2-year is sharply negative. The 10-year – 3-month and the 10-year – Fed Funds Rate have both accelerated lower but are not yet negative. All three point toward significant monetary tightening. That is before the impending acceleration in the contraction of the Fed’s balance sheet is

When the yield curve inverts it is quite normal to get an initial flurry of concern about the potential for a future recession. However, the initial stages of a tightening are generally welcomed by investors because they worry about inflation. Confidence that the Fed will succeed in quelling inflation gives way to stocks rebounding. We saw that following the initial inversions in both 2008, 2019 and now. So, in the short-term we are in a bull recovery.

When the yield curve inverts it is quite normal to get an initial flurry of concern about the potential for a future recession. However, the initial stages of a tightening are generally welcomed by investors because they worry about inflation. Confidence that the Fed will succeed in quelling inflation gives way to stocks rebounding. We saw that following the initial inversions in both 2008, 2019 and now. So, in the short-term we are in a bull recovery.

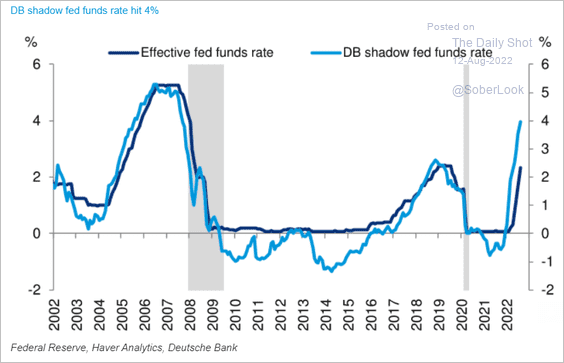

As the tightening cycle progresses and the lagged effects of tightening show up in official statistics, growth surprises on the downside and unemployment eventually rises. The Shadow Bank rate is now estimated to be around 4% for example.

The Fed then panics at the speed with which a contraction in economic activity is unfolding so they aggressively cut rates. That results in the yield curve spread shooting higher. Historically this is when stock markets experience the most selling pressure because an earnings recession is twinned with an economic recession. That’s the medium-term bear case.

For me the short-term bull versus medium-term bear arguments is a rationale for being willing to short rallies.

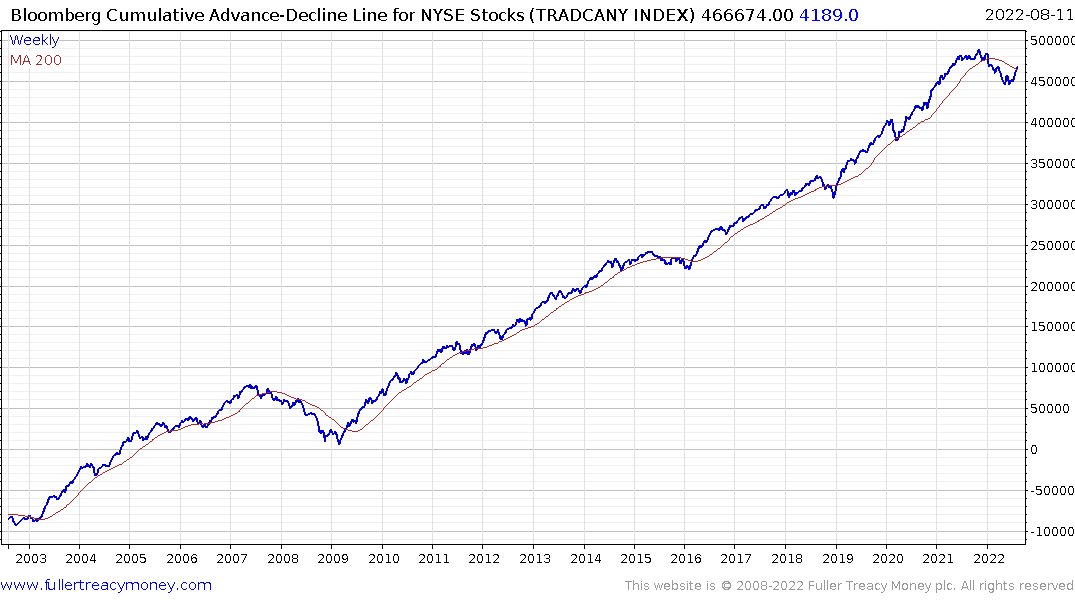

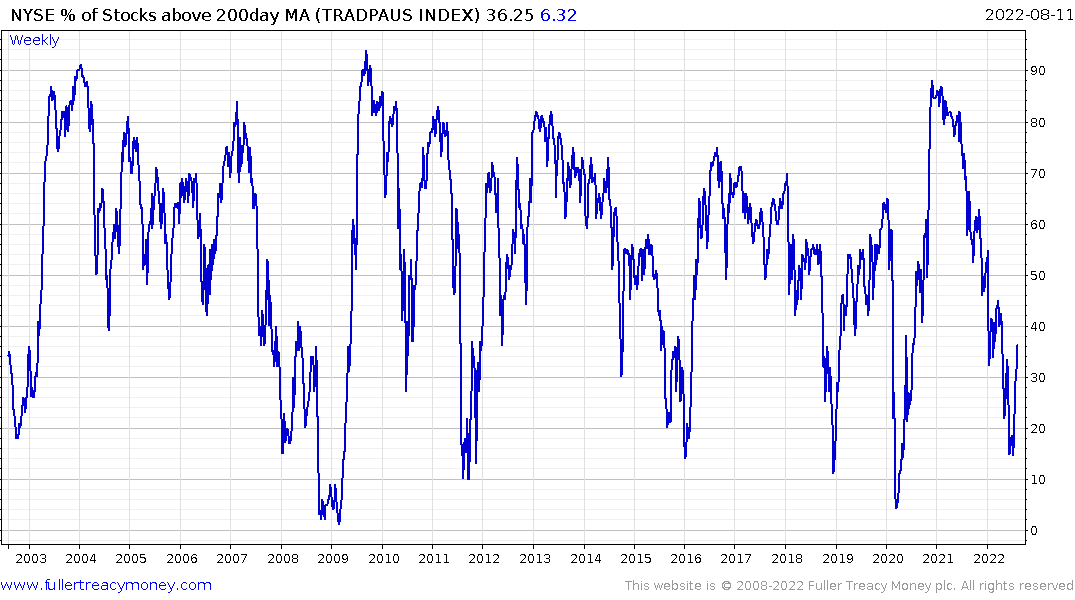

Let’s look at the countervailing argument. The NYSE Cumulative Advance-Decline Line has broken its downtrend and the number of shares trading below their respective trend means has turned sharply higher.

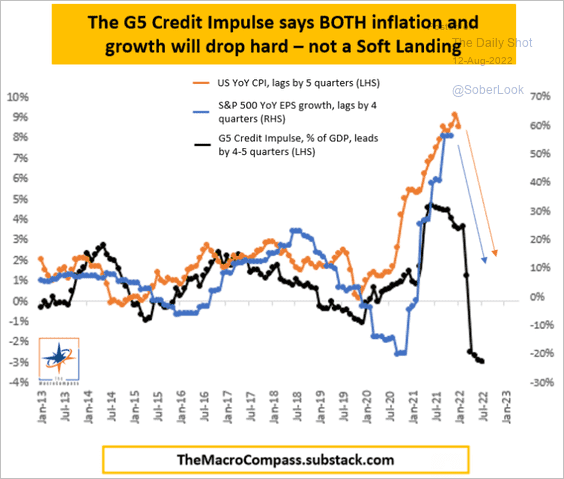

That supports the view this has been a particularly broad-based rebound which is consistent with bottoming activity. Many commodity prices have also rolled over, with oil testing the lower side of a four-month range.

So, this begs the really big question: Is this a medium-term correction in an ongoing secular bull market or are we witnessing the first leg lower in a new secular bear?

.png) This monthly long-term logscale chart of the S&P500 supports the argument we are still in a secular bull market. Unleveraged long-term investors will heart from this bounce since it is consistent with similar tests of the long-term trend mean from other corrections. However, the background environment is still skewed towards tightening so caution is still warranted.

This monthly long-term logscale chart of the S&P500 supports the argument we are still in a secular bull market. Unleveraged long-term investors will heart from this bounce since it is consistent with similar tests of the long-term trend mean from other corrections. However, the background environment is still skewed towards tightening so caution is still warranted.

.png)

I shorted the Nasdaq-100 market yesterday because we are still in tightening monetary environment, quantitative tightening is only beginning, yields are rising, and the major indices are testing their respective 200-day MAs.

My logic is simple enough. I have purchased a suite of out of the money 2024 puts as an insurance policy. The best time to initiate new leveraged futures positions is following a rally to a potential area of resistance. (now) If that short does not work out and the major indices sustain moves back above the 200-day MA I will be encouraged to chase a momentum move higher while expressing a willingness to buy investment positions in oversold growth sectors.

The bull case rests on the assumption a soft landing is achieved, and the inflationary pressures dissipate as quickly as they manifested. I still believe it is worth having a hedge against this best of all possible world scenarios failing.

I am very aware that making money on short positions makes it difficult to turn around and be a bull again. Therefore, I continue to try and look at all sides of the argument and will adjust my tactics accordingly.

Back to top