Brookfield plans 12-16 gigawatts of India renewables over next decade

This article from the Economic Times may be of interest to subscribers. Here is a section:

Brookfield is looking to multiply its current 4 GW renewable portfolio by 3 to four times in India within the next decade in generation as well as help corporates make the transition to decarbonise and invest in building large scale supply chain in the country, said a top executive.

The renewables current assets under management is approximately $1 billion.

Earlier this year, Brookfield Asset Management announced that it raised a record $15 billion for its inaugural Global Transition Fund. This marks the world's largest private fund dedicated to the net zero transition, signaling that investors are still committed to establishing cleaner portfolios. Brookfield is the single largest sponsor of the fund having deployed $2 billion itself.

Brookfield deals with state utilities but sees incremental green power demand coming from corporates who are increasingly becoming bulk consumers. For example, as part of its road map to achieve 100 per cent dependence on renewable energy by 2025. Amazon on Wednesday announced its first utility-scale projects in India — three solar farms located in Rajasthan. These include a 210-megawatt (Mw) project to be developed by India-based developer ReNew Power, a 100 Mw project to be developed by local developer Amp Energy India, and a 110 Mw project to be developed by Brookfield Renewable Partners.

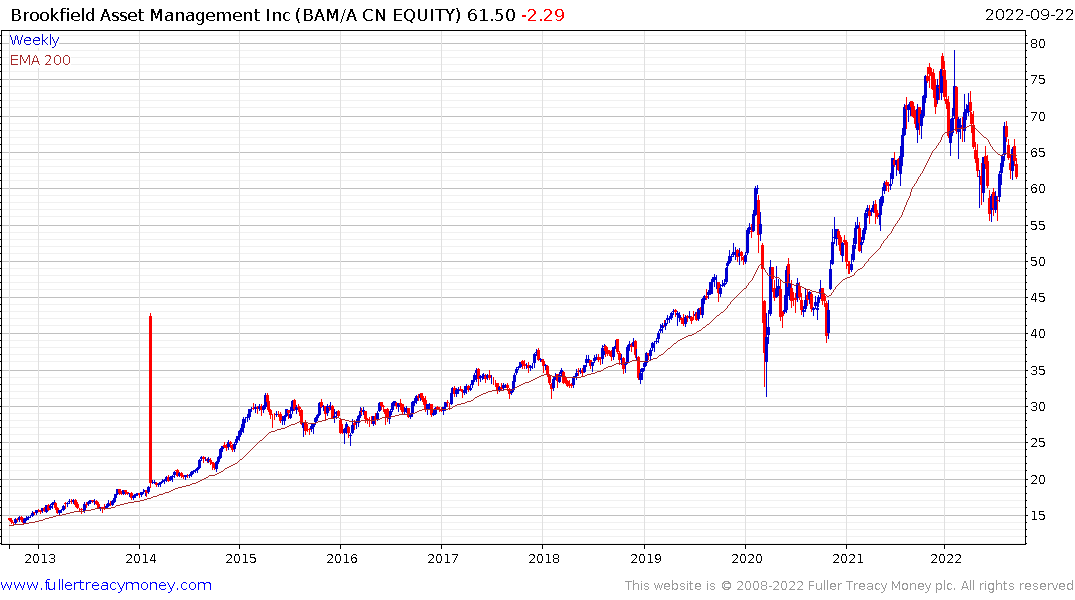

Brookfield is the name that comes up in almost every conversation I have with investors. The name is treated reverentially because the team so artfully plotted a route through the Global Financial Crisis and the subsequent boom.

That was achieved by deploying financial engineering to create degrees of separation between the core fund and the offshoots. It was funded through leveraging access to free money and by providing a much-needed service to pensions in dire need of yield.

Today Brookfield owns a portfolio of commercial real estate, warehouses and renewable energy power plants that is almost unrivalled internationally. The most difficult question to answer is how exposed Brookfield is to rising rates, and falling real estate prices? The share price continues to roll over the with the wider market.

Today Brookfield owns a portfolio of commercial real estate, warehouses and renewable energy power plants that is almost unrivalled internationally. The most difficult question to answer is how exposed Brookfield is to rising rates, and falling real estate prices? The share price continues to roll over the with the wider market.

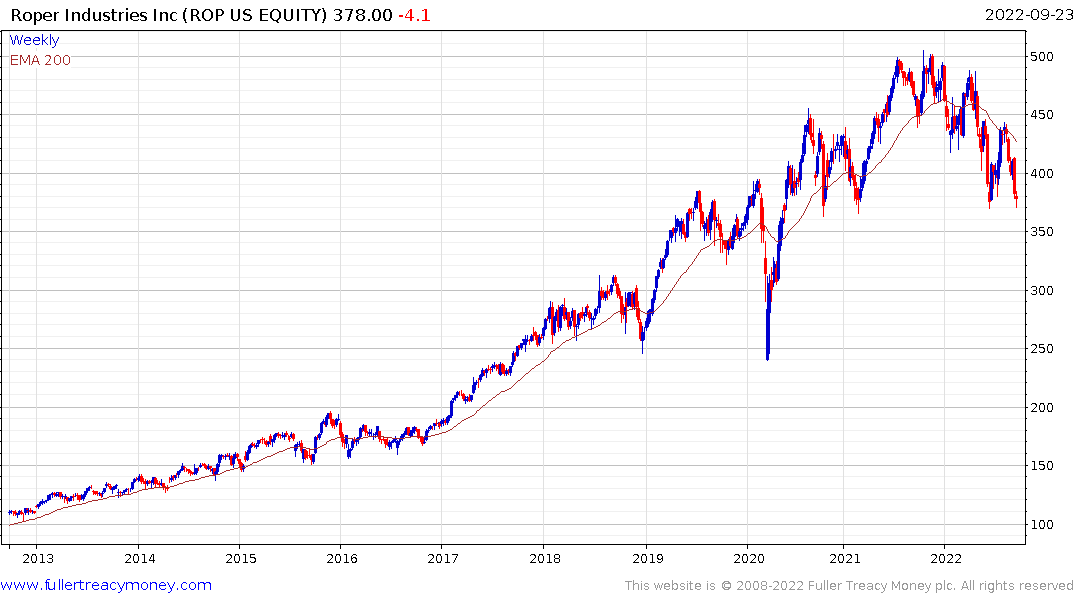

Danaher is another high-profile company that utilised the private equity business model to thrive over the last couple of decades. The share has a lot of commonality with Brookfield.

Danaher is another high-profile company that utilised the private equity business model to thrive over the last couple of decades. The share has a lot of commonality with Brookfield.

Roper Technologies is another example and is breaking lower today.