Boris Johnson fights on but hit by new wave of resignations

This article from the BBC may be of interest. Here is a section:

New chancellor Nadhim Zahawi has urged unity after his predecessor, the health secretary, and several junior ministers walked out.

But the prime minister has been hit by six further resignations, taking the total to 16 in the past day.

It comes as he prepares for PMQs later and a grilling by senior MPs.

Mr Johnson's premiership has been plunged into crisis following the dramatic resignations of Chancellor Rishi Sunak and Health Secretary Sajid Javid.

They quit within minutes of each other on Tuesday following a row over Mr Johnson's decision to appoint Chris Pincher deputy chief whip earlier this year.

Their departures triggered a wave of resignations from more junior roles that has continued on Wednesday.

In six further departures ahead of PMQs, education ministers Will Quince and Robin Walker, Justice Minister Victoria Atkins, Treasury minister John Glen, and ministerial aides Laura Trott and Felicity Buchan have all walked out.

Boris Johnson is a proven vote winner, but it was widely reported when he became Prime Minister that he is not well liked by his party colleagues. That later point is now becoming relevant as demand for solutions to unfolding economic issues are in high demand. Regardless of efforts to remove him, the range of possible options to mounting economic, inflationary and energy challenges will be the same.

The Bank of England is impeded from being more aggressive in raising rates because so much consumer debt is floating rate. The benefit for the government is the UK has some of the longest duration debt of any developed economy but that is irrelevant when dealing with inflation in the short term.

France just nationalized EDF Energy so the government is taking over full control of the nuclear industry. The UK is not so far from price controls and now would be a good time to introduce them because commodity prices are falling. Putting a cap on prices before the public is widely aware they have peaked is just sound politics.

The Pound continues to hold the move below $1.20 but is unlikely to be boosted by political news. The challenges facing the UK economy are not all down to Boris Johnson’s decisions. Instead, the best hope for a rebound for either the Euro or Pound would be in a weaker argument in support of the Dollar. The long-end of the curve is contracting. That suggests the widening interest differential argument is becoming less convincing.

The Pound continues to hold the move below $1.20 but is unlikely to be boosted by political news. The challenges facing the UK economy are not all down to Boris Johnson’s decisions. Instead, the best hope for a rebound for either the Euro or Pound would be in a weaker argument in support of the Dollar. The long-end of the curve is contracting. That suggests the widening interest differential argument is becoming less convincing.

The threat of recession in Europe and North America is rapidly correcting overzealousness in the oil markets. As recently as last week predictions of $380 oil were commonplace; on the possibility Russia would cut off supplies.

There has been some commentary on how easy it would be for Russia to stop producing as much as 5 million barrels a day. Since a lot of that oil is coming from areas with permafrost, stopping supply is no trivial matter because the cost of restarting would be stratospheric.

Not only can Russia not stop production, but they are facing significant costs for ensuring their pipelines are serviceable; as frost turns to bog. As recently as December, the cost of dealing with melting permafrost under pipelines was estimated at $110 billion.

Faced with decaying infrastructure and NATO expanding all the way to the western frontier, Russian planners probably concluded they had no choice but to act pre-emptively to avoid terminal decline. Even then, the country faces significant issues. Losing thousands of young men of reproductive age in the battles for Ukraine is not a good long-term strategy for a population in already in decline.

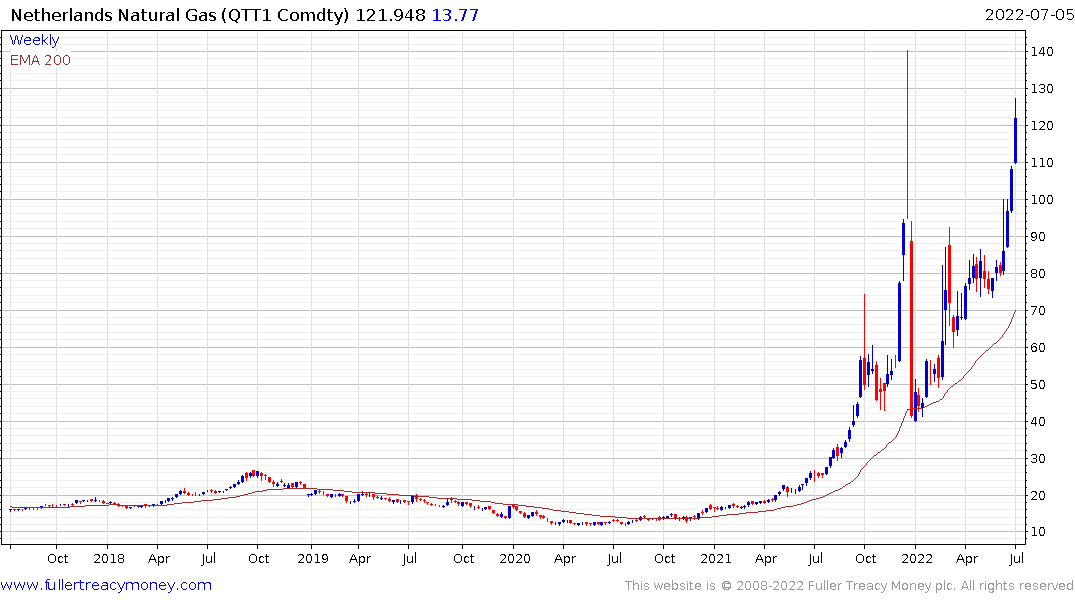

European gas prices continue to surge. The Dutch benchmark rate reversed an earlier decline to close in the region of the December peak.

The global economy is a looking at a significant demand shock as economic activity slows down from the liquidity-fuelled fervour of the last couple of years. However, the damage to the global supply chain is still present and will continue present challenges. That suggests we should expect much more volatile trends will large peak to trough and back again swings.

Back to top