Email of the day on surging electricity prices

I know you have consistently highlighted the challenges that UK households will experience in relation to their energy bills, and just today they are saying that "typical" households could be paying nearly £600 in January, money that most just can't find. Already consumers are a collective £1.3 billion in arrears on their bills, with an expected 86% hike in the energy cap expected on 1 October.

But far less is said of the impact on businesses, and on this I can shed some very specific light. I own a small business, an indoor children's play centre. On 1 December last year I renewed my energy supply contract, and faced with an increase then from 15p/kwH to 20p/KwH I opted to take just a 1 year renewal, with gas prices fairly stagnant until then as you know.

I have been informed today that when I come to renew once more on 1 December, I am going to staring at a tariff of anywhere between 50p/kwh to as much as 89p/kwh. I was also told in no uncertain terms by the 'sales' person at my current supplier, that they are trying to migrate away from small and medium business in this environment, and are deliberately pricing us away. the daily fixed standing charge will move from £83 per month, to potentially as much as £1,000.

For context, my own energy bill is going to shift from £20k per year to closer to 60k-£70k. This is going to be catastrophic for U.K. businesses, as many will be left in dire straits, unable to keep the lights on, and customers cool (in summer) or sufficiently warm in the winter. So many businesses in the hospitality sector especially are saddled with the burden of Covid "bounce back loans", delayed VAT repayments, and of course huge inflation on input costs with a consumer at breaking point. Business closures = higher unemployment...it is looking particularly dire here in the U.K.

Thank you for sharing this visceral experience of price increases business owners are experiencing. The challenges are significant and options to raise prices are inhibited so many businesses will close. The strike action in the UK which has been building for months and will escalate further. They are a symptom of how much living standards are being impacted by the rising cost of living.

Faced with public unrest and out of control energy costs, politicians have two options. They can bow to demands for wage increases in the public sector. Alternatively, they can introduce price controls. Wage increases are crowd pleasers, but they do not tackle the inflation issues. By addressing symptoms rather than causes they might even make the problem worse. The biggest issue is wage hikes tend to be permanent.

Faced with public unrest and out of control energy costs, politicians have two options. They can bow to demands for wage increases in the public sector. Alternatively, they can introduce price controls. Wage increases are crowd pleasers, but they do not tackle the inflation issues. By addressing symptoms rather than causes they might even make the problem worse. The biggest issue is wage hikes tend to be permanent.

Price controls directly tackle inflationary pressures. They have the added benefit of buying time in the hope prices come back down after some time has passed. Additionally, price controls apply to all of society and not to a narrow band of union represented privileged, often public sector, employees. The challenge is price controls abandon the market economy, create massive dislocations, imply capital controls because arbitrage opportunities have to be outlawed, and they are very expensive.

Look out for a jingoistic argument that the money spent on price controls is a down payment on enhanced productivity from the economy. It will be justified as a necessary step to further the ambition of becoming a globally significant competitive manufacturing and energy hub capable of delivering on the promise of Brexit.

The most important point is price controls are a massive departure from the economic norm, and at the best of times are anathema to market focused investors. Conditions have to be bad before they are welcomed by investors as the best possible solution. Given the constraints the UK government is under, and the inability of the Bank of England to aggressively raise rates, it is hard to imagine how price controls can be avoided.

Gilt yields continue to rebound from the region of the trend mean and the uptrend remains in place.

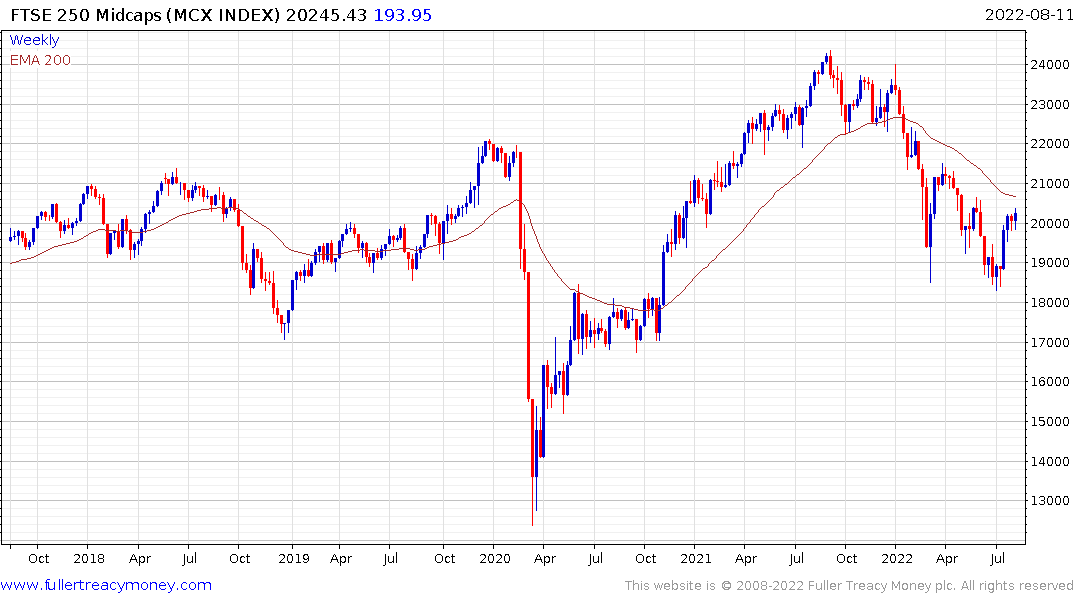

The FTSE-250 is just about steady as it tests the sequence of lower rally highs and the region of the 1000-day MA.

The Pound is relatively stable at present because the challenges the UK faces are not an isolated issue. However, it is worth considering the currency was exceptionally volatile during the 1970s; falling from a $2.60 in 1972 to $1.07 in 1984, with a massive counter trend rally between 1976 and 1980.

That experience highlights how important it is to snuff out inflationary pressures now before they become truly entrenched. Energy independence is a national priority everywhere today.

Here is a section EDF’s website which is relevant following permissioning of the Sizewell C reactor.

The UK urgently needs new investment in energy infrastructure to replace old and polluting electricity generation sources. Since 2010 26 power stations have closed, which equates to 20% of the UK’s generation capacity. By 2030 a further 35% of existing generation capacity will close down. We’re committed to providing a clean, secure and reliable solution to this problem, and we believe nuclear power has an important role to play. Nuclear is the most affordable large-scale, low carbon energy source available to the UK.

Large ongoing investment in electricity generating capacity is an inevitable cost for the UK and that’s independent of the growth in electrification.

Back to top