Email of the day on elevated valuations:

on today's video you highlighted the virtues of the NOBL Dividend Aristocrat index, but on closer inspection the yield on this is just 2%. A year ago, that was 4x the yield on short term treasuries in the US, but with 1 and 2- year treasuries yielding 4% now, double that of NOBL, there seems to be far less support from those seeking out yield.

The TINA approach is fast coming to an end. With that in mind, and with the Sterling continuing to take strain, what investment vehicles are available to us in the UK to invest in 3M, 1Y an 2Y US Treasury paper?

Thank you for this question which may be of interest to the Collective. There is of course a big difference between capturing a high yield now and buying with the expectation of dividend increases in future. It is essentially the difference between current yield and yield to cost.

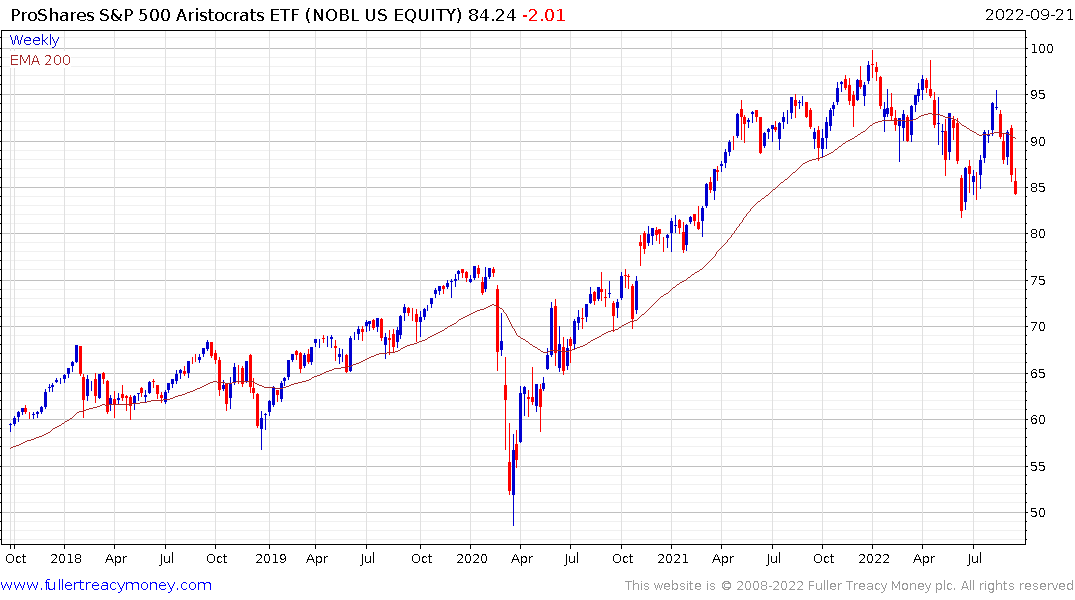

The S&P Dividend Aristocrats ETF is trending lower because investors are pricing in the potential for earnings to roll over. That will improve the yield on these kinds of companies. The security of future dividend increases makes them ideal buy the dip candidates because the yield to cost improves every year, particularly when bought following a deep correction.

I could not find UK listed funds offering direct exposure to US short-term debt. If subscribers know of promising candidates, please let me know.

The only type of instrument that will come close to providing positive returns will have to be actively managed. Buying any debt fund at present comes with significant risk. That is what the yield is supposed to compensate you for.

At Nevada Trust Company, where I am a director, we run a cash Treasury management service which commits to beating the national average on money market money (0.18%). That’s only achieved by going through tough negotiations with lenders. In October we’ll offer the annualized rate will be 2% and that will be bumped up again in November.

Unfortunately, there is a lag between rates rising and when we can realise better terms from banks in search of deposits. That’s especially true when the Fed is offering banks 3.15% via reserve balances. I only mention this as a real-world example of how difficult it is to match headline yields without being extremely active in trading individual bonds.

The one instrument that caught my attention today is the SME Credit Realisation Fund Ltd. It provides short-term lending to small and medium-sized enterprises in the UK, EU and USA.

The fund is trading at a premium to NAV of 18% and the dividend yield is 117%. The clear risk with a fund like this is the loans go sour. The primary speculation in buying is governments will step in to prevent an outsized default cycle among small companies.