Email of the day on bond investing:

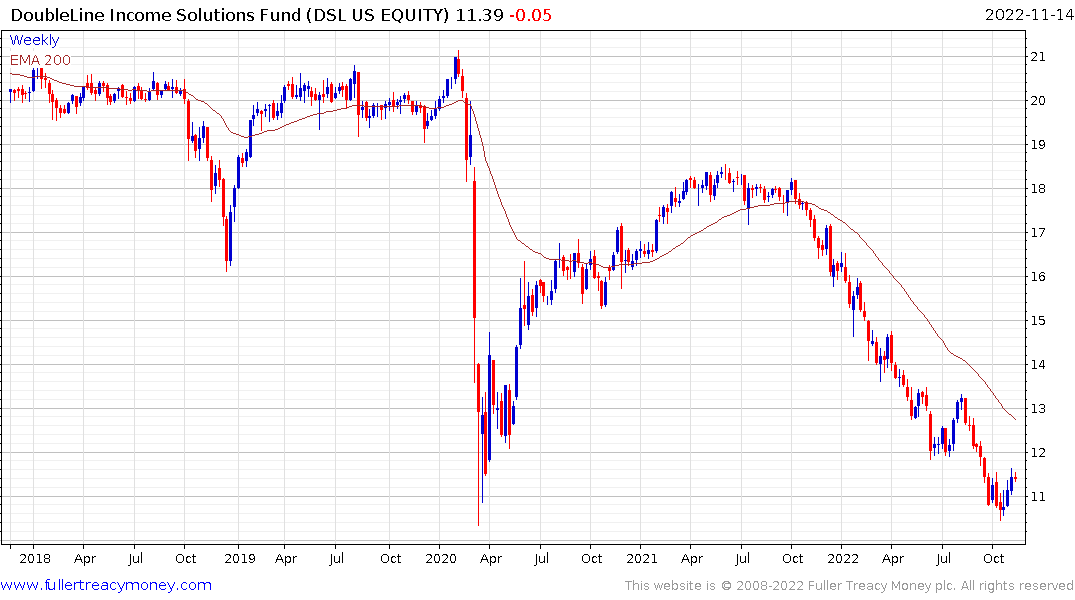

Interested in your investment purchase of DoubleLine Income Solutions Fund. as a long term subscriber I’ve now moved into another investment age whereby I am now an income & growth investor and the timing of your purchase appears to be potentially beneficial.

I have checked with a number of UK online investment portals and they do not appear to offer access to this closed end fund and therefore my question is whether you accessed this via a US trading platform or direct?

Any help will be appreciated.

Thank you for this question which may be of interest to the Collective. Growing up in Ireland in the last 1970s and early 1980s interest rates were very high. My grandmother used to buy national savings certs for all her grandchildren. They automatically rolled over the interest at maturity. As a teenager, I cashed them in and found they had risen by over 300%. That taught me the simple lesson. Buying bonds when rates are high and before inflation peaks is very attractive.

I believe it is very likely inflation is peaking now and a deflationary shock is in the future. That suggests there is clear scope for bond yields to contract significantly over the next 18 months. High yields spreads are rolling over. That suggests equity-like instruments are rallying faster than Treasuries.

In a recession, default risk rises and spreads rise with them. That is usually because Treasury yields go down and junk yields rise. This year both yields have gone up together. It looks like there is significant room for that condition to be corrected.

Personally, I am always interested in high income investments because of the potential for compounding. I expect to reinvest my dividends for the foreseeable future. I have my SEP with TDAmeritrade in the USA, so it was a very straightforward purchase.

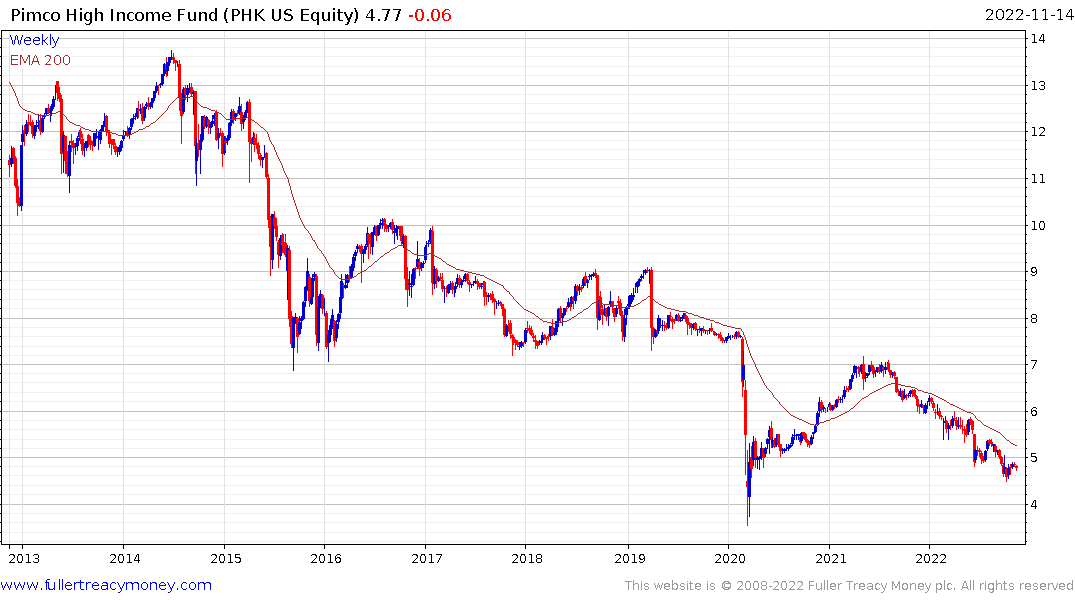

The Pimco High Yield Fund has similar chart pattern and yield.

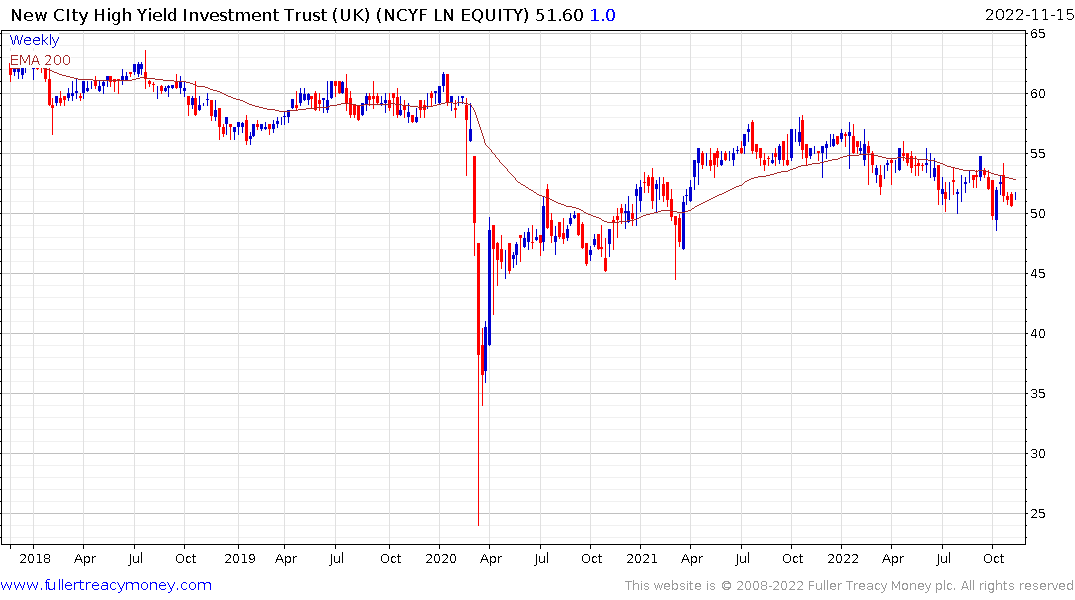

The UK listed CQS New City High Yield Fund Ltd trades at a premium of around 6% which is normal of the fund. It yields 8.68% from a portfolio dominated (40%) by UK assets. The price is attempting to stabilise above 50p but will need to break the sequence of lower rally highs to confirm a return to demand dominance.