New UK Prime Minister

This note from Bloomberg may be of interest:

Thanks for joining us as we took you through the results of the Conservative leadership race. Liz Truss will take office Tuesday and give a speech outside her new home -- No. 10 Downing Street. In the meantime, these are the key takeaways so far:

Liz Truss won the race to be the UK’s next prime minister, but achieved a smaller-than-expected margin of victory over Rishi Sunak, with 57.3% of Tory members’ votes.

She vowed to cut taxes, grow the economy, and address the crises in energy and the National Health Service.

Truss will visit Queen Elizabeth II in her Scottish castle to be formally appointed on Tuesday, after which she will make a speech to the nation and appoint members of her cabinet.

She inherits a forbidding in-tray: surging inflation, predictions of a recession and a record squeeze on living standards spurred by soaring energy prices.

Truss has promised to announce how she would help Britons through the cost-of-living crisis in her first week -- reports suggest she could freeze energy bills and offer targeted financial help to low-income households and pensioners.

The Pound and Gilts have sold off aggressively over the last month as traders priced in the rising potential Liz Truss would succeed Boris Johnson. The most urgent issue is the massive impending jump in electricity costs. No prime minister can survive through that kind of living standard decline, so price caps are inevitable.

Cutting taxes while introducing subsidies is a not as easy as it sounds on the campaign trail. The realities of government will mean more spending but nowhere near to the extent promised. Both the Pound and Gilts steadies today from deep oversold conditions. However, inflationary pressures will have to peak before significant recovery is likely.

Price controls bring down headline inflation but do not tackle the underlying price pressures. The UK became an energy importer almost twenty years ago. That has reduced the ability of successive governments to rebound from crises. A long-term energy policy, predicated on easy access and cost to the consumer is essential. That implies significant infrastructure investment will need to be prioritized and potentially at the expense of social programs.

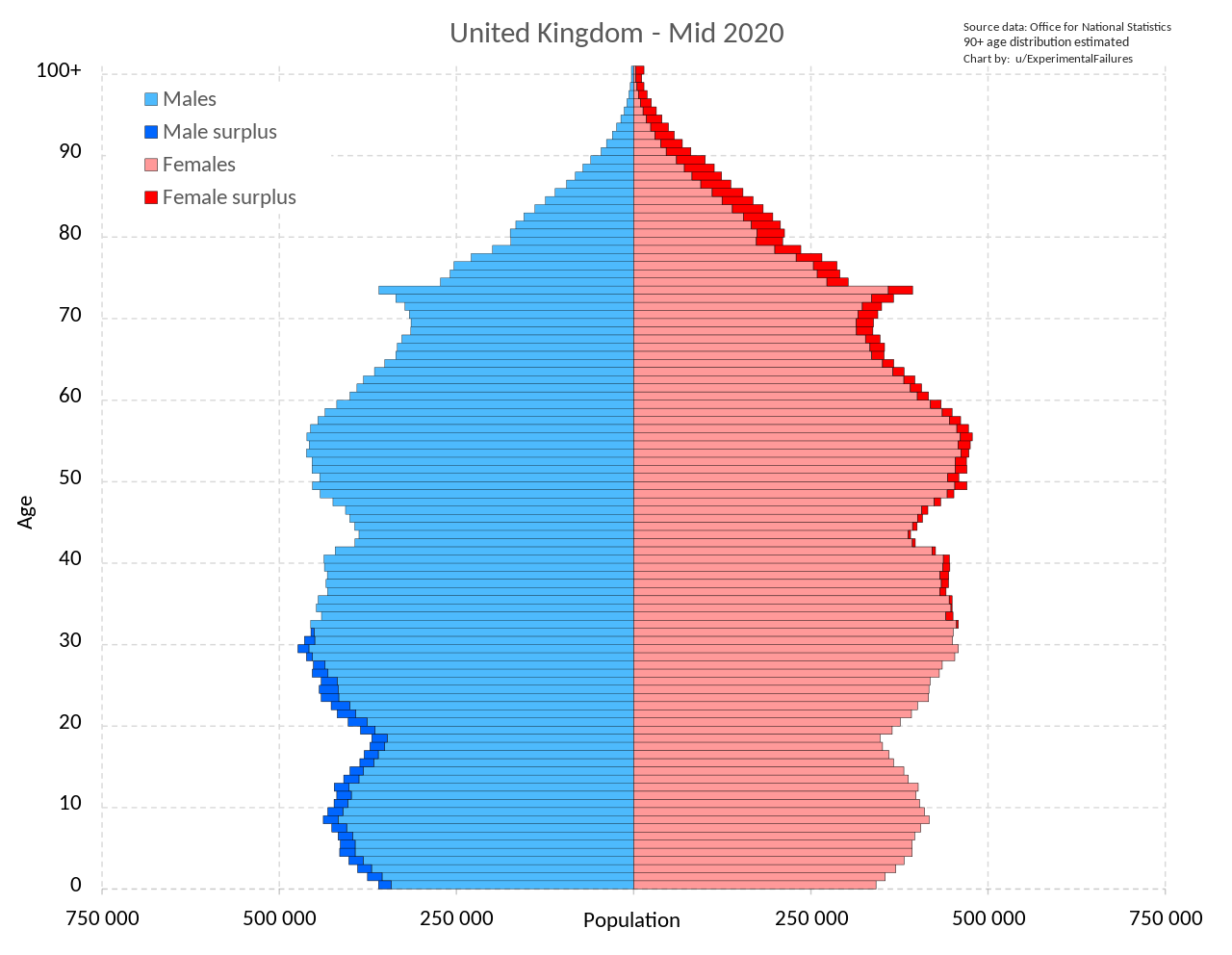

The NHS is an altogether more difficult issue. One look at the demographic pyramid shows us there are fewer people under the age of twenty than older than 50. That implies a significant challenge over the next thirty years for staffing and funding the NHS. It’s hard to think how that challenge can be met without significant immigration which comes with a whole array of additional social challenges.

The NHS is an altogether more difficult issue. One look at the demographic pyramid shows us there are fewer people under the age of twenty than older than 50. That implies a significant challenge over the next thirty years for staffing and funding the NHS. It’s hard to think how that challenge can be met without significant immigration which comes with a whole array of additional social challenges.

As the UK moves to phase out £20 and £50 banknotes, the odds of overt efforts to crack down on free movement of capital are increasing.

Back to top