A bad back currently prevents me golfing, walking the dog, or driving the car and, in my opinion justifiably, I am feeling a grumpy.

So here are a few gripes for you:

First gold:

For several years you taught us that the gold price follows an approximate 35-year cycle between highs, although the gold price could outpace stock indexes for short periods in between those highs. We’ve not heard too much about the 35-year cycle for a while, the message now being that it is not unusual for gold to trade in a boring range for up to 18 months or so before breaking out conclusively up or down. You believe it will break to the upside taking out previous highs (which runs contrary to your 35-year cycle theory). I hold a fair chunk of gold and silver miners in ETFs but regard the holding as a hedge rather than representing a belief that gold will imminently break to the upside. It might and it would be nice if it did but I doubt it. As David said, investment options are similar to a beauty parade and for the foreseeable future, many options are likely to look superior to gold.

Second India v China:

You are very hard on China and its political system. Having lived most of my life in Asia I take a less severe view. Like most observers I was disappointed to see that XI, the reformer, had no intention of political reform but on reflection, I think he’s probably right to opt for political stability at a time when China is still struggling to bring modernity to all its people and regions; when lightening-speed technological change is taking place across the globe and when it finds itself in an inevitable struggle to assert what it regards as its rightful influence on global institutions and practices. On a smaller scale in Singapore Lee Kuan Yew did much the same thing and while there is now a little more political tolerance in Singapore than there was, the Government – and most of its people – believe that full-throated democracy would lead to economic and societal break-down. That would be Xi’s worst nightmare.

My grouse is not so much with your view on China but with your uncritical view of India. I agree with you that India should do well given its demographic advantage and talents of its people. However, I think the Modi government is quite repugnant in its covert – and not so covert – support of extremist Hindu nationalism represented by terrorisation of the Muslim and Christian communities, and by its appalling failure to do much about the abuse of women, also fuelled by Hindu extremists. In the medium term, I fear this, together with over-dependence on coal, will limit India’s investment appeal and therefore its economic potential.

To declare my investment positions, I have reduced my exposure to India and wait for an opportunity to reinvest in China. My favourite Asian market currently is Vietnam.

Third, the purpose of your ‘service’:

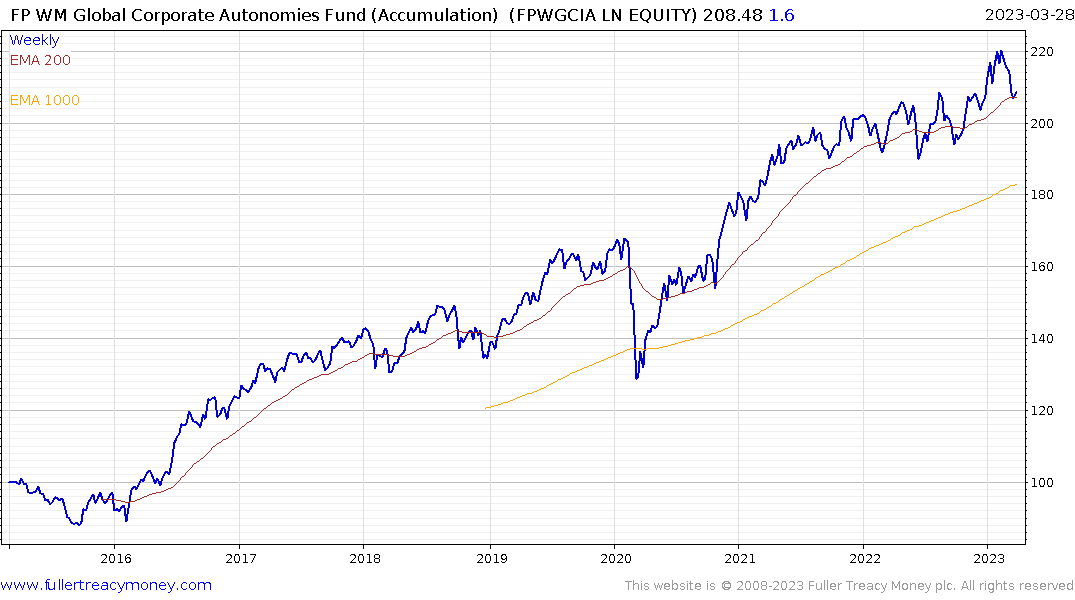

Under David’s direction, Fuller Money provided objective macro oversights together with some trading suggestions/recommendations and some investment suggestions/recommendations. He often put his money where his mouth was and invested in his recommendations. Towards the end of his career, he stopped publishing his investment portfolio which I regarded as a pity. Under your direction, Fuller-Treacy Money continues to provide objective (if sometimes convoluted and long-winded) macro oversights, but I find it difficult to work out whether beyond that you are offering trading hints or investment hints. I use the word ‘hints’ rather than ‘suggestions’ because in this aspect you are far more non-committal on specifics than was David. The details you provide of your own investment activities suggest that you are a trader with long(ish) term investments in gold bullion, gold miners and Rolls Royce. I made several profitable purchases based on David’s recommendations but so far have identified none under your watch.

Fourth Daily Audio and Video:

From emails you have referred to from other subscribers, I am confident that I am not alone in being irritated by several of your constant refrains. Three which particularly annoy me are ‘The big question is ….’ (to which we never get an answer); ‘[Gold (for example) has a lot of work to do’ (which is a nonsense, better to identify factors which might influence buying/selling decisions) and; ‘I can’t talk and chew gum at the same time’ (which sounds quite catchy heard for the first time, but grates increasingly after many repetitions).

So, getting that off my chest makes me feel slightly less out of sorts. I shall be renewing my subscription in March. It’s been part of my routine for too long.

Eoin Treacy's view - Thank you for this detailed email, your long-term support and I hope you back feels better soon. If it is muscular, rather than a herniation, I strongly recommend Yunnan Baiyao. I’ve pulled muscles in my lower back on several occasions either playing tennis or lifting. If it is taken quickly after injury, it provides a powerful, quick solution with no side effects I have experienced.

I began questioning the wisdom of relying on the Dow/Gold ratio during the early stages of the pandemic. Here is a link to Comment of the Day on April 24th 2020. It includes a large number of long-term ratios and concluded that the Dow Jones Industrials Average is no longer the best way to look at the long-term ratio, confirmed concentration of attention in the growth sector, predicted the recovery in oil prices, higher wages, and the return of inflation.

This section continues in the Subscriber's Area.

Back to top