Now That Powell's Convinced Markets He Means It

This article from John Authers at Bloomberg may be of interest to subscribers. Here is a section:

Market-based expectations for how the Fed moves its target fed funds rate have also broken out. The shift in expectations has come with breathtaking swiftness. The following chart shows implicit expectations for rates after each of the next seven meetings as they stood on Dec. 31, where they had moved by the day the tanks entered Ukraine, and where they are now:

Bear in mind that as the year began, CPI had already topped 7% for the first time in four decades. It’s remarkable both how long it took for investors to come around to expecting a sharp monetary tightening, and how swiftly that realization has now taken root.

What does this imply for asset allocation? Higher bond yields tend to be bad news for stocks if they are part of a Fed tightening, and make high stock valuations harder to justify. However, expectations of a more aggressive Fed are even worse for bonds. The mathematics of the bond market on this point is

inexorable. If rates and yields are going up, then bond prices have to come down.

And, indeed, just as those who’ve been saying There Is No Alternative (to stocks) would have predicted, this news has been far worse for bonds than stocks, meaning that the returns for those who are long in stocks relative to bonds have surged to yet another new high:

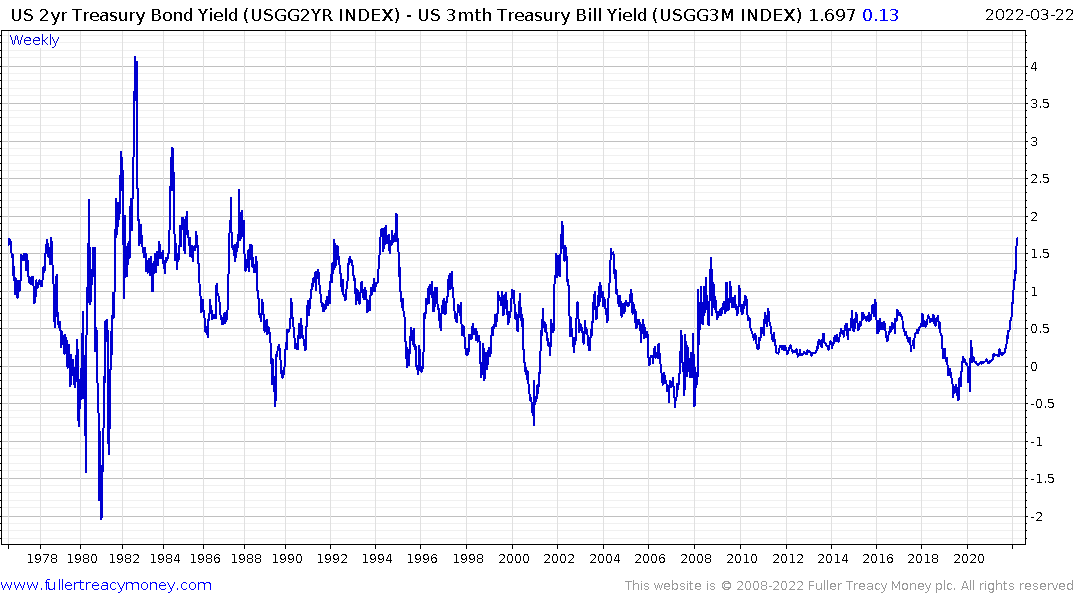

There is a significant anomaly developing in the bond markets. 2-year and 10-year yields are ramping higher on the expectation of future inflation and much higher rates. 3-month bills are also rising but at a much more sedate pace. The rate is currently at 0.5% which approximates the Fed Funds rate. That’s an oddity because investors are increasingly convinced a 50-basis point in May is a certainty.

As longer-dated bonds have sold off, investors have been forced to reduce duration risk. That has created outsized demand for near cash items like 3-month bills. These instruments offer some measure of protection from rising rates but are not immune from rate hikes. They will eventually play catch up.

.png)

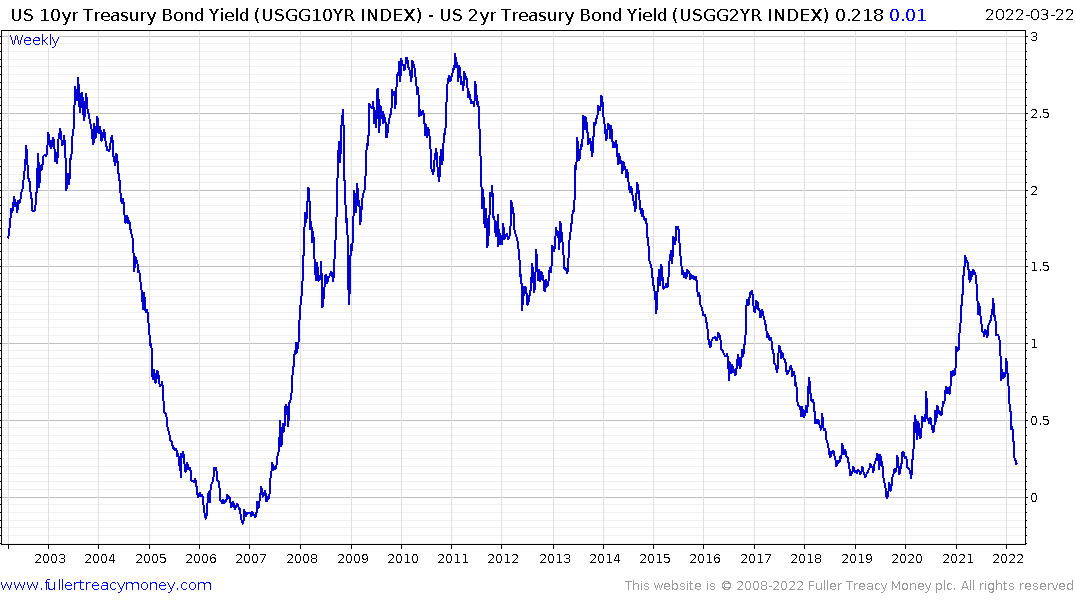

The 10-yr-2-yr yield curve spread continues to accelerate lower and currently stands at 19 basis points. The 10-yr-3-month is breaking on the upside.

The spread between the 2-year and the 3-month has not exceeded 200 basis points since 1987. That suggests there is a lot of catch-up potential for the short end of the curve. Jay Powell is pointing to that short-term spread as the best predictor of recessions even if a cursory perusal suggests it is less reliable than conventional spreads.

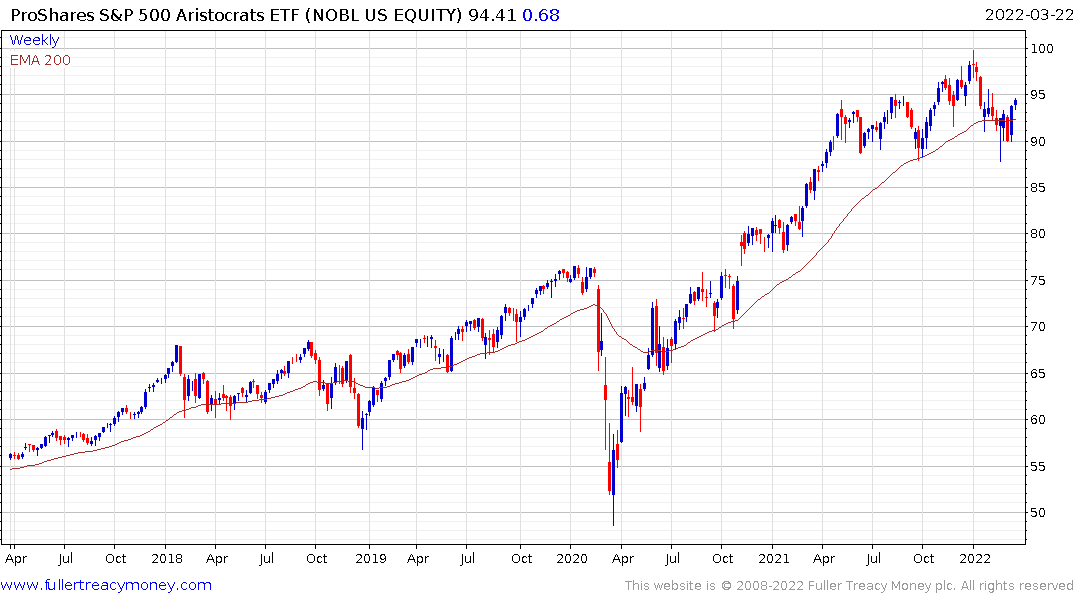

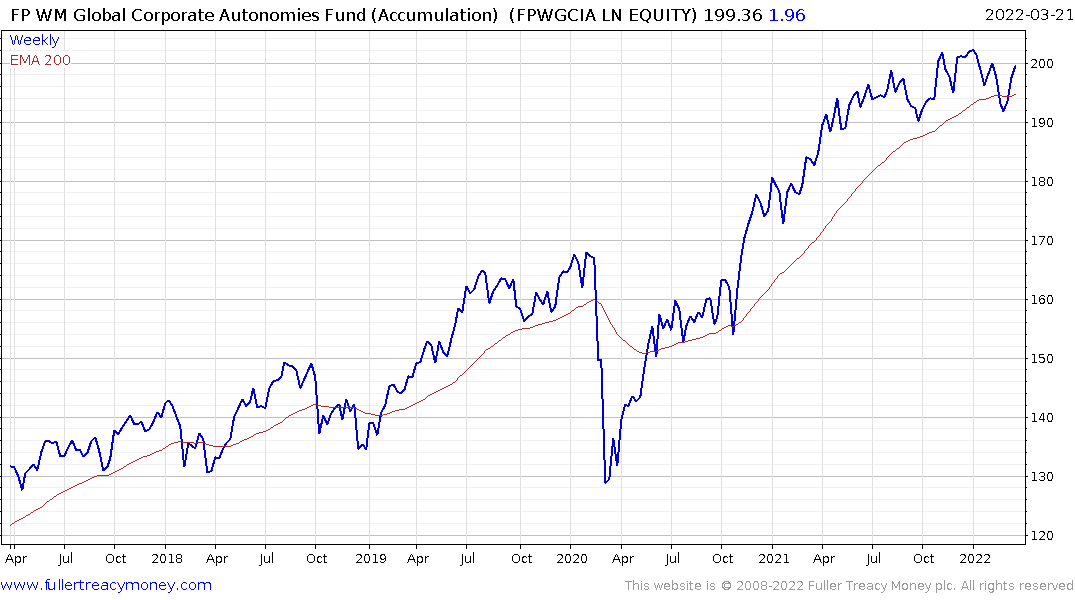

The argument we used for supporting the Autonomies back in 2012 was that companies with strong franchises and the ability to raise dividends offer the best hedge against inflation. Now that inflation is truly an issue, that view is proving resilient.

The Dividend Aristocrats ETF has been mostly ranging while the wider market has pulled back sharply over the last few months. It is now rebounding from the lower side of the range.

The Autonomies Fund has a similar pattern.

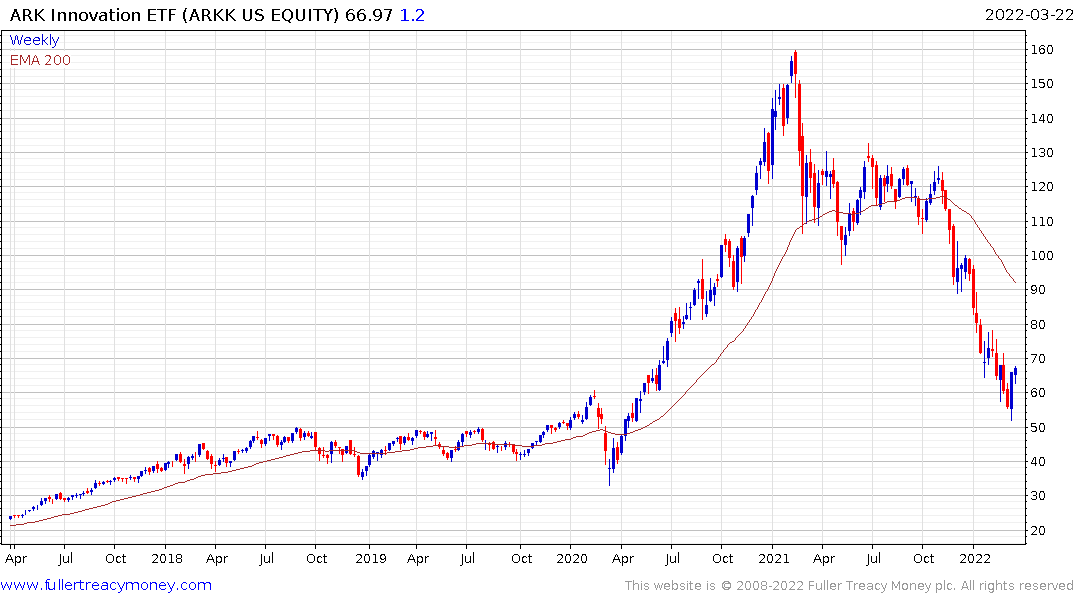

Loss making companies, relying on access to cheap abundant liquidity are least well prepared to deal with the unfolding situation. That suggests the Ark Innovation ETF and its constituents are most likely to experience lengthy type-3 bottoming characteristics once the short-covering rally has run its course.

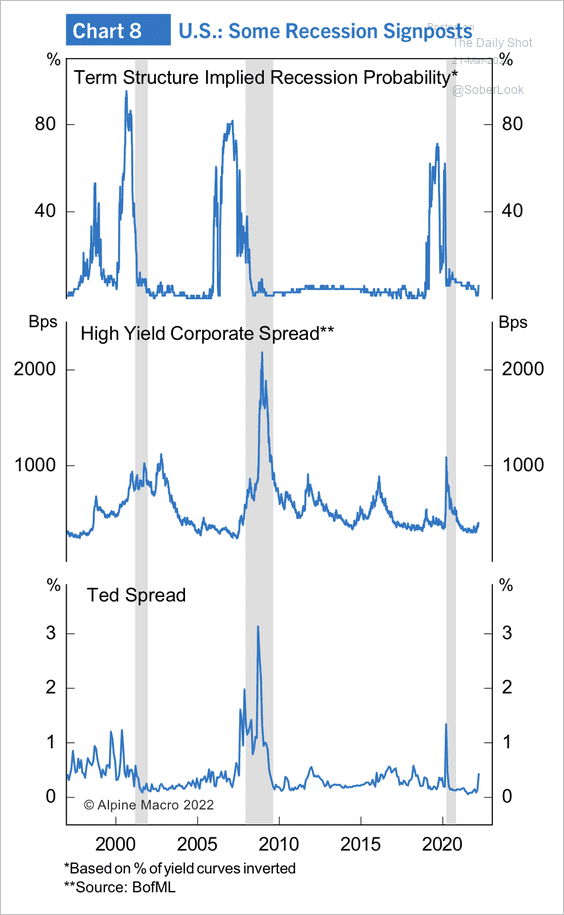

This list of recession predictors from Alpine Macro includes the term spread and high yield curve spread. They all tend to peak immediately before recessions and rise as a warning that liquidity conditions are tightening.